Survey: 9-in-10 Christian Consumers Think Payday Loans Hurt Borrowers Image courtesy of frankieleon

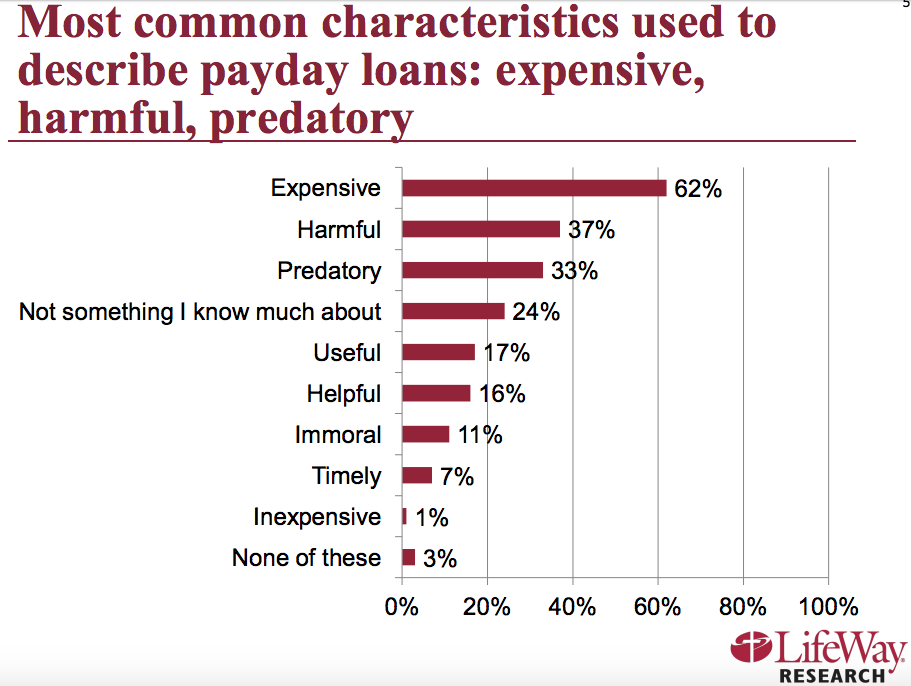

Expensive. Harmful. Predatory. Those are just a few of the words that members of faith-based groups used to describe payday and auto-title loans in a recent report that asked congregants in 30 states to detail their experience with the short-term, high-cost loans and similar financial products.

Faith-based organizations have been among the loudest voices when it comes to battling predatory lending practices, but it isn’t just the leaders of those groups that see the dangers of payday loans and other short-term lines of credit.

A new report [PDF] from LifeWay Research and Faith for Just Lending found that payday loans are widely viewed in a negative light by Christians in the 30 states that allow these high-cost lines of credit.

Nearly 77% of the 1,000 people surveyed for the report say they believe its is a sin to loan someone money when the loaner gains by harming the borrower financially.

But those viewpoints haven’t stopped these same consumers from obtaining the high-cost loans. Overall, 17% of those surveyed said they had taken out a payday loan.

Either through their own experiences or those of people they know, more than 90% of the consumers surveyed indicated that payday loans “mostly hurt” borrowers, while another 84% say they witnessed an increased need for emergency assistance by payday borrowers.

Wednesday’s report is just the latest way in which faith-based groups have spoken out against the payday loan industry, from efforts to educate consumers about the dangers of the loans to calling on politicians to denouce pro-payday loan bills.

Now it appears that their congregations are mostly behind those efforts, with several consumers indicating that they would support reforms to the industry.

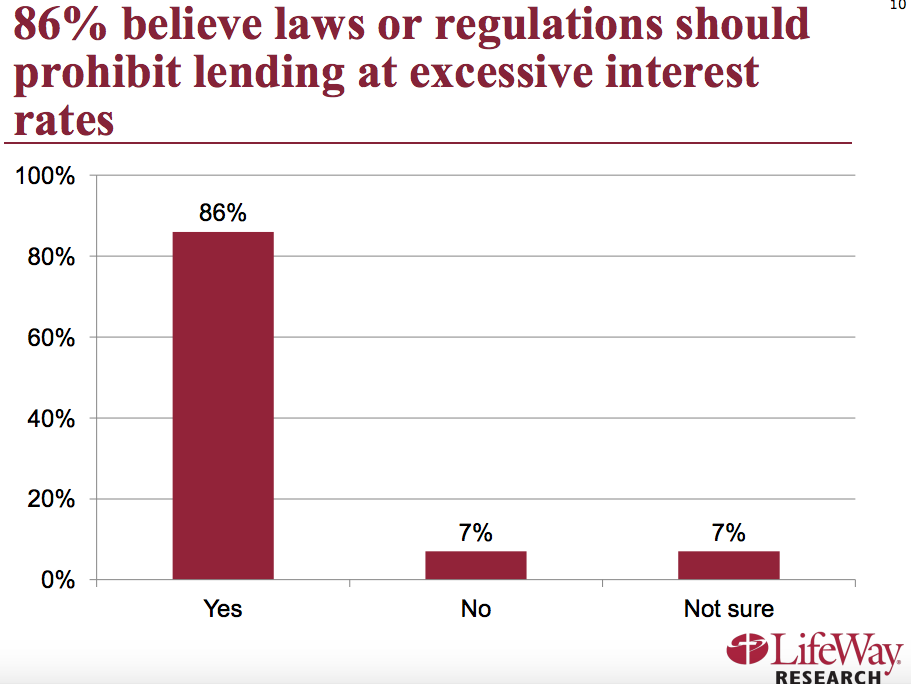

Of the consumers surveyed, 94% agree that lenders should only extend loans at reasonable interest rates based on ability to repay, and 86% believe that should be mandated by laws or regulations.

Faith leaders say the report serves as confirmation of the debt-trap realities of payday loan and that responsible reforms are needed.

“The payday lending business model is widely considered harmful and sinful,” Stephen Reeves, associate coordinator for partnerships and advocacy of the Cooperative Baptist Fellowship, said in a statement. “People of faith across a wide spectrum of beliefs are unified in their call for reform. It is time for lawmakers and regulators to step up, listen to the voice of the people so often drowned out by industry money and political influence, and enact fair and responsible boundaries for these predatory products.”

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.