The San Jose Mercury News has compiled a list of financial tips for people just entering college. These are the sorts of things that will help you avoid racking up huge debts or wasting money you don’t have on fees and penalties—and of course they can apply to pretty much anyone, not just college students.

students

College Freshmen, Avoid These Money Traps

Personal finance blog Poorer Than You warns new college students to be on the lookout for money-sapping, credit-ruining traps.

Credit Unions Dive Into The Student Loan Market

Private loans are the worst type of student debt, but the best place to get them may be your local credit union. Like most credit union products, their loans are usually a better deal with more favorable terms than similar loans from bigger banks.

Want Help Getting A Student Visa? Call This $3-A-Minute 1-900 Number

Jon is headed to grad school in England and looking to nail down his student visa. Before he can hop the pond he’s going through a grad-level course on absurd, pricely hassles. Turns out the U.K. may have outsourced its visa customer service to a contractor that takes calls at a pay 1-900 number.

Students Can Use Internet To Rent Textbooks Rather Than Buy Them

The college textbook racket is a cruel exploitation of a captive market, and book prices seem to rise faster than Google stock.

Parents May Not Skimp As Much On School Supplies This Year — But They'll Still Skimp

Eiither the economy is improving somewhat or more parents are sacrificing to get their kids geared up for school this year, a survey by Deloitte & Touche LLP says.

Costly Private Loans Masquerade As Federal Student Loans

Some students who didn’t read the fine print are finding out too late that what they thought were federal student loans were actually private loans. The mistake is the difference between a 6% and 18% interest rate.

Big Shocker: Students Are Abusing Credit Cards

Sallie Mae‘s 2009 study of credit card use shows that students just love binging on plastic. Kids these days have more than four cards on average, and most of them carry a balance pushing $3,000. Many don’t tell their parents, and almost a fifth graduate with more than $7,000 of debt. This is how meltdowns start…

Abel's Copies Won't Issue A Refund Even After Selling You The Wrong Product

Abel’s Copies is standing by their strict “No Refunds” policy even after ordering the wrong course packet for reader David. The workers at the off-campus bookstore near the University of Texas at Austin insisted there was only one instructor for David’s course and that they couldn’t order a new course packet unless David paid in advance. When David got home, he realized that Abel’s sold him the wrong packet. He called the store and learned that Abel’s had the right packet in stock for $25 less than he paid—but Abel’s refused to issue a refund…

How Universities And Credit Card Companies Make Money Off Of Students

How can an educational institute act in its students’ best interest if it stands to make money off of increasing their debt load? The symbiotic relationship between universities and credit card companies is being questioned more than ever by student groups and politicians, writes the New York Times.

How To Get Your First Credit Card

I got my first credit card from one of those guys on campus with a folding table and free tshirts. Back then, they gave give credit to anyone who could fog a mirror. No income? No assets? No clue? No problem! The tshirt wasn’t even cool, it was for AT&T, and I got it as easily as my first beer. Nowadays, what the meltdown of our financial system and all, they actually have some requirements to pass before giving you a credit card. Crazy. So what’s a young consumer looking for fresh plastic to do?

Bally Total Fitness Scams College Student By Swapping Contracts

Chanda signed up for a month-to-month membership at a Bally Total Fitness in Montclair, California, but when things went wrong—as they frequently do with this company—Chanda found himself signed up for a 3-year agreement. Their proof? An unsigned contract that doesn’t look like the one he was given.

POLL: Does The Current Drinking Age Limit Actually Encourage Binge Drinking?

A new campaign arguing that the 21-year-old drinking age is not working, and that it “has created a culture of dangerous binge drinking” on college campuses has been signed by an eclectic group of over 100 college presidents, including those of Duke, Dartmouth, The Ohio State University, and Johns Hopkins.

