For-Profit Colleges Lead The Way On Loan Defaults: Report

During the Great Recession, the growing industry of for-profit colleges promised millions of Americans a path to a higher education. But the high tuitions charged by many schools sent U.S. student loan debt soaring to more than $1.2 trillion. A new report claims that while for-profit schools charged top-dollar, many students were getting a cut-rate education, making it difficult to obtain jobs that will allow them to pay down this debt.

The report [PDF] from the Brookings Institute analyzed Department of Education data on student loans and earnings to look for any correlation between a student’s education and loan default rates. The authors found that the current student loan debt crisis is largely concentrated among nontraditional borrowers who attended for-profit schools and other non-selective institutions.

Prior to the recession, for-profit colleges and non-selective education institutions accounted for just a fraction of the student loan debt in the U.S., the report states.

The report’s authors, Adam Looney of the U.S. Treasury Department and Stanford University’s Constantine Yannelis, found that the biggest changes for student loans began around the time the recession hit, when many consumers lost their jobs and returned to college in search of better opportunities.

Many of these nontraditional students were drawn to for-profit colleges that touted flexible schedules and high job placement rates.

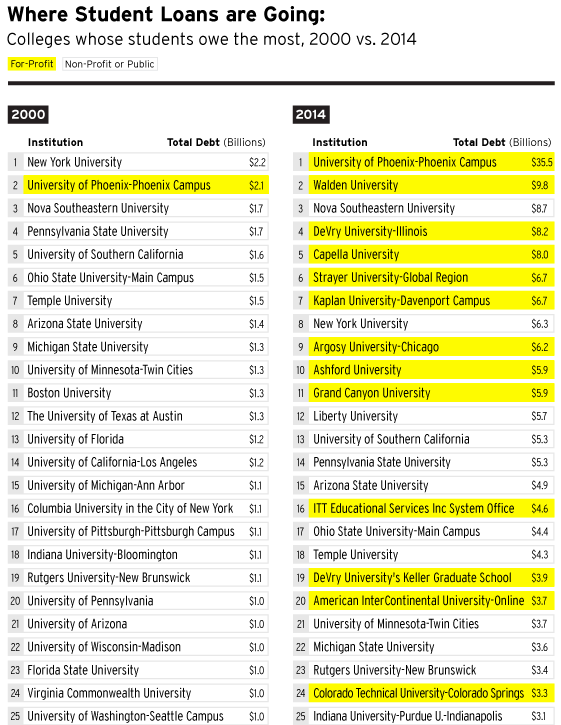

When the researchers compared the schools that received the most student loan funding in 2000 versus the largest loan recipients of 2014, the growth of for-profit schools is clearly evident.

In 2000, only one for-profit school — the University of Phoenix — made the list, and its $2.1 billion in loan funding was the second-largest amount of all schools. Fourteen years later, more than half of the list — and eight of the ten top spots — were for-profit schools. By this time, Univ. of Phoenix’s loan reliance had shot up to $35.5 billion; its 2000 figure of $2.1 billion would not have even made the top 25 in 2014.

According to the report, by 2011 – some three years after the recession began – borrowers at for-profit and two-year institutions represented almost half of student-loan borrowers leaving school and starting to repay loans.

These students went on to account for 70% of student loan defaults just three years later, the report found.

“[These students] borrowed substantial amounts to attend institutions with low completion rates and, after enrollment, experienced poor labor market outcomes that made their debt burdens difficult to sustain” the report states.

For example, the report found the median borrowers from a for-profit institution who left school in 2011 and found a job in 2013 earned about $20,900. However, one-in-five (or 21%) of these students were not employed.

Likewise, community college borrowers on the same timeline earned $23,900, while almost one-in-six (or 17%) were not employed.

Unfortunately, these students borrowed heavily to pay relatively high tuition costs. Median loan balances for these borrowers jumped almost 40% – from $7,500 to $10,500 – for for-profit students and about 35% – from $7,100 to $9,600 – for those at two-year colleges.

These more expensive loan debts, coupled with the relatively high percentage of students who remained unemployed after attending for-profits or community colleges has created a student loan debt crisis centered around the proprietary educational industry, the authors found.

In all, the report shows more than 25% of students attending nontraditional universities who left school during or soon after the recession would default on their loans within three years.

“In other words, what type of institution students attend matters: default rates have remained low for borrowers at most 4-year public and private non-profit institutions, despite the severe recession and relatively high loan balances,” the report states. “These students’ generally high earnings, low unemployment rates, and greater family resources appear to have enabled them to avoid loan repayment problems even during tough economic times.”

In fact, the report found that of the students who started repayment on loans in 2011, just 2% of graduate students and 8% of traditional undergraduates defaulted within two years.

Still, the authors say the increase in students seeking education during the recession and ultimately settling on for-profit institutions is just one part of the story, the other is the schools themselves.

For-profit college students represent a relatively small fraction of consumers seeking higher education – just 11% – but they represent about 44% of all federal student loan defaults.

The authors say these rates lead them to believe it’s ultimately the quality of education at these schools that drive students to default, as they aren’t prepared to find employment that would allow them to pay their loans.

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.