Although many of us saw the final collapse of Corinthian Colleges Inc. on the horizon since last summer, for the nearly 16,000 students who were currently enrolled at the company’s 28 remaining Everest University, Heald College and WyoTech campuses news that they no longer have a school to attend was no doubt jarring, opening a door to questions about their future education and the debt burden they now carry. [More]

the cost of an education

Petition Calls For Loan Relief For Corinthian College Students

Ever since for-profit education chain Corinthian Colleges began its downward spiral last summer, consumer groups, students and legislators have urged the Department of Education to provide current and former students relief from student loans they took out to finance an education based on deceptive recruitment practices. Now that CCI has closed its remaining Everest University, Heald College and WyoTech campuses, consumer advocates say discharging federal student loans held by these students – and protecting students of other for-profit institutions – should be of immediate concern for the Department. [More]

Corinthian Colleges Completes Collapse, Closes Remaining Campuses Effective Immediately

Although it was nearly a year in the making, the largest collapse in U.S. higher education finally occurred Sunday, as embattled for-profit education chain Corinthian Colleges Inc. – the operator of Everest University, Heald College and WyoTech – announced it would close the remainder of its campuses effective Monday. [More]

Senators Want To Close Federal Funding Loophole Exploited By For-Profit Colleges

Each year for-profit colleges receive billions of dollars in Post 9/11 GI Bill benefits by exploiting a loophole in the rules that govern how these institutions collect federal funds. Once again, a group of senators has set out to change the way in which these schools count student aid, this time by urging the Department of Education to take an aggressive stand. [More]

California Orders Corinthian Colleges To Stop Enrollment At WyoTech, Everest Campuses

The collapse of for-profit education chain Corinthian Colleges – operator of Everest University, Heald College and WyoTech – continued today after a California regulator issued an order requiring the company to cease enrolling new students at its Everest and WyoTech campuses in the state. [More]

Corinthian Colleges Fined $30M Over Falsified Job Placement Rates At Heald College

The Department of Education continued its crackdown on deceptive for-profit college practices Tuesday by levying a $30 million fine against embattled Corinthian Colleges Inc. – operator of Everest University, Heald College and WyoTech – over the use of misstated and inaccurate job placement rates to recruit students. [More]

Nine Attorneys General Join “Corinthian 15,” Urge DOE To Provide Student Loan Debt Relief For Wronged Borrowers

A group of former and current Corinthian College Inc. students refusing to pay their federal student loans in protest of the government’s support of the crumbling for-profit college chain now have the backing of several top political officeholders afternine attorneys general from across the U.S. sent a letter to the Department of Education asking it to forgive the students’ loan debts. [More]

New York Consumer Agency Opens Investigation Into Four For-Profit Colleges

Student dropouts, loans default rates and recruiting tactics have been the cornerstone of many federal and state investigations into for-profit colleges. It appears to be much of the same for four such schools facing probes by the New York City Department of Consumer Affairs. [More]

For-Profit College Enrollment Is Down Following Scandals & School Failures

With increasing scrutiny from lawmakers, regulators, consumer advocates and the general public, the past five years have been hard on a for-profit college industry that had enjoyed years of happily feeding at the federal student aid trough. There have been changes to schools’ often excessive advertising budgets, damning reports of abuse, and soon-to-be-implemented rules requiring for-profit programs to demonstrate their effectiveness. The fractures in a business model that has attracted some of the biggest names in investment have become more evident, especially when comparing previously robust enrollment numbers with the most recent figures. [More]

Current, Former Corinthian College Students On “Debt Strike” Plan To Meet With Gov’t Officials

Last month, we told you about the Corinthian 15, a group of current and former students at crumbling Corinthian College Inc.’s WyoTech, Heald College, and Everest University campuses who were refusing to pay their federal student loans in protest of the government’s support of the for-profit college company. Now that group has grown to what could be called the Corinthian 100+, and it’s made plans to take its case to several government agencies this week.

Senators Chastise Govt. For Making Money Off Struggling Student Loan Borrowers, Not Offering Enough Relief

For several years now the government has offered federal student loan forgiveness programs aimed at helping borrowers to avoid defaulting on their debts. While recent reports have shown that the popularity of the programs has exceeded expectations, a group of six senators say the Department of Education could do more given the billions of dollars in payments it receives from federal loans each year. [More]

Current, Former Corinthian College Students Go On “Debt Strike,” Refuse To Pay Private & Federal Loans

With for-profit educator Corinthian Colleges Inc. selling off campuses and closing schools, thousands of Everest, WyoTech, and Heald College students are waiting to learn the fate of the more than $1 billion in private and federal student loan debt used to finance their education. While the Department of Education and the Consumer Financial Protection Bureau have worked to secure deals in which some of that debt will be forgiven, some students are increasing the pressure on such deals by staging a “debt strike.” [More]

