Consumer advocates, regulators, and representatives of the small-dollar lending industry descended upon Kansas City on Thursday to discuss the Consumer Financial Protection Bureau’s long-awaited proposed rules intended to rein in predatory lending. [More]

Small-dollar loans

Pew Charitable Trusts Illustrates The Devastating Effects Of Payday Lending, How It Can Be Fixed

Back in March, the Consumer Financial Protection Bureau took its first long-awaited step in reining in the payday loan industry by releasing an outline for potential regulations over the small-dollar lines of credit known to thrust consumers into a devastating cycle of debt. While consumer groups were quick to applaud the steps, they also expressed concern that more could be done to protect people from the devastating consequences of such loans. This week, Pew Charitable Trusts released a video detailing the predicament nearly 12 million Americans face every year when taking out payday loans and how regulators might be able to find an answer. [More]

Outline For Payday Lending Rules A Good Start, But Not Enough To Fully Protect Consumers

Today, the Consumer Financial Protection Bureau released the first details of long-awaited regulations governing payday loans and other small-dollar lines of credit known to thrust consumers into a devastating cycle of debt. While consumer advocates were quick to applaud the Bureau’s work, and those in the financial industry to voice displeasure with aspects of the potential rules, both groups agreed that the coming months will involve more time and effort to craft meaningful protections for both sides of the issue. [More]

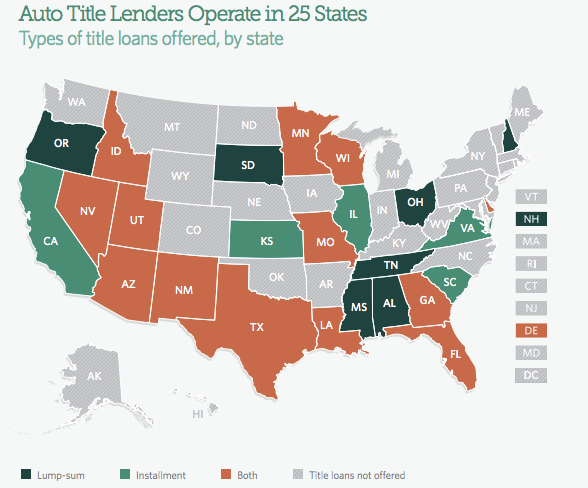

Report: Auto Title Loans Just As Bad, If Not Worse Than Payday Loans; Should Face Same Rules

Each year millions of consumers turn to high-interest, short-term loans to make ends meet. While you may be more familiar with payday lenders who charge triple-digit interest rates with the goal of trapping borrowers into taking out new loans to pay off the old ones, a new report finds that payday’s lesser-known relative, auto title loans, have equally destructive repercussions. [More]