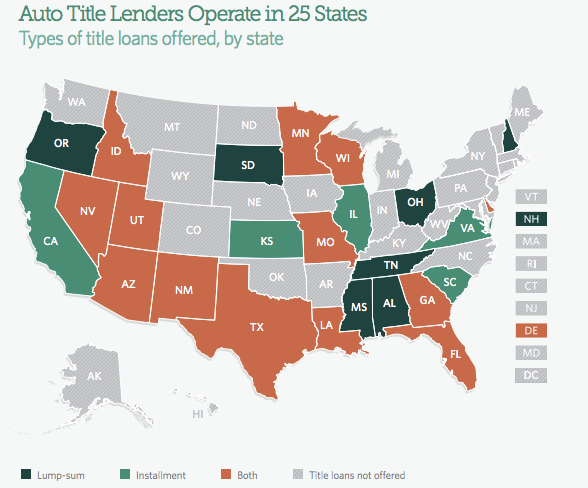

Each year millions of consumers turn to high-interest, short-term loans to make ends meet. While you may be more familiar with payday lenders who charge triple-digit interest rates with the goal of trapping borrowers into taking out new loans to pay off the old ones, a new report finds that payday’s lesser-known relative, auto title loans, have equally destructive repercussions. [More]

High Interest Rates

Report: Auto Title Loans Just As Bad, If Not Worse Than Payday Loans; Should Face Same Rules

Feds Take Action Against Pair Of Deceptive Auto Title Lenders

When it comes to short-term, high-interest loans, payday lenders may get most of the headlines, but auto title loans can be just as perilous for borrowers, especially when the lenders use deceptive marketing. This morning, the Federal Trade Commission announced its first ever legal actions involving title loan operations that misled borrowers. [More]