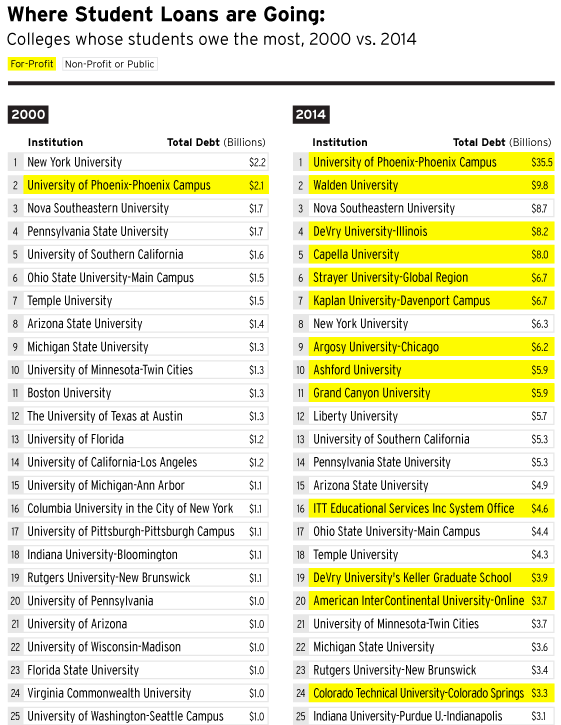

During the Great Recession, the growing industry of for-profit colleges promised millions of Americans a path to a higher education. But the high tuitions charged by many schools sent U.S. student loan debt soaring to more than $1.2 trillion. A new report claims that while for-profit schools charged top-dollar, many students were getting a cut-rate education, making it difficult to obtain jobs that will allow them to pay down this debt.

[More]

defaults

For-Profit Colleges Lead The Way On Loan Defaults: Report

Can’t Pay Your Student Loans? In Some States It Might Cost You Your License To Drive Or Work

In addition to causing irreparable damage to their credit scores, student loan borrowers who default on their debts face a much more devastating and counter-intuitive danger: the lost of their driver’s or occupation licenses, including those used by nurses, doctors, teachers and emergency personnel [More]

Current, Former Corinthian College Students Go On “Debt Strike,” Refuse To Pay Private & Federal Loans

With for-profit educator Corinthian Colleges Inc. selling off campuses and closing schools, thousands of Everest, WyoTech, and Heald College students are waiting to learn the fate of the more than $1 billion in private and federal student loan debt used to finance their education. While the Department of Education and the Consumer Financial Protection Bureau have worked to secure deals in which some of that debt will be forgiven, some students are increasing the pressure on such deals by staging a “debt strike.” [More]

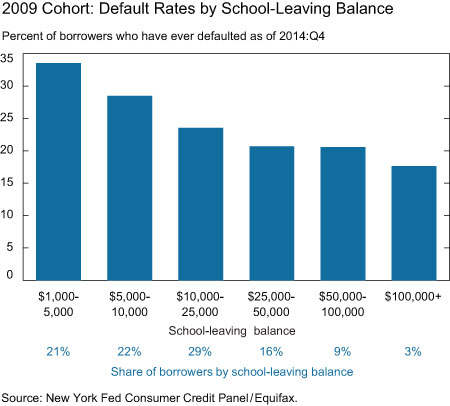

Why Are Borrowers With Less Student Loan Debt More Likely To Default?

Just days after the Federal Reserve Bank of New York showed that student loan delinquency rates were once again on the rise, a new Fed report finds it’s student loan borrowers with the lowest levels of debt who typically are the most delinquent.

[More]

Why Do Student Loan Borrowers Default?