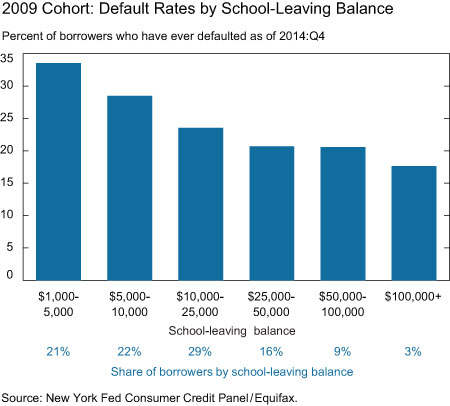

Why Are Borrowers With Less Student Loan Debt More Likely To Default?

Just days after the Federal Reserve Bank of New York showed that student loan delinquency rates were once again on the rise, a new Fed report finds it’s student loan borrowers with the lowest levels of debt who typically are the most delinquent.

[More]

Ontario Education Officials Close 14 Everest Campuses Amid Corinthian Colleges’ Downfall

If you thought the issues plaguing beleaguered for-profit college operator Corinthian Colleges Inc. didn’t extend beyond the borders of the United States, then you were wrong. Some 2,400 students in Canada are now left to pick up the pieces after the Ministry of Education in Ontario announced it would shut down CCI-operated Everest College campuses in the province. [More]

Deal Provides $480 Million In Debt Relief To Current & Former Corinthian Colleges Students

When student-loan servicing company Educational Credit Management Corporation revealed it would purchase 56 campuses belonging to embattled for-profit college chain Corinthian Colleges, regulators and consumer advocates began working to ensure that students affected by CCI’s collapse would be protected under the deal. Today, the Consumer Financial Protection Bureau and the U.S. Department of Education announced some students would receive the help they deserve in the way of $480 million in debt relief. [More]

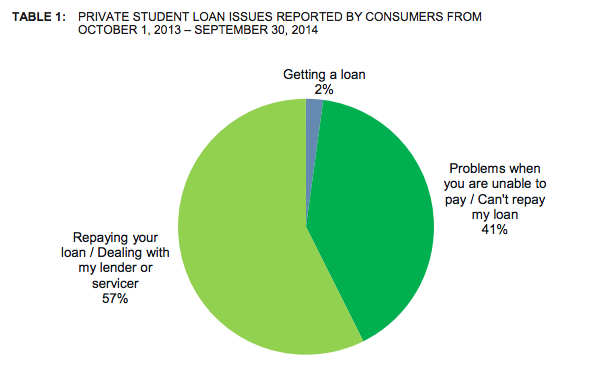

CFPB: Private Student Loan Companies Provide Few Options For Borrower, Driving Them To Default

By now we all know that for many consumers taking out private student loans is the only option when it comes to financing their higher education. We also know that many of those same borrowers will ultimately end up defaulting on their debt. A new report from the Consumer Financial Protection Bureau suggests that it’s not borrowers’ lack of willingness to repay that lands them further in debt, but a lack of resources provided by lenders that drives consumers to default. [More]

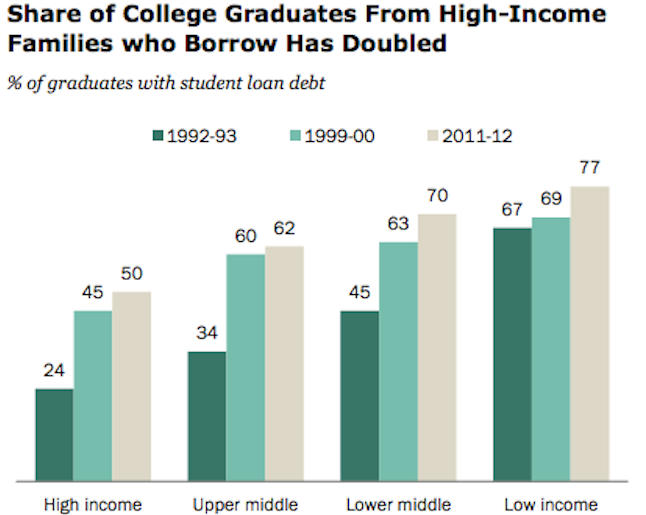

Percentage Of Rich Kids Needing Student Loans Has Doubled Since 1992

At one time, prospective college students from affluent families could count on having their tuition paid for by their parents or college savings accounts. But times have changed and now even students from the highest income brackets are borrowing to finance their high education dreams. [More]

Your Corinthian-Operated School Is Closing, But You Might Not Be Completely Screwed

It’s not everyday that a higher education institution shuts down or announces it might be sold. But for the thousands of students attending Corinthian College Inc. (CCI) schools — like Everest University, WyoTech, or Heald College –– that’s their new reality, and it’s one that leaves more questions than answers. [More]