In an effort to rein in short-term, high-cost loans that often take advantage of Americans who need the most help with their finances, the Consumer Financial Protection Bureau has finalized its new rule intended to make these heavily criticized financing operations to be more responsible about the loans they offer. But will bank-backed lawmakers in Congress use their authority to once again try to shut down a pro-consumer regulation? [More]

auto title loans

Financial Protection Bureau Finalizes New Rules To Curb Predatory Lending, But Will Congress Let It Happen?

South Dakotans Vote To Cap Payday, Auto-Title Loan Interest Rates At 36%

More than a dozen states and the District of Columbia currently prohibit payday lenders and other short-term loan companies from charging exorbitant interest rates on their financial products. Last night, the residents of South Dakota added their state to that list, voting to cap interest rates on short-term loans at 36%. [More]

Consumers, Payday Lending Employees Face Off On Proposed Short-Term Lending Rules

Consumer advocates, regulators, and representatives of the small-dollar lending industry descended upon Kansas City on Thursday to discuss the Consumer Financial Protection Bureau’s long-awaited proposed rules intended to rein in predatory lending. [More]

1-in-5 Auto Title Loans Lead To Vehicle Seizure

When seeking an infusion of cash to make ends meet, consumers may turn to payday loans, cash advance loans, or auto title loans. While each of these short-term, high-interest loans pose a financial risk to borrowers, only one has the ability to take away what is often a person’s largest asset: their vehicle. And, according to a new report, one-in-five consumers who take out a single-payment auto title loan have their car seized by lenders. [More]

Millions In Campaign Contributions Enable The Title Loan Cycle Of Debt

Each year, thousands of consumers lose their vehicles – often their largest asset – after taking out small-dollar, high-interest auto title loans to cover expenses. Despite hundreds of attempts by lawmakers to rein in the often predatory auto title market, generous campaign donations from the industry’s leaders have created a cycle in which consumers are plunged deeper into debt, while title lenders continue lining their pocketbooks. [More]

Abusive Lending Practices Can Lead To Negative Long-Term Consequences For Borrowers, Communities

Every year, more than 12 million Americans spend $17 billion on payday loans, despite the fact research has shown these costly lines of credit often leave borrowers worse off. Yet abusive lending practices are not relegated to borrowers in need of a couple hundred dollars to stay afloat until their next paycheck; there are mortgages, car loans, and other traditional lines of credit that can leave the borrower in a bind. Even if you never find yourself on the wrong end of a predatory loan, these products can still be a drain on your entire community. [More]

Outline For Payday Lending Rules A Good Start, But Not Enough To Fully Protect Consumers

Today, the Consumer Financial Protection Bureau released the first details of long-awaited regulations governing payday loans and other small-dollar lines of credit known to thrust consumers into a devastating cycle of debt. While consumer advocates were quick to applaud the Bureau’s work, and those in the financial industry to voice displeasure with aspects of the potential rules, both groups agreed that the coming months will involve more time and effort to craft meaningful protections for both sides of the issue. [More]

Report: Auto Title Loans Just As Bad, If Not Worse Than Payday Loans; Should Face Same Rules

Each year millions of consumers turn to high-interest, short-term loans to make ends meet. While you may be more familiar with payday lenders who charge triple-digit interest rates with the goal of trapping borrowers into taking out new loans to pay off the old ones, a new report finds that payday’s lesser-known relative, auto title loans, have equally destructive repercussions. [More]

Faith V. Greed: The Battle Between Faith-Based Organizations And The Payday Loan Industry

“The Bible condemns gaining wealth through usury; and the writers of Scripture warn about gaining wealth through exploiting the poor… [but] The State of Alabama allows Payday lenders to charge an annual interest rate of 456%.” [More]

1-In-4 Americans Turn To Payday Loans & Other High-Cost Financial Products

When discussing the topic of payday loans — or other high-cost, short-term financial products like auto-title loans and check-cashing — there can be a tendency to treat them like something that only a small percentage of Americans use. But a new report from the FDIC confirms that 25% of us have turned to one of these potentially predatory services in the past year, and that this rate has not been going down. [More]

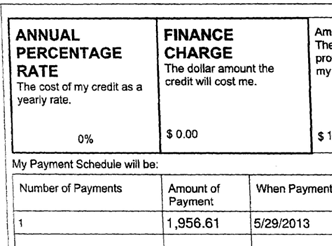

Auto-Title Lender Skirts Law By Giving Away Cash For Free

Several cities in Texas have recently enacted laws intended to drive out or rein in short-term, high-interest lenders offering auto-title loans, in which borrowers put up their cars as collateral for short-term loans averaging around $1,500. But one lender has figured out a way to get around those laws — by giving away free cash and redirecting customers elsewhere when they need to refinance. [More]

How Predatory Lenders Get Around The Law To Loan Money To Military Personnel

In spite of the Military Lending Act, a law intended to prevent predatory lenders from gouging military personnel with exorbitant interest rates and mountains of fees, some of these lenders have figured out ways to work around the very specific limits of the law, targeting active-duty service members with loans that are almost indistinguishable from the ones forbidden by the Act. [More]

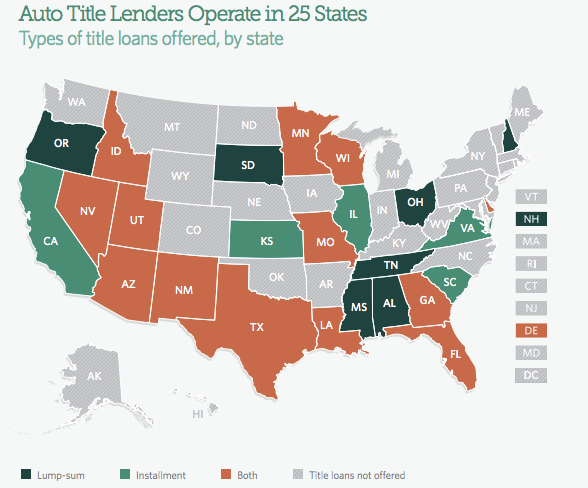

Report: Average $951 Car-Title Loan Results In $2,142 In Interest

If you live in any of the 21 states where car-title loans are available, you’ve probably seen the TV commercials touting the ease of this short-term borrowing option. But a new report claims that the average car-title loan results in revolving door of debt and a mountain of interest payments. [More]

Professor Tries, Fails To Defend Payday Lending As Legitimate Form Of Credit

Most regular readers of Consumerist know that we’re not exactly fans of payday loans, which charge upwards of 25 times the interest of a high-interest credit card and hundreds of times the interest on a standard loan. And yet, there are people — well-educated people at that — who stick with the argument that payday loans are a good thing. [More]

Auto Title Loans, Illegal In Most States, Even Riskier In Georgia

Meet Scott. When builders in financial trouble stopped paying him the money he was owed as a brick and stone contractor, he became desperate. He needed a loan to buy him time while he tried to collect the money he was owed. Thinking he understood the risks, he used his wife’s 2004 Ford Expedition to get an auto title loan of $2,000 at an interest rate of 25% per month — or 300% APR.