Dick Fuld is in the news again — this time for selling a $14 million Florida house to his wife for $100. No one is quite sure why he felt he needed to do this, but some are speculating that he may be trying to hide assets from Lehman Brothers shareholders in case they are getting ready to sue to him.

wall street

Citibank Will Split Into Two Companies, Promises To Lend To Consumers

Vikram Pandit, CEO of Citigroup, announced today that the company would be split after reporting a net loss for 2008 of $18.72 billion. He also promised to put the money from the $700 bailout to work by extending credit to consumers and businesses… responsibly.

Federal Reserve: Don't Get Excited, We're Not Done Bailing Out Banks Yet

Federal Reserve chairman Ben Bernanke said that the $800 billion stimulus plan being discussed by the new administration might “provide a significant boost to economic activity,” but that it wouldn’t work without more bank bailouts.

Investors Willing To Pay The Treasury To Borrow Their Money

Here’s a sad bit of news, investors are so shaken that they’re willing to put their money into Treasury bills — even if it means losing money.

WaMu Told Washington That Adjustable Rate Mortgages Were Safer Than Some Fixed Ones

The Associated Press says that a review of regulatory documents shows that years before the subprime mortgage crises developed into a full blown economic meltdown— the government ignored warnings and listened instead to lobbyists who represented some of the same banks that have now failed.

Stock Market Pleased By New Phase Of Bailout

Today the Federal Reserve announced the creation of a new special purpose entity that will buy consumer and business debt. Under the new plan, the Treasury will provide $20 billion dollars in of credit protection (from the Troubled Asset Relief Program) — and will absorb most of the losses, should they occur.

Citibank Teaches Us How To Destroy A $244 Billion Banking Institution

Only two short years ago, Citibank was worth $244 billion. Now, after its stock lost half of its value in just the past week, the bank is estimated to be worth $20.5 billion. What happened? The New York Times attempted to answer that question Saturday, and it pointed the finger at the usual suspects — conflicts of interest between those who were supposed to manage risk — and those who stood to benefit from making risky bets.

Consumer Prices Are Plummeting! Steepest Drop In History!

The Consumer Price Index, which measures how much Americans spend on consumer goods like groceries, clothing, entertainment and other goods and services, fell by 1 percent in October compared with prices in the previous month, says the NYT. “It was the steepest single-month drop in the 61-year history of the pricing survey.”

Pro-Consumer Regulation Needs Real Teeth So You Can Sue The Jerks

If the recent economic meltdown has a bright spot, it is the possibility that smart regulation may return. There will always be those who will cheat if they can, putting both consumers and the market at risk. It cannot function properly without regulation to prevent cheating and ensure consumers are getting a fair deal. But without a private right of action and attorney fees, consumer protection regulations are nearly worthless. A “private right of action” means…

Treasury, FDIC Considering Plan To Guarantee Millions Of Mortgages

The Washington Post says that the Treasury Department and the FDIC are considering a plan to guarantee millions of mortgages. According to the WaPo, the plan under consideration would encourage lenders to reduce borrowers monthly payments based on the homeowner’s ability to pay. To attract lenders into the program, the government would guarantee to repay the lender for a portion of its loss if the borrower defaulted on the reconfigured loan.

Attention: Credit Card Companies Have Realized That You Are Broke

The New York Times has an article detailing what promises to be the next fun financial crisis — credit card debt! Apparently, credit card companies have only just now realized that you people are broke! Whoops.

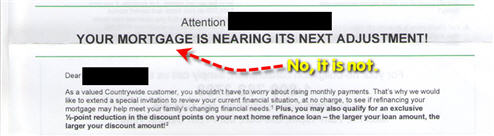

Countrywide To Fixed Rate Customer: Your Mortgage Is About To Adjust!

Countrywide either doesn’t know, or doesn’t care that reader Graham has a fixed rate mortgage, because they keep sending him “notices” that his mortgage is about to “adjust.”

../../../..//2008/10/28/the-case-shiller-home-prices-index/

The Case-Shiller home prices index, which tracks US home prices, fell a record-breaking 16.6% from last year in 20 metropolitan areas. [Forbes]

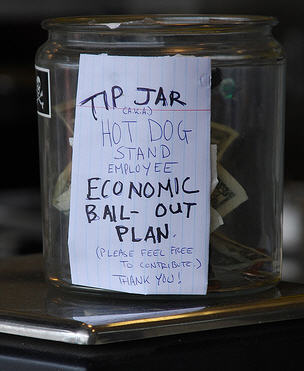

How An Ex-Lehman Brothers ibanker Fills His Days

What does an ex-Lehman Brothers i-banker do now that he has no reason to live? This brilliant, amusing, well-put-together, and NSFW video explores the answer. “I’ve been waking up 5:40 every morning, not waking up for Lehman Brothers necessarily, but when I wake up, I put on a suit.” I know there’s a lot of so-called “funny videos” on the internet, but seriously, this is a good one. Watch it inside.

Global Financial Panic: At Least We're Not Iceland…

Floyd Norris at the New York Times is live blogging the global financial panic today, and has compiled a list of how the world’s markets have performed in October. Compared to some countries, our situation doesn’t seem that bad. Which is scary.

Bank of America CEO Explains How He Beat Wall Street

Is the new financial capital of our country located in Charlotte, NC? 60 Minutes traveled down south to talk to CEO Ken Lewis about his bank, its recent purchase of Merrill Lynch, whether or not the bank bailout is “socialism” and the economic crisis in general.

../../../..//2008/10/13/stock-markets-finally-rose-with/

Stock markets finally rose with investors heartened by coordinated global intervention into the financial crisis and amid signs that the credit freeze was beginning to thaw a bit. [WSJ]