Tsk tsk, Wells Fargo. You should’ve known that stealing Citibank’s unspoiled bride at the alter was going to draw a bitter legal challenge. Late last night, Citibank’s team of repo-lawyers claimed a partial victory, announcing that a New York judge has agreed to block Wachovia’s sale. Citibank is also demanding $60 billion from Wells Fargo for interfering with the deal.

subprime meltdown

Why Did Everyone Buy This Stupid Toxic Debt? No One Understood It

Marketplace has the answer to one of the most troubling questions of our time. Why did people who are supposed to be smart buy all this stupid toxic risky debt? Apparently, it’s because they weren’t that smart, and they didn’t understand what they were buying or selling.

UBS Uses Markets, Not Goverment, To Deal With Sub-Prime Crisis

Instead of sucking off the blood of taxpayers, Swiss banking giant UBS is weathering a financial crisis wrought by investing in bad mortgages by aggressively selling off its U.S. commercial and residential mortgage-related assets. Reports Forbes:

10 Things To Expect From The New Post-Apocalyptic Economy

Kiplinger’s has put together a list of 10 things that you, fair consumer, can expect from our new post-wall-street-apocalypse economy. Should you be scared? Maybe.

WaMu Says, "Take A Picture It Lasts Longer…"

Reader Steve says this photo was taken at the Austin City Limits Festival on the same day that WaMu was seized by federal regulators — making it not only funny, but extremely accurate.

What Will The Largest Government Bailout Of Private Industry In US History Look Like?

A bailout of some kind is coming, but no one seems to know what it will look like and who it will help. The Wall Street Journal says that Senate Banking Committee Chairman Christopher Dodd of Connecticut has some ideas that might not go over too well with the Treasury Department.

SEC, Treasury Throw More Sandbags Into The Wall Street Flood Waters

The SEC has temporarily banned short selling of 799 financial stocks, and the Treasury Department has said that it would guarantee (temporarily?) money market funds up to the amount of $50 billion. The New York Times called this move “startling” because money market funds have long been considered one of the safest investments — about as safe as a savings account.

AIG's "Strength To Be There" Commercials Are Suddenly Hilarious

When Treasure Secretary Henry M. Paulson Jr. and the Fed chairman, Ben S. Bernanke, convened a meeting with House and Senate leaders on Capitol Hill last night to discuss giving AIG an unprecedented $85 billion loan, do you think they had a laugh about AIG’s commercials? We picture Paulson saying something like, “Ha, ha, ha… ‘strength to be there.’ That’s rich! Rich! Ha! I’m on a roll!”

"Crazy" Jim Cramer Takes This Opportunity To Gloat

About a year ago, CNBC’s Jim Cramer completely lost his sh*t on CNBC, screaming at Bernanke to lower interest rates before millions of borrowers went into foreclosure. Now, as the “Armageddon” that he was carrying on about is in full swing, Cramer is taking this opportunity to gloat.

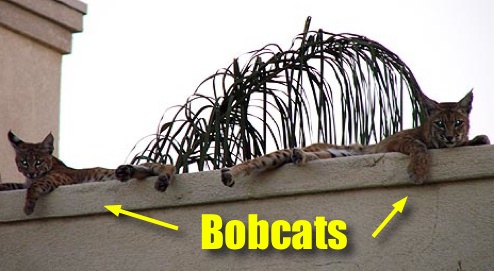

This Foreclosed Property Is An Excellent Home For Bobcats

Unlike prospective homebuyers, this pair of bobcats went absolutely wild over a foreclosed Lake Elsinore home. According to the L.A. Times, the bobcats were likely attracted by an outdoor koi pond, which isn’t just decorative, but serves as a fabulous source of drinking water. Like any suburban couple, the pair is expected to stay until the kids are old enough to leave.

FBI Saw Mortgage Crisis Coming, Didn't Stop It

The LA Times says that FBI agents told reporters that low interest rates and “soaring home values, [were] starting to attract shady operators and billions in losses were possible.” According to the report, Chris Swecker, the FBI official in charge of criminal investigations, told reporters that the FBI thought it was going to prevent a crisis similar to the S&L debacle.

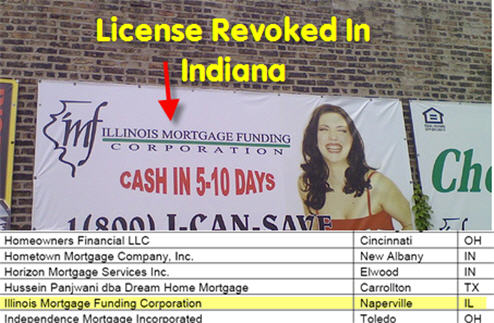

Oh Sh*t! 40% Of Indiana's Mortgage Brokers Lose Their Licenses

40% of Indiana’s mortgage brokers have lost their licenses because they did not comply with a new law aimed at “raising the standards” of the mortgage lending industry. The law requires mortgage brokerages to “name a principal broker with at least three years experience who has passed a state exam and will oversee his company’s business affairs,” says BusinessWeek. Sounds reasonable, doesn’t it?

Will The New Homeowner Rescue Bill Help Rescue You?

A new bill that will help 1-2 million homeowners escape their unaffordable mortgages by refinancing into new low-cost fixed-rate loans insured by the Federal Housing Administration (FHA) has passed the House and will now move on to the Senate. If it is eventually passed by the Senate and signed by the President (who is no longer threatening to veto it), will it help you?

../../../..//2008/06/19/over-400-people-have-been/

Over 400 people have been charged in the government’s national mortgage fraud probe, called “Operation Malicious Mortage,” which dealt with individual rather than corporate fraud. [Reuters]

../../../..//2008/06/19/two-former-bear-sterns-executives/

Two former Bear Sterns executives were arrested today for securities fraud. [NYT]

More Than 1 Million Homes Are Now In Foreclosure

Grim numbers today from the Mortgage Bankers Association. 2.5% of all mortgages serviced by the association’s members are now in foreclosure — 1.1 million homes. The rest of the numbers aren’t any more cheerful. Both the rate of new foreclosures and late payments were the highest on record going back to 1979, says the AP.