The downfall of Corinthian Colleges — the operator of Everest University, WyoTech, and Heald College — has put for-profit education chains in the spotlight, with people focusing on allegations of bogus job-placement statistics, grade manipulation, questionable marketing practices, and speculation regarding what will happen to $1.4 billion in federal student aid. But what about the actual students who have been watching this collapse from the inside? What about their stories? [More]

the cost of an education

Corinthian Employees: School Manipulated Grades, Job-Placement Stats To Score Federal Aid Money

When a college touts its job-placement statistics to prospective students and investors, does that number only refer to graduates who have jobs in their field of study? What about people who have decent jobs that aren’t in that field, but which they wouldn’t have gotten without the extra schooling? And should that stat include every grad who is earning any sort of paycheck, regardless of how meager the income or how unrelated to their education? [More]

The Government Has 1.2 Billion Reasons To Keep Corinthian Colleges Afloat

For the last week, we’ve been telling you about the ongoing negotiations between the U.S. Dept. of Education and Corinthian Colleges, the operators of the for-profit Everest University, WyoTech, and Heald College chains, that would sell off some of the schools and wind-down the others. Some people have asked why the government doesn’t just let Corinthian collapse. Part of the reason is that it would leave some 72,000 students in the lurch, but a big motivating factor is that the government could end waving bye-bye to more than $1 billion in student loan debt. [More]

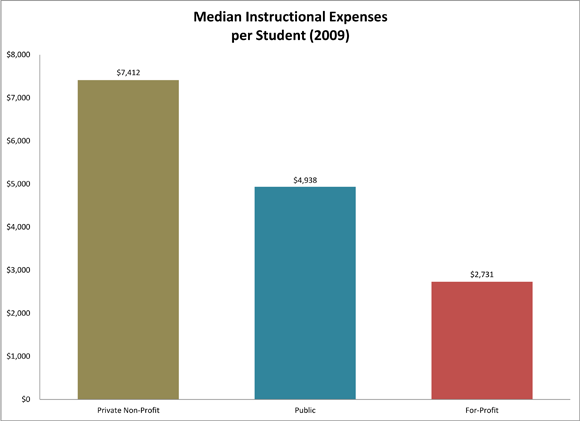

Your College Education Might Be A Better Investment For Goldman Sachs Than It Is For You

Americans have always viewed a college education as an investment in a student’s future, but there’s another sort of investment going on behind-the-scenes, and it’s nearly risk free. With access to a revolving door of prospective students and a continuous supply of federal aid, some colleges are turning hopes and dreams into big returns for Goldman Sachs and other investors. [More]

Private Student Loan Borrowers Face Automatic Default Because Of Co-Signer Provisions

College graduates with private student loans know the importance of staying current on their payments. But a new report by the Consumer Financial Protection Bureau finds that even consumers who pay their loans on time are finding themselves placed in default when the co-signer of their loan dies or declares bankruptcy. [More]

Colleges Tight-Lipped On Revealing How They Divvy Out Financial Aid

When choosing a college to attend most teens and their families shop around a little. With tuition skyrocketing, many consumers look at financial aid offered by universities as a top priority when considering which institution to attend. Even with regulations on the books requiring schools to outline how financial aid is distributed, families are finding it nearly impossible to estimate their child’s worth to a school. [More]

CFPB Sues ITT Tech For Allegedly Exploiting Students, Pushing Predatory Loans

The Consumer Financial Protection Bureau filed a federal lawsuit against a well-known for-profit college chain, alleging the company exploited its students and pushed them into high-cost private student loans that were likely to end in default. [More]

How To Not Suck… At Saving For College

(This is Part One of a two-part feature on paying for an education. Part Two looks at the best way to borrow for college.)

