Earlier this year, Wells Fargo announced plans to get out of the payday loan-like business of direct deposit advances. Now it looks like the banking giant is getting ready to shed another aspect of its business: government-guaranteed student loans. [More]

student loans

Treasury Dept. Urges Student Loan Servicers To Do A Better Job, Try Incentives

Hot of the heels of a report from the Consumer Financial Protection Bureau detailing how loan servicers trick consumers into paying more, top officials with the Department of Treasury implored the industry to fix their often nefarious ways. [More]

Student Loan Servicers Tricked Borrowers Into Paying More, Made Illegal Collection Calls

As if student loan borrowers needed more bad news, the Consumer Financial Protection Bureau released a report this week detailing how some student loan servicers have tricked consumers into paying higher fees and misrepresented balances due. [More]

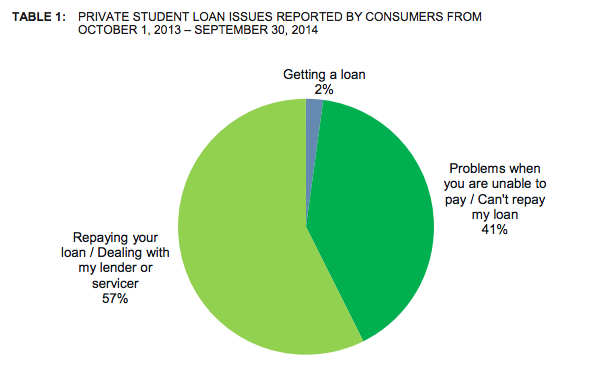

CFPB: Private Student Loan Companies Provide Few Options For Borrower, Driving Them To Default

By now we all know that for many consumers taking out private student loans is the only option when it comes to financing their higher education. We also know that many of those same borrowers will ultimately end up defaulting on their debt. A new report from the Consumer Financial Protection Bureau suggests that it’s not borrowers’ lack of willingness to repay that lands them further in debt, but a lack of resources provided by lenders that drives consumers to default. [More]

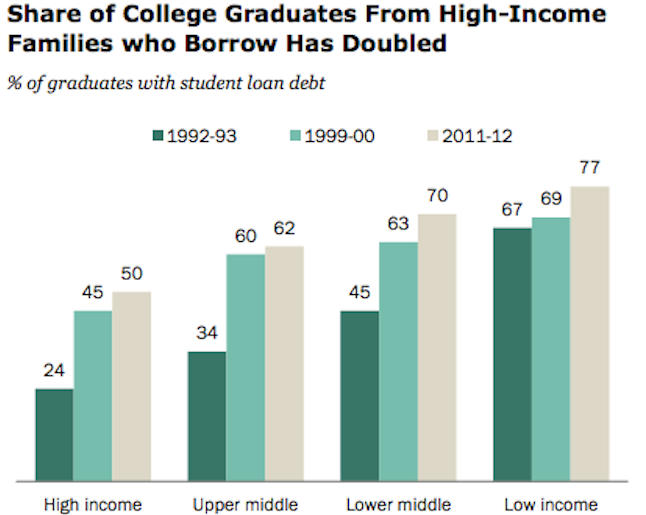

Percentage Of Rich Kids Needing Student Loans Has Doubled Since 1992

At one time, prospective college students from affluent families could count on having their tuition paid for by their parents or college savings accounts. But times have changed and now even students from the highest income brackets are borrowing to finance their high education dreams. [More]

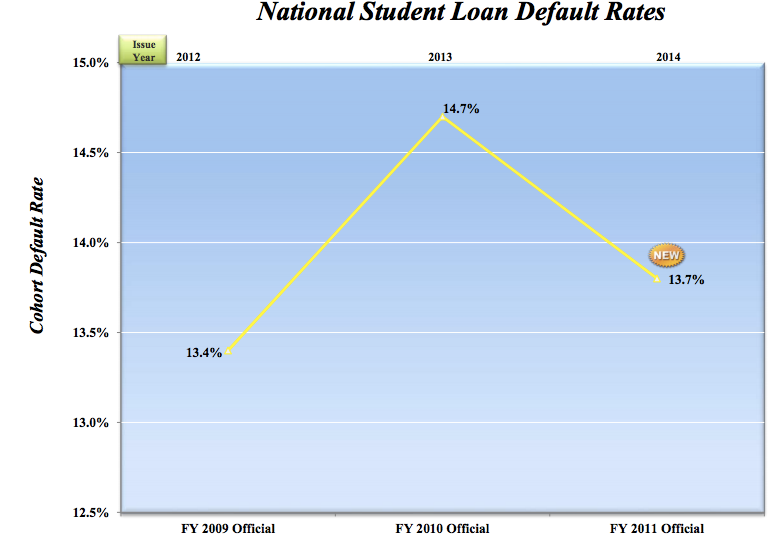

650,000 Student Loan Borrowers Who Began Repayment In 2011 Have Defaulted On Federal Loans

