There are no shortage of surveys and studies that have found consumers aren’t doing so great with their finances: from 45% of Americans carrying at least $25,000 in debt to one-in-four families failing to seek medical attention because of financial worries. Now, another survey — this time from the Consumer Financial Protection Bureau — found that more than 40% of adults struggle to make ends meet. [More]

survey

1-In-4 Families Don’t Seek Medical Attention Because Of Financial Worries

With the latest reports suggesting that the American Health Care Act — a budget resolution intended to repeal and replace much of the Affordable Care Act — would leave more than 23 million consumers without insurance and facing higher out-of-pocket costs, it’s no surprise that consumers are a bit uneasy when it comes to their healthcare. In fact, a new survey suggests that in the face of rising costs, some families are foregoing medical care to save a few — or a few thousand — bucks. [More]

Half Of America Is Not Prepared For A $100 Emergency

If you opened your mailbox today and found that you owed the city $100 and you had to pay it right away, would you be able to? A new report claims that nearly half of us are not prepared to absorb this cost, and more than 1-in-4 Americans is up a creek if they have to unexpectedly pay as little as $10. [More]

45% Of Americans Carry At Least $25,000 In Debt

If you owe creditors less than $5,000 (not including a mortgage) you’re in a rather small group of Americans with minimal debt. According to a new survey, nearly half the country owes at least $25,000 — and spends as much as half of their monthly income paying down their debt. [More]

Most Americans Favor Payday Loan Reforms

Despite claims from the payday loan industry that Americans don’t want reforms intended to prevent borrowers of these short-term loans from falling into a revolving debt trap, two new reports show that most people do think it’s time to rein in payday lending and provide more affordable loan options for borrowers in need. [More]

1-In-4 Consumers Contacted By Debt Collectors Feel Threatened

More than 70 million Americans are contacted by a debt collector or creditor each year. While those debt collectors have a job — to get borrowers to repay on their overdue debts — some have used illegal tactics, such as threatening lawsuits, arrests, or contacting consumers’ employers or family members. Now, a new report by the Consumer Financial Protection Bureau finds that harassment by these collectors is all too common. [More]

Wells Fargo Overhauls Teller Pay System After Fake Account Fiasco

Shortly after federal regulators fined Wells Fargo $185 million for its decades-long fake account fiasco perpetrated by employees who opened more than two million unauthorized accounts in order to meet high-pressure sales goals, the company said it would ditch the incentive system. Now, the bank has finally outlined its new approach to compensating employees that shifts the focus away from upselling add-on products and toward improved customer satisfaction. [More]

Report: Fake Account Fiasco Could Cost Wells Fargo $4B, Thousands Of Customers

As Wells Fargo continues to grapple with the consequences of its potentially decade-long fake account fiasco, we’re beginning to see what the future might hold for the banking giant: a large loss both financially and in its customer base. [More]

Majority Of Shoppers Using Amazon To Search For Products, Even If They Buy Elsewhere

For years we’ve talked about “showrooming” — the practice of going to a bricks-and-mortar retailer just to look at a product you intend to buy online, and now Amazon has apparently supplanted traditional search engines as the place for most Americans to begin their product hunt.

[More]

Two-Thirds Of College Students Who Take Out Loans Have No Idea What They’re In For

Would you walk into a bank — or call up the federal government — and borrow $50,000 or more without having some idea of when or how you’ll be expected to pay it back, or what can happen to you if you fall behind? That probably sounds unwise to you, but the results of a new survey show that a large majority of college students who take out loans are jumping into the deep end of the debt pool without any advice or guidance. [More]

Survey: 9-in-10 Christian Consumers Think Payday Loans Hurt Borrowers

Expensive. Harmful. Predatory. Those are just a few of the words that members of faith-based groups used to describe payday and auto-title loans in a recent report that asked congregants in 30 states to detail their experience with the short-term, high-cost loans and similar financial products. [More]

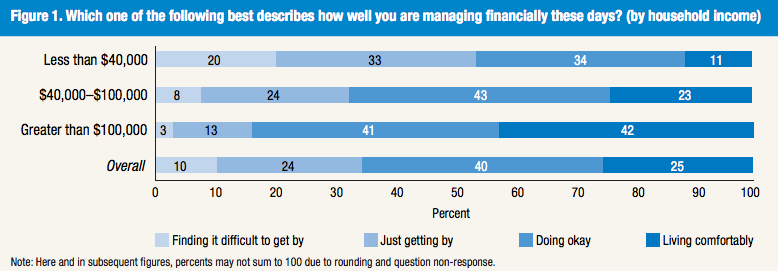

Fed Survey Finds Most Consumers Are Happy With Their Finances, Despite Lack Of Retirement Savings

As the economy continues to bounce back from the Great Recession, consumers have adopted a more optimistic outlook when it comes to their finances despite the fact that a third of the country has no savings put away for the future, according to a new survey from the Federal Reserve. [More]

Nearly 1-In-3 Privately Insured Americans Received A Surprise Medical Bill In Last Two Years

When you visit your doctor for a blood test, get an ultrasound, or have surgery at a medical facility that accepts your insurance, you likely expect that you’ll only be required to go out-of-pocket for the co-pays and deductibles detailed in your health plan. But the results of a new survey show that there’s a decent chance you’ll be hit with a surprise charge or two when those medical bills finally arrive. [More]

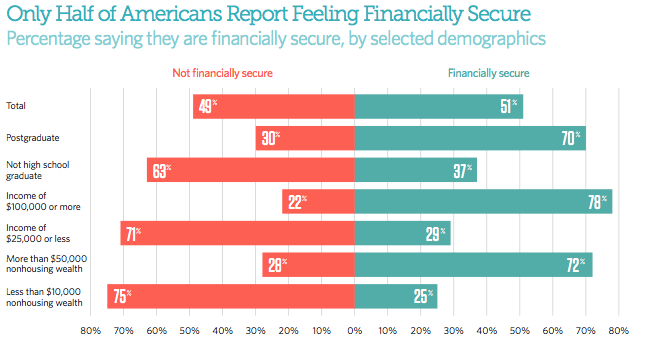

Report: Americans Are Optimistic About Their Finances But Few Actually Feel Secure

Americans’ positive feelings about the economy have officially returned to the level they were at on the eve of the Great Recession, according to a new study from Pew Charitable Trusts. While that might sound comforting, it doesn’t mean consumers are actually feeling secure in their own financial stability. [More]

Let’s See How Well You Can Predict What’s Going To Happen In 2015

In case you hadn’t checked the calendar, 2014 is over but there’s still a lot of unfinished business oodles of uncertainty in front of us. So let’s see what images your crystal ball is conjuring. [More]

Poll: 1-In-5 Consumers Say They’ll Die While Still In Debt

Millions of Americans dream of the day that they exit the dark, desolate tunnel of debt and can live their lives without owing money to anyone. But sadly, a new report finds that most consumers actually have little hope of ever being debt-free. [More]