If there’s any number that freaks people out in Western culture, it’s 666, the supposed “number of the Beast” in the Bible’s book of Revelations. A Tennessee man who says that he’s been a born-again Christian for a decade was pretty spooked when he received the 666th W-2 earnings statement that his employer had printed. Now he’s quit his job and refuses to pay his taxes until he gets new, Beast-free paperwork. [More]

taxes

Here’s What To Do If You Can’t Afford To Pay Your Taxes

While many Americans look forward to tax season and the promise of a rewarding tax return, there are plenty of those who dread it, as they’ll have to fork over cash to settle up with the Internal Revenue Service. But for those who find they can’t afford to pay what they owe — whether in back taxes or due to other circumstances — the Federal Trade Commission is warning tax payers to avoid companies offering tax relief help. [More]

Hold Your Horses. Tax Season Will Kick Off Late This Year

We know you’re all just ready to put on your IRS face paint and get into the spirit of Tax Season, but there’s some sad news for tax fans everywhere today — this year’s filing season won’t kick off until Jan. 30, more than a week later than expected. [More]

Amazon Payments Locks Me Out Of Form For Not Filling Out Form

Rey had a really great idea for a Kickstarter project. We don’t know what it is: he didn’t tell us. The world may never have the chance to know what his amazing idea was, because he didn’t even get to the point of setting up his page and posting a slick video. Instead, Amazon stood in his way. Amazon? Why Amazon? Well, you have to accept Amazon Payments to use Kickstarter. Amazon needed information that Rey had already provided long ago and was still valid. In fact, they had just sent him some money. They asked him for it again anyway, and then things got ridiculous and confusing. [More]

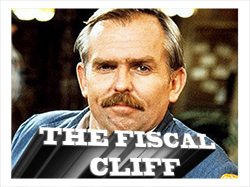

Is The End Near For Mortgage-Interest Deductions?

One of the benefits to homeownership has long been the ability to deduct any interest paid on your mortgage on your federal tax return. But with the so-called fiscal cliff looming in the new year, some folks in Washington are considering putting the deduction on the chopping block — or at least on a diet. [More]

Theater Sells Carrots For Performances Instead Of Tickets To Avoid Higher Taxes

Times are tough in Spain, with new austerity measures prompting everyone, including businesses, to tighten their belts and stretch their wallets. After the government slapped a 21% tax on theater tickets, one theater in a small town came up with quite a clever way to avoid shelling out extra cash — he sells carrots instead of tickets, and then “gives” performances away for “free.” [More]

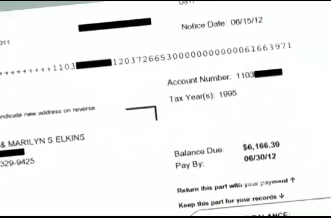

State Goes After Man For Tax Bill From 1995

Did you pay your taxes in 1995? More importantly, can you prove it? That’s the problem facing a California man who insists he paid his taxes 17 years ago and is now being forced to prove it. [More]

Tax Collectors Using The Power Of Peer Pressure To Get People To Pay Delinquent Taxes

Peer pressure can work wonders when it comes to convincing us to buy certain products, dress a certain way or even decide to start cooking kale even though we don’t totally get it. But taxation experts are hoping it will also do the trick to encourage people to pay up on their delinquent taxes. And maybe start wearing friendship bracelets to show how cool they are. [More]

Reminder: If You Filed A Tax Return Extension, You’ve Got Until 10/15 To File The Real Thing

It seems like it was just six months ago that everyone was freaking out, filing their last-minute tax returns, while you calmly filed an extension and said “I’ll deal with it in October.” Well, now the clock is ticking and folks who got extensions back in April now have until next Monday, Oct. 15, to file their actual returns. [More]

The 26 Top CEOs Who Made More Than Their Companies Paid In Federal Taxes

Once again, it’s time for the annual Institute for Policy Studies report on which top CEOs are earning more money than the companies they work for are paying out to federal government in taxes. [More]

Would You Turn Down Game Show Winnings Just Because Of The Taxes Involved?

All of your wildest dreams have come true, and there you are, on The Price Is Right, spinning that wheel, bidding your heart out and maybe, just maybe, winning it all in the Showcase. But with all that glory comes the cold hard tax facts — winners have to pay the government a portion of their haul, which can be a turnoff. One man who won the show last year held an “Ask Me Anything” thread on reddit (with his son’s help) and delved into the cold hard reality of paying for playing. [More]

City Informs Man Via Mail That It's Not About To Let That $0.07 Tax Shortfall Slide

In times of economic insecurity, every last penny counts. And in one Michigan city, that’s true down to seven cents a resident didn’t pay in local taxes. The man said he received a four-paragraph letter from the city treasurer informing him that he was short that a few pennies on his summer taxes. [More]

Church Buys Foreclosed Property, Ends Up With $170,000 Tax Bill

Members of a Dallas-area church congregation thought they had done their due diligence when they looked into buying some foreclosed property. They were told that all the back taxes had been cleared off the books; so why are they now facing a tax bill for $170,000? [More]

Do Not Report Debit Card Holding Your Fraudulent $2 Million Tax Refund Stolen

Yes, it is tempting to lie about your income and taxes already paid on your tax return and collect a huge refund. It’s even more tempting to get that massive undeserved refund on a debit card. But that’s totally unusual, and would get the government’s attention, right? Not in Oregon, where a woman has been charged with filing fraudulent return using Turbotax, and spending the $2.1 million prepaid debit card holding her refund. [More]

Washington Residents Have More Booze-Buying Options, But Are Paying More For It

Until now, buying liquor in Washington state had meant you needed to go to a state-operated store. But that monopoly has now ended after residents voted to open up liquor sales to a wide range of retailers. Unfortunately, this now means that some folks are now paying a lot more to get tipsy. [More]

Bioethicist: If We're Going To Tax Obese People More, We Should Tax Cat Owners Too

A growing number of people believe that obese Americans should pay more in taxes than healthy folks since being overweight can put you at a higher risk for health problems. It’s similar to the logic used to justify additional taxes on cigarettes. But bioethicist Art Caplan asks: Why not tax cat owners more while we’re at it? [More]

Higher Cigarette Taxes Drove Smokers To Pipe Tobacco & Cigars

Among the intended goals of higher taxes on cigarettes is that some smokers will quit rather than deal with the increased cost. While this may happen, newly released numbers show that taxing cigarettes also drove up the sales of forms of tobacco that are taxed at lower rates. [More]

Trimmed-Down IRS Staff Means Fewer Audits This Year

We certainly don’t want to give comfort to tax cheats — and we’re not trying to imply that any of our beloved readers are anything less than honest when filing their tax returns — but for those who dread a random audit, there’s some good news: Budget and staff cuts at the IRS will likely mean fewer audits. [More]