While the number of borrowers defaulting on their federal student loans didn’t increase this year, the number of consumers who remain in default hasn’t really change either, creating a stand-still of sorts. [More]

default rates

How The Federal Government Tries To Keep Financially Troubled Colleges From Failing

Under federal law, colleges that record a student loan default rate of 30% or more for three consecutive years – or 40% in a single year – can lose their access to federal aid. While the rule is meant to weed out bad players and schools that don’t provide students with means for gainful employment, a new report shows that the government often intervenes, propping up schools just before they fail. [More]

For-Profit Colleges Lead The Way On Loan Defaults: Report

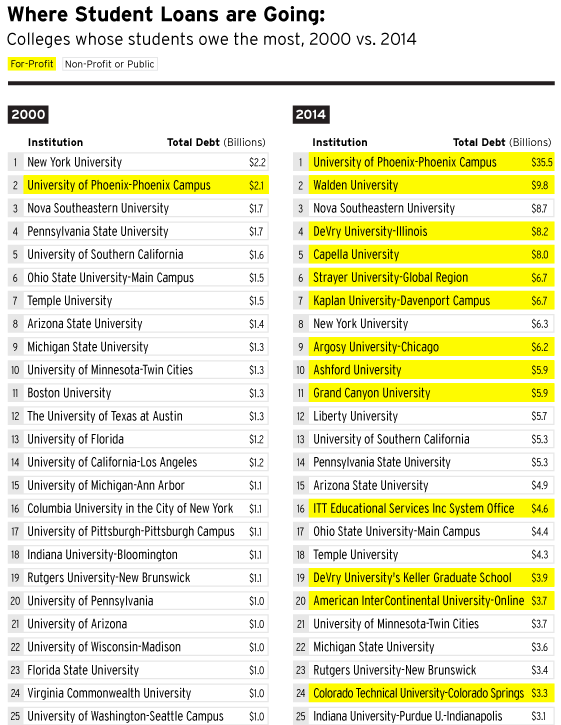

During the Great Recession, the growing industry of for-profit colleges promised millions of Americans a path to a higher education. But the high tuitions charged by many schools sent U.S. student loan debt soaring to more than $1.2 trillion. A new report claims that while for-profit schools charged top-dollar, many students were getting a cut-rate education, making it difficult to obtain jobs that will allow them to pay down this debt.

[More]