Fewer Than Half Of Federal Student Loans Currently Being Repaid

It’s scary enough to think that the federal government has around $1 trillion in student loan money out there waiting to be repaid. More frightening is the fact that not even half that amount is currently being paid back.

It’s scary enough to think that the federal government has around $1 trillion in student loan money out there waiting to be repaid. More frightening is the fact that not even half that amount is currently being paid back.

Earlier today, the Consumer Financial Protection Bureau ran some numbers on who owes what in student loan debt, and whether these folks are paying it back.

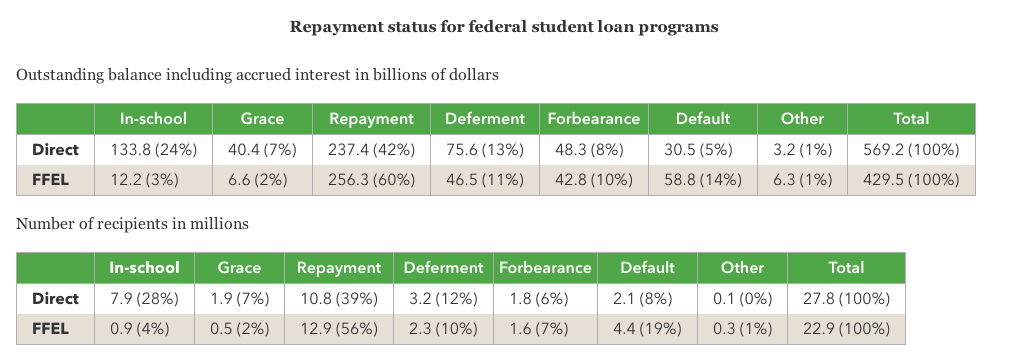

According to information on the government’s Direct Loan and Federal Family Educational Loan programs (NOTE: FFELP ceased writing new loans in 2010, but the data is included here because it still represents $429 billion in outstanding student loans), about $494 billion of the $999 billion owed to these programs is currently in the “Repayment” phase. Around 23.7 million borrowers, nearly 47% of borrowers, are actively paying off their loans.

Another $146 billion (14.6%) is being used by 8.8 million students right now, so it has yet to enter the repayment stage. The same is true for the $47 billion owed by 2.4 million borrowers still in that brief grace period between the end of their schooling and the beginning of their life lived in debt. In total, that’s nearly one-fifth of that $1 trillion that borrowers haven’t even had to start paying off yet.

5.5 million student loan borrowers have manage to have $122.1 billion in outstanding loans deferred, meaning they will need to get back to paying down the loans once their deferments expire.

Then there are the 3.4 million Americans whose $91.1 billion in loans are in forbearance. So while they are able to go a short while without having to make payments, the outstanding debt is still accruing interest. That’s likely why this group has the highest debt/borrower ratio ($26,800) of each of the groups.

The group with the lowest debt/borrower ratio is the 6.5 million borrowers who have defaulted on their federal loans totaling $89.3 billion. On average, that comes out to $13,740/borrower.

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.