Despite efforts by the Department of Education to educate prospective college students about the burden of student loans, nearly two-thirds of students who took out loans to pay for college say they had no idea what they were signing up for. To fix this problem, it’s going to take more than making these students sit in a class about financial aid and student loans; it may require an overhaul of the entire college financing system. [More]

Know Before You Owe

Know Before You Owe Mountains Of Student Loan Debt

Each year millions of students take out thousands upon thousands of dollars in student loans and other financial aid to help pay for a college education. But as we found out yesterday, many of these prospective students are woefully unprepared for the reality of student loan debt. From reading through piles of paperwork to making payments each month and keeping track of loan servicers, financing your education can be overwhelming, but that doesn’t mean you shouldn’t learn as much as possible before you end up under a mountain of loan debt. [More]

Two-Thirds Of College Students Who Take Out Loans Have No Idea What They’re In For

Would you walk into a bank — or call up the federal government — and borrow $50,000 or more without having some idea of when or how you’ll be expected to pay it back, or what can happen to you if you fall behind? That probably sounds unwise to you, but the results of a new survey show that a large majority of college students who take out loans are jumping into the deep end of the debt pool without any advice or guidance. [More]

![The CFPB's electronic version of its Know Before You Owe Mortgage Toolkit includes interactive forms to help consumer find the right mortgage for them. [Click to Enlarge]](../../consumermediallc.files.wordpress.com/2015/03/screen-shot-2015-03-31-at-2-08-15-pm.png?w=300&h=225&crop=1)

CFPB Releases Mortgage Toolkit Aimed At Making The Home Buying Process Easier

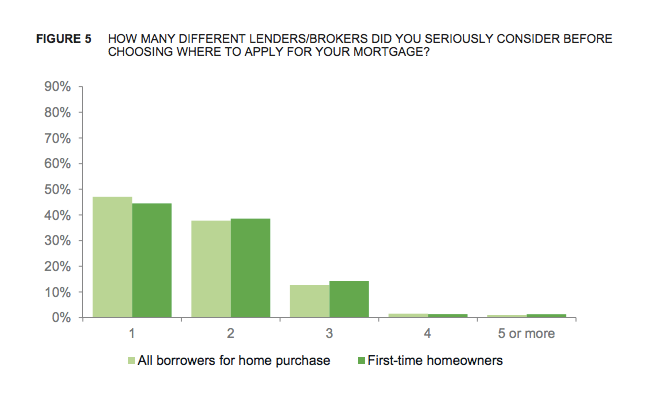

In January, the Consumer Financial Protection Bureau released a report suggesting that many homebuyers spend more time looking for a TV than shopping around for the right mortgage. In an attempt to make things a little less daunting for prospective borrowers, the Bureau today released the “Know Before You Owe” mortgage shopping toolkit. [More]

Am I Completely Screwed If My Student Loan Co-Signer Dies?

Imagine this scenario: You’ve been out of college for several years, have a good job and you have no problems making your student loan payments in full and on time. Then tragedy hits; your parent dies or declares bankruptcy. If this loved one was a co-signer on your student loan, this change can trigger an often-overlooked clause that allows the lender to claim you are in default on your loan, potentially wreaking longterm havoc on your credit and finances. [More]