On Monday, we shared the results of a two-year Senate investigation into how much federal money is going to for-profit colleges, and what kind of return students and society as a whole are getting on that investment. (Answers: $32 billion, and a pretty terrible return on that investment.) A study that the National Consumer Law Center released yesterday shows the college bubble from a different perspective: that of student loan borrowers who have gone into default. It’s not pleasant. [More]

Here's A Cookie, America, For Paying Your Credit Cards Off And On Time

Good job, America. You are being most excellent at paying your credit card bills and paying them on time. LowCards reports that credit card default and late payment levels fell once again in April to their lowest since 2008. The reasons why are pretty obvious: [More]

Bank Of America Puts Customer In Default After Paying Off Mortgage

Not being a Bank of America customer won’t protect you from the company’s formidable foreclosure machine, but if you are a customer, paying off your entire mortgage doesn’t help, either. After an Illinois woman sent a check for more than $60,000 to pay off her mortgage, she learned that the company hadn’t applied the money in her escrow account to the principal as they were supposed to, putting her in default. The company helpfully came after her to collect the money she supposedly owed and help her avoid foreclosure. [More]

Avoiding Student Loan Default At Citibank: A Cautionary Tale

It’s an enormous relief to find someone at a large, powerful company who is kind, helpful, and able to solve your problems. Unfortunately, reader Flora learned that just because a person is kind and helpful, that doesn’t mean that you shouldn’t document your conversations with them in case things go horribly wrong. [More]

This Citibank Balance Transfer Offer Sure Sounds Dangerous

RP was just offered a transfer on his Citi card by a Citibank CSR, but the CSR was kind of vague on the details of the offer and could only repeat the benefits. RP looked online while the CSR pitched the offer, and found that there’s quite a big catch in the fine print–after six months, the interest rate jumps from 3.99% to 29.99%. [More]

Go Ahead, Strategically Default On Your Underwater Mortgage

“Homeowners should be walking away in droves. But they aren’t. And it’s not because the financial costs of foreclosure outweigh the benefits. One can have a good credit rating again–meaning above 660–within two years after a foreclosure.” That’s the conclusion reached by a law professor who’s written a paper about strategic default, which is when you elect to walk away from an underwater mortgage because you stand to lose more money trying to keep it than if you cut your losses immediately. The problem is, lots of people think it’s the wrong thing to do, because individuals are supposed to play by different rules than the companies they do business with. [More]

Homeowners With Good Credit Are More Likely To Strategically Default

Here’s an interesting discovery about mortgage defaults from the LA Times:

Don't Have $5,300 For Season Tickets? The Washington Redskins Will Sue You Into Bankruptcy

UPDATE: The Redskins have vacated their judgment.

Credit Card Squeeze Is Pushing Consumers Toward Foreclosure

USAToday says that panic by the credit card industry is squeezing customers who ordinarily would be able to pay their bills — pushing them toward financial ruin and foreclosure.

Credit Card Defaults Hit QVC

QVC, the home shopping network, has announced that they will be laying off 910 workers over the next 14 months. A reader who would like to remain anonymous, described the layoff process in an email to Consumerist.

Hold On To Your Hats And Sunglasses, Here Comes The Credit Card Meltdown

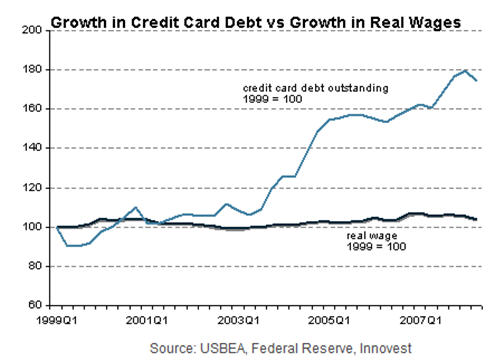

We hope you’re enjoying our current economic roller coaster because it’s likely to continue — According to a new report from research firm Innovest Strategic Value Advisors, titled “Credit Cards at the Tipping Point,” the fun has only just begun. As the credit crunch begins to affect consumers, they’re going to have more difficulty paying their credit card bills. The report suggests that credit card companies’ misleading practices and cavalier extension of credit may come back to bite them. Who should be worried? Capital One.

Online Bank Cancels Cards On "Risky" Customers

Egg, a Citibank-owned online bank in the UK, announced this past weekend that it’s canceling the accounts of 161,000 of its customers after “conducting a one-off, extensive risk review.”

Nobody Knows The True Cost Of Credit

Credit card companies make it impossible for consumers or markets to know the true cost of credit, according to Georgetown Law professor Adam Levitin. The professor makes his point with a pop quiz:

… what’s the interest rate on the credit cards you’re carrying? How about the default rate? Do you know what constitutes an event of default? What will trigger a penalty fee or surcharge? How much are those fees? If you’re like most Americans, you probably cannot answer many or all of these questions.