We believe in unicorns and ghosts, but someone voluntarily letting a city keep her tax refund? Yes, such a person really exists, but somehow her act of goodwill toward the city of Detroit has been turned into an ordeal of vastly annoying proportions. The city now claims that she actually owes it $5,300. Good thing she’s kept up on her personal paperwork. [More]

taxes

Mississippi Takes Man’s Tax Refund Twice To Pay Child Support For Kid He Doesn’t Have

It has to feel completely awful to get a letter from the government saying it’s holding onto your refund check. But even worse, as one couple found out, is the feeling of that happening twice. And then there’s this doozy: Tax officials claim the refunds were put on hold because the state of Mississippi twice has said the husband owed back child support payments. Problem is, the couple has never lived in Mississippi and the man hasn’t father a child there either. Not once, and definitely not twice. [More]

Marijuana Shop Owners Paying Taxes In Cash Because Banks Can’t Take Their Money

Marijuana may be legal and taxed in Colorado, but the federal government still considers anyone who sells it to be a drug dealer and won’t allow banks to offer accounts to these businesses. So how is a legal businessman supposed to pay those sales tax to the state? [More]

H&R Block Sending $25 To Customers Impacted By Filing Delay

Last month the Internal Revenue Service said H&R Block had bungled over 600,000 tax returns, potentially causing refund delays for those customers. The tax preparation firm says to make up for that glitch, it’ll be sending out $25 gift cards to any customers who filed their taxes at company-owned H&R Block locations and were impacted by the processing delay. [More]

Loan Co-Signers Should Not Be On The Hook With The IRS If The Debt Is Forgiven

We’ve written numerous stories over the years about parents who co-signed student loans for their children and then were stuck with the payments when their child passed away or could not find employment. Sometimes lenders will choose to forgive that debt, but even then some are making a mistake that could continue to hurt the co-signer at tax time. [More]

Legislation Would Prevent IRS From Providing Pre-Filled Tax Returns

In 2002, when the IRS and the tax-prep software industry created Free File, which gives consumers with simple tax returns the ability to file electronically without being charged, the IRS agreed to not provide its own “free, online tax return preparation and filing services to taxpayers.” That arrangement is expiring, so some lawmakers (with a bit of money from tax-prep companies in their pockets) are seeking to make it permanent. [More]

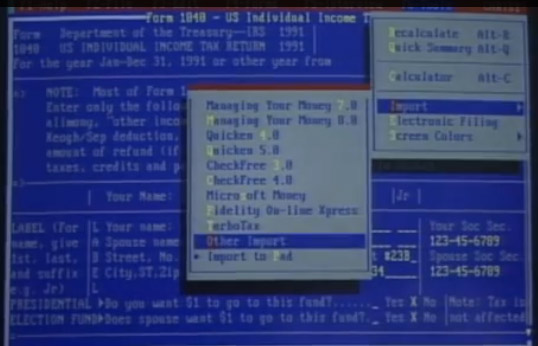

Filing Your Taxes Can Be Stressful, But At Least You Aren’t Using MS-DOS

It was pretty exciting for our household back in 1992 when Tax Dad got his first home office computer, and was able to use a primitive version of TurboTax to prepare his clients’ returns, instead of using a typewriter. In these days of Web filing, tax software from 1991 looks positively antiquated. [More]

Maybe You Can’t Deduct Nose Jobs & Sex Toys From Your Taxes, But Someone Can

One of the only entertaining things about tax season has to be the crazy deductions. Because honestly, what other joy can be reaped from this most dreaded of days? Well, besides a refund, if you get one. While you might not be able to write off a nose job or your excessive sweating as tax deductions, somewhere out there, someone can. We salute you, crazy deduction-takers. [More]

Ask Tax Dad: Dependent Mom And Free Fast Food

Usually, our staff Certified Tax Cat handles readers’ questions about taxes, but he’s too busy staring at a blank spot on the wall. Filling in for him is Laura’s dad, a retired accountant and real live independent tax preparer. Exclusively on Consumerist this spring, Tax Dad answers your questions. Also, to celebrate federal income tax deadline day, we link some coupons for free fast food deals good for today only.

This should be the last installment of Ask Tax Dad for 2013: tune in next year when Tax Cat comes back, Tax Dad returns, or maybe Tax Cat’s dad will show up to handle your tax questions. [More]

Ask Tax Dad: Old Clothes, An Audit Dispute, And IRA Rollovers

Usually, our staff Certified Tax Cat handles readers’ questions about taxes, but he’s also a cat, and cats occasionally just do whatever the hell they want. Filling in for him is Laura’s dad, a retired accountant and real live independent tax preparer. Exclusively on Consumerist this spring, Tax Dad answers your questions. [More]

Ask Tax Dad: Overfunded 401(k), Living In My Rental Property, And More Tax Returns For Dead People

Usually, our staff Certified Tax Cat handles readers’ questions about taxes, but he’s currently at a Warby Parker showroom shopping for some even less fashionable glasses. Filling in for him is Laura’s dad, a retired accountant and real live independent tax preparer. Exclusively on Consumerist this spring, Tax Dad answers your questions. [More]

Ask Tax Dad: Professional Organizations, Accident Settlements, And No Refund In 2014

Usually, our staff Certified Tax Cat handles readers’ questions about taxes, but caught his tail in an antique adding machine and is out on medical leave. Filling in for him is Laura’s dad, a retired accountant and independent tax preparer. The April 15th filing deadline is coming up, and Tax Dad is here to dispense his wisdom in between e-mails gently urging his daughter to just send over her 1098-E already. [More]

Ask Tax Dad: A Recovering Slacker, An Incompetent Accountant, And The Tax Return Of The Dead

Usually, our staff Certified Tax Cat handles readers’ questions about taxes, but he got his tax refund early this year and is on vacation, taking a salmon-watching cruise on the Pacific coast. Filling in for him is Laura’s dad, a retired accountant and real live independent tax preparer. Exclusively on Consumerist this spring, Tax Dad answers your questions. [More]

Ask Tax Dad: Employer Gas Cards, Student Loan Interest, And Escape From New York

Usually, our staff Certified Tax Cat handles questions about taxes, but he’s recovering from carpal tunnel paw surgery. Filling in for him is Laura’s dad, a retired accountant and real live independent tax preparer. Exclusively on Consumerist this spring, Tax Dad answers your questions. [More]

Ask Tax Dad: Should I Hire A Tax Preparer? What If I Win The Lottery?

Usually, our staff Certified Tax Cat handles questions about taxes, but he got into some really bad ‘nip and is taking the year off. Filling in for him is Laura’s dad, a retired accountant and real live independent tax preparer. Exclusively on Consumerist, Tax Dad answers your questions. [More]

Tax Dad Sez: Send Us Your Questions For Consumerist’s Designated Tax Preparer

Seriously old-school Consumerist fans might remember Ask Meghann’s Dad, where readers sent in questions about electrical wiring and home repair, and Mr. Marco was all competent and helpful. During a meeting to think of new story ideas, we remembered this and asked ourselves: what other experts do we have access to who are also related to us? Why, there’s our very own Tax Dad, independent tax preparer John Northrup. [More]