Report: Auto Title Loans Just As Bad, If Not Worse Than Payday Loans; Should Face Same Rules

Each year millions of consumers turn to high-interest, short-term loans to make ends meet. While you may be more familiar with payday lenders who charge triple-digit interest rates with the goal of trapping borrowers into taking out new loans to pay off the old ones, a new report finds that payday’s lesser-known relative, auto title loans, have equally destructive repercussions.

According to Pew Charitable Trust’s latest report [PDF] in its long-running Payday Lending in America series, nearly two million American’s spent a total of $3 billion at auto title storefronts across the country to borrow money against the value of their cars.

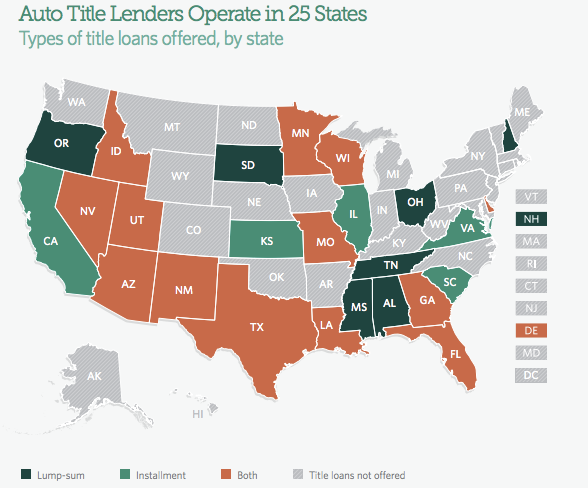

With nearly 8,000 stores operating in 25 states, title loans are less widely used than payday loans, but can often be even more devastating to consumers’ financial livelihoods.

Much like payday loan companies, auto title lenders require borrowers to repay the principal plus a fee within a specified time period. Unlike payday loans which give consumers about two weeks to make the payment, auto title borrowers typically have a month to repay.

However, the amount of money generally tied up in a title loan is often much greater than that of a payday loan. Pew reports the typical auto title loan averages $1,000 and comes with an annual percentage rate of about 300%, while a payday loan averages around $300 with equally high interest rates.

While neither the payday loan or auto title loan model takes into consideration a borrower’s ability to repay, the latter short-term product doesn’t even require borrowers to show proof of income.

On average a typical auto title loan represents nearly 50% of a borrower’s gross monthly income, where as only 36% of an average borrower’s paycheck is taken by payday loan payments.

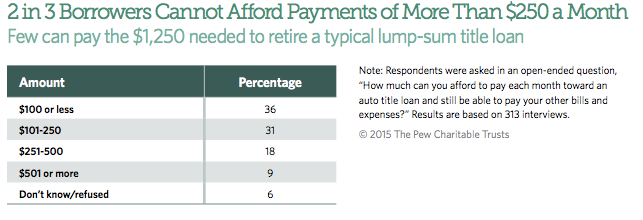

Most auto title loan borrowers say they can’t afford the hefty payments required to retire the loans.

According to the report, two in three title loan borrowers can not afford payments of more than $250 a month, let alone the $1,250 needed to retire a typical lump-sum title loan.

“As with payday loans, this disparity between what title loan customers can afford and what is required to retire the debt leads them to repeatedly renew their loans,” the report states.

Because of this, a majority of title loans due each month are rolled over, creating a business model – much like that of payday loans – that relies heavily on the expectation that borrowers will rollover their debt for additional months, while incurring costly fees.

One industry insider tells Pew that on average the typical 30 day auto title loan is rolled over eight times. These rollovers represent 84% of all title loans in Tennessee and 63% of those in Texas, according to the report.

While consumers fall deeper and deeper into debt with each renewal, when the funds eventually come due borrowers stand to not only lose needed funds, but their vehicles as well.

In fact, one in nine title loan customers has their car repossessed annually for failing to repay the debt.

According to the report, some 15% to 25% of repossessed vehicles are returned to borrowers who pay their overdue loan balances pulse fees. The rest of the vehicles are sold. In all, 120,000 to 222,000 borrowers lose their cars in any given year due to auto title loans.

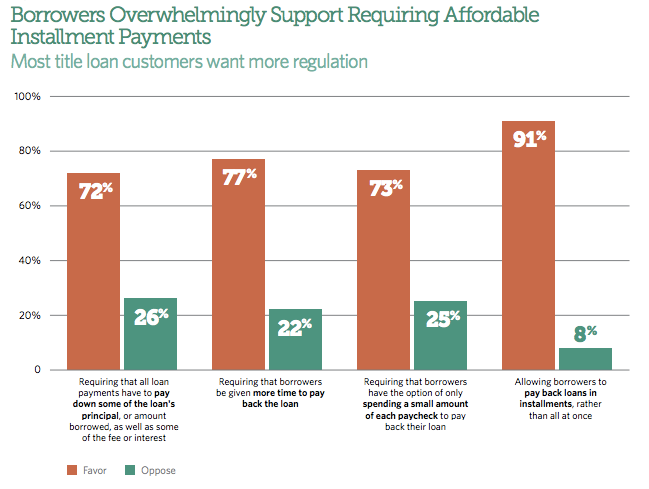

A majority of auto title loan borrowers favor regulations that would make the loans more affordable.

While borrowers see title loans as providing help and temporary relief at difficult times, they also expressed a desire for more robust regulations over the high-interest loans.

Nearly 66% of the borrowers surveyed by Pew said the industry should be more regulated to ensure that title loans are repayable in affordable, amortizing or principal-reducing installments.

Consumers say this structure would allow for more predictable and realistic payments, reducing their loan balance and providing a clear pathway out of debt.

According to Pew, the striking similarities between payday loans and auto title loans suggest that the latter advance should face the same regulatory reforms as payday loans rules. The Consumer Financial ProtectioN Bureau is expected to release an outline for its long-awaited payday loan rules later this week.

“The Consumer Financial Protection Bureau does not have the authority to regulate interest rates, but it can and should require small-dollar loans to have manageable installment payments and establish certain important safeguards,” the report states.

Pew’s small-dollar loan policy recommendations include:

• Ensure that the borrower has the ability to repay the loan as structured. Lenders should be required to determine applicants’ ability to repay based on their income and expenses.

• Spread loan costs evenly over the life of the loan. Any fees should be incurred evenly over the life of the loan. Loans should have substantially equal payments, each of which reduces the principal, amortizing smoothly to a zero balance.

• Guard against harmful repayment or collections practices. Policymakers should ensure that lenders do not use excessively long repayment periods to increase revenue. Generally, six months is long enough to repay a $500 loan, and one year is long enough to repay $1,000.

• Require concise, accurate disclosures of periodic and total costs.

• States should continue to set maximum allowable charges. Research shows that loan markets serving those with poor credit histories are not price competitive.

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.