Maybe more consumer are realizing the long-lasting negative effects that can come from not repaying their student loans. Or maybe not. we don’t really know why, but we do know that the number of borrowers defaulting on some federal student loans is decreasing. [More]

Group Makes Debt Disappear, Pays $3.9M Toward For-Profit Students’ Outstanding Private Loans

If you’re one of the millions of consumers saddled with hard to repay student loan debt, you’ve probably dreamed of the day when your repayment obligation is finished. While it will take most of us years to reach that fine day, others are finding their student loan debt have been paid in full by a group of strangers. [More]

Senate Once Again Blocks Bill To Allow Borrowers To Refinance Federal And Private Student Loans

A bill that would have allowed millions of private and federal student loan borrowers to refinance their debts to the lower rate currently being issued on new federal and private student loans was once again blocked in the Senate. [More]

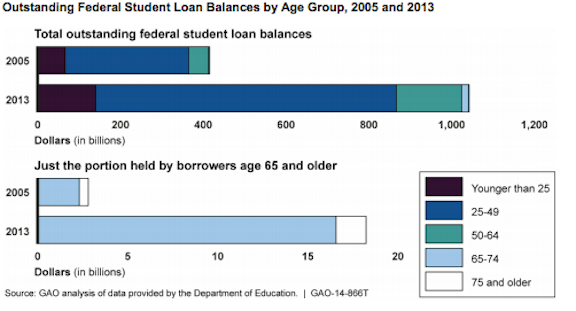

Report: Student Loan Debt Isn’t Just An Issue For Young Americans

When we talk about student loan debt it’s easy to picture a spry, young 20-something who is struggling to get out from under mountains of high-interest loans. But, as a new report points out, that’s not always the case, sometimes those who graduated even decades ago continue to struggle in paying back their student loans. [More]

Report: 40 Million Consumers Have At Least One Student Loan

Increases in college tuition might have made sense during the brief boom years of the real estate bubble. But when the economy tanked and Americans struggled to recover, college costs continued to soar, resulting in even more students taking on loans to pay for their education. [More]

Senate Set To Vote On Bill To Refinance Private & Federal Student Loan Interest Rates

A bill left for dead in the Senate back in June has been resurrected. The Bank On Students Emergency Loan Refinancing Act that would allow consumers to refinance their student loans to the rate currently being issues on new federal and private student loans is slated for a vote Tuesday morning. [More]

John Oliver On For-Profit Colleges: You Might As Well Go To Hogwarts

What would it look like if you condensed all our hundreds of stories about student loans and for-profit colleges into a profanity-filled, hilarious rant that takes a brief detour to discuss Lyndon Johnson’s scrotum? John Oliver answered that question on Sunday night. [More]

Corinthian Colleges Employee: “We Work For The Biggest Scam Company In The World”

Corinthian Colleges — the operator of for-profit school chains Everest University, WyoTech, and Heald Colleges — is selling off or shutting down campuses as it faces lawsuits and investigations from multiple state and federal agencies. The allegations involve bogus job-placement stats, grade manipulation, and misleading marketing. We recently spoke to several current and former CCI teachers and admissions staffers who confirmed these bad practices and explained that it was all done in pursuit of billions of dollars in federal aid from taxpayers. [More]

Your Corinthian-Operated School Is Closing, But You Might Not Be Completely Screwed

It’s not everyday that a higher education institution shuts down or announces it might be sold. But for the thousands of students attending Corinthian College Inc. (CCI) schools — like Everest University, WyoTech, or Heald College –– that’s their new reality, and it’s one that leaves more questions than answers. [More]

Corinthian Colleges To Sell Off 85 Campuses; Close 12 Others

While most of us spent the July 4th weekend relaxing and trying to not think about work or school, the folks at faltering for-profit education company Corinthian Colleges — operators of Everest University, WyoTech, and Heald College — were busy slapping For Sale signs on almost all of their campuses around the country. [More]