Next to a home purchase, sending your kids to college may be the biggest expense of your lifetime. And like all things money, this one is easy to screw up. [More]

California Sues For-Profit College Operator For Lying To Students & Investors

California Attorney General Kamala Harris filed suit yesterday against a company that operates three for-profit colleges, alleging that it lied both to students about the prospects of job-placement, but also to investors about the success rate of its graduates. The complaint also accuses the colleges of illegally using military seals in its ads to lure in members of the armed services. [More]

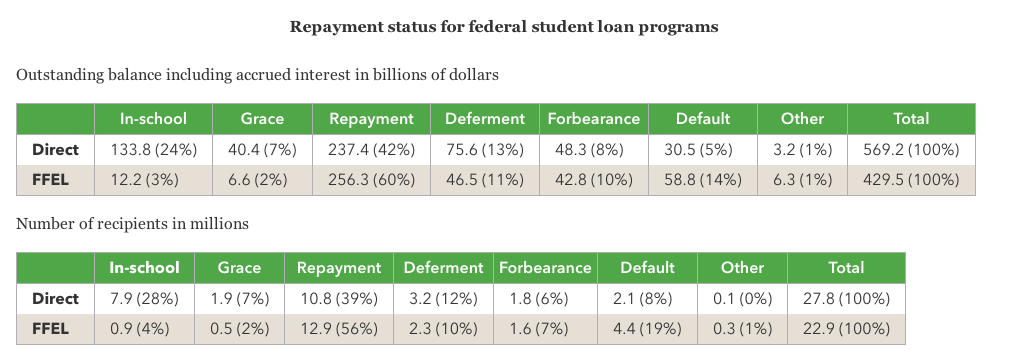

Fewer Than Half Of Federal Student Loans Currently Being Repaid

It’s scary enough to think that the federal government has around $1 trillion in student loan money out there waiting to be repaid. More frightening is the fact that not even half that amount is currently being paid back. [More]

Why College Isn’t Always A Good Financial Investment

There’s no doubt that the average college graduate earns more than the average worker with only a high school diploma, but a new report shows that it may not always make financial sense to invest in a degree. [More]

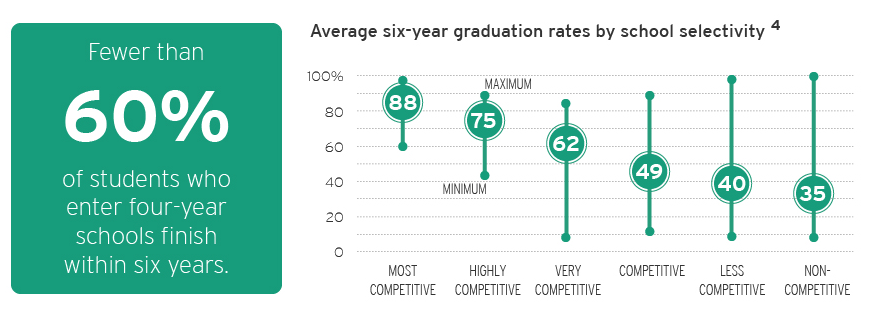

Report: $32 Billion In Federal Aid Going To Students At Underperforming For-Profit Colleges

Earlier today, the Senate Committee on Health, Education, Labor, and Pensions (HELP) announced the findings of its two-year investigation into exactly where the $32 billion annual investment in federal student aid is going — and whether students are getting a return on taxpayers’ investment. [More]

Hard-Up College Students Turning To Food Stamps

Being in college and having an empty wallet tend to go hand-in-hand. A full course load can make it difficult for students to find steady work, and in many college towns the work that’s available isn’t going to pay for very much. But while my fellow students were undergoing (legal) drug trials and donating whatever bodily fluid they could get a few cents for, some in the current generation of cash-strapped collegians are turning to food stamps. [More]

Private Colleges Starting To Offer Four-Year Degree Guarantees

Battling concerns from parents and students that they’ll toil in school for a half-decade or more without landing a degree, several private colleges are offering four-year degree guarantees. As long as students agree to meet with advisers and succeed in class, the colleges will waive tuition for any additional years it takes to finish up. [More]

More College Grads Defaulting On Student Loans

According to the latest numbers from the Dept. of Education, there was a sizable increase in the percentage of college students who defaulted on their student loans in 2009. [More]