Castle Toyota Rescinds Scholarships After Students Decide To Mourn Their Dead Teacher Instead Of Staging A Commercial

Poor Howard Castleman. All he wanted was a little PR for his car dealership. Castleman planned to give four scholarships to students at Patterson High School in Baltimore, but instead of honoring Castleman’s charity by inviting the media and displaying his dealership’s banner at the senior’s farewell ceremony, the school instead decided to honor a long-time teacher who recently died of a heart attack…

Students And Parents, It's Time To Fill Out Your FAFSA

Tax time is also FAFSA (Free Application for Federal Student Aid) time for students and their parents. While the federal due date is June 30th, in some states, the FAFSA is due even before your taxes, so make sure to remember this important piece of paperwork.

Bad Voodoo: Transforming Student IDs Into Debit Cards

Cash-strapped colleges are partnering with banks to transform student IDs into debit cards. The deals are a windfall for the institutions, but force students to open accounts laden with hefty penalty fees and surcharges.

Adobe Won't Fix DRM Screw-Up Rendering E-Books Unreadable

If you use Leopard on a Mac and plan on buying e-books, be very careful—according to the various complaints on this thread, Adobe’s Digital Editions still doesn’t work on Leopard, and yet most places selling Digital Editions e-books won’t warn you of this, leaving you with activated books you can’t return but also can’t read.

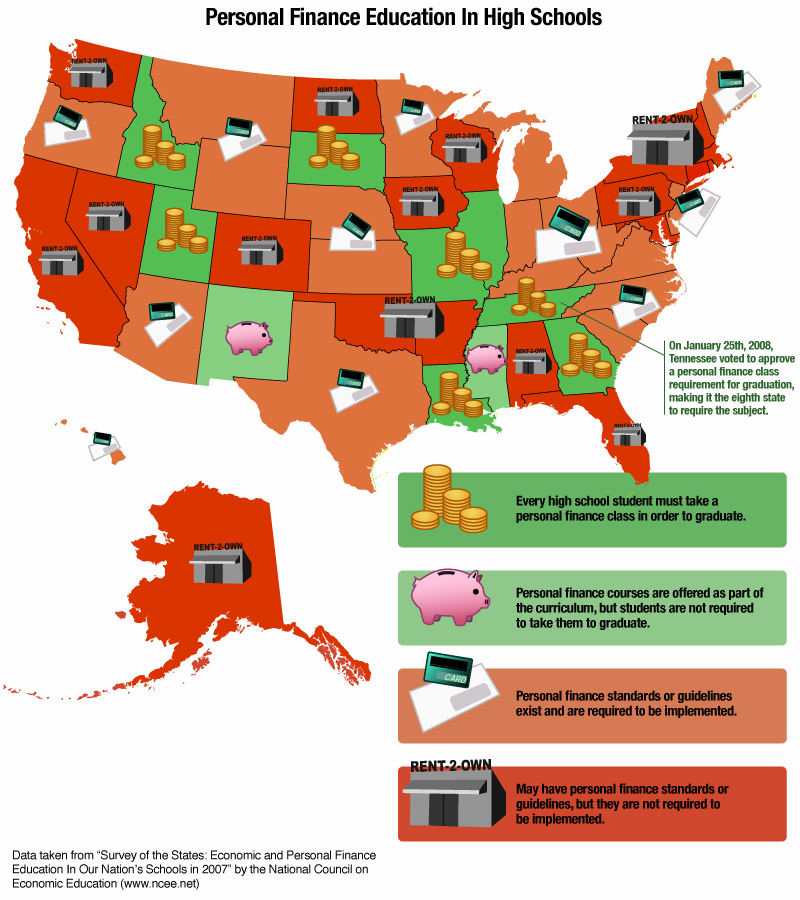

Report Card On Personal Finance Education Nationwide

Less than a week ago, Tennessee voted to require a personal finance class of all graduating high school students, starting with this year’s seventh graders. Unfortunately, less than 20% of states have similar requirements. We’ve made a fancy-schmancy graphic to show which states are teaching tomorrow’s citizens how to manage money, and which states are likely to be great places to set up payday loan shops. Inside, see the chart nice and big.