“Know before you owe” took on a different meaning for students at Indiana University this year. A new initiative by the school resulted in students borrowing nearly $31 million less than in previous years. [More]

student loans

Why These 5 Pro-Consumer Bills Won’t Become Law In 2014

Back in January, at the dawn of the year, we gazed into our not-quite-crystal ball and took a look at some pieces of pending legislation that could help consumers this year. Now, in July, we’re at the halfway point of the year, and so it’s a good time to take a look at those bills and see how the wheels of government have turned in 2014. [More]

The Government Has 1.2 Billion Reasons To Keep Corinthian Colleges Afloat

For the last week, we’ve been telling you about the ongoing negotiations between the U.S. Dept. of Education and Corinthian Colleges, the operators of the for-profit Everest University, WyoTech, and Heald College chains, that would sell off some of the schools and wind-down the others. Some people have asked why the government doesn’t just let Corinthian collapse. Part of the reason is that it would leave some 72,000 students in the lurch, but a big motivating factor is that the government could end waving bye-bye to more than $1 billion in student loan debt. [More]

Senators Hope To Block New Student Enrollment At For-Profit Corinthian Colleges

Days after the U.S. Dept. of Education brokered a deal with Corinthian Colleges — the operator of for-profit school chains like WyoTech, Heald Colleges, and Everest — that would allow these programs to remain open while it faces numerous state and federal investigations, a dozen Senators have asked the Education Secretary to block continued enrollment at Corinthian-owned schools. [More]

Not Everyone Has $100,000 In Student Loan Debt, But That Doesn’t Mean There’s Not A Problem

Horror stories about student loan debt have dominated the headlines in recent years. Many feature consumers with hefty loan tabs of more than $100,000, however, those experiences aren’t necessarily representative of the student loan landscape as a whole. But, just because you’re not bleeding to death, doesn’t mean you’re not bleeding. And just because most borrowers have $10,000 or less in debt doesn’t mean they aren’t hurting. [More]

Expected Bill Would Allow Private Student Loan Debt To Be Discharged In Bankruptcy

If at first you don’t succeed, try again with a more drastic measure. Just two weeks after a bill to allow private student loan borrowers to refinance at lower interest rates failed to gain traction in the Senate, a new bill expected to be introduced this week takes things a step farther. [More]

FAFSA Twitter Account Sorry For Posting “I’m Poor” Tweet Aimed At Financial Aid Applicants

You know what isn’t always that funny to people who can’t afford say, college? Calling them out for being poor on social media. Oh, hello, Federal Student Aid’s twitter account. You seem to have made a mistake in that area. [More]

For-Profit Corinthian Colleges To Sell Off Campuses, Phase Out Programs

Corinthian Colleges, the company that operates for-profit education chains like WyoTech, Everest, Heald Colleges, and others has been the subject of both state and federal investigations that have kept it from opening up any new campuses. Today, Corinthian announced it’s working on a deal with the U.S. Dept. of Education that would keep its schools operating while it sells off a number of campuses and phases out others. [More]

Report: Millennials Feel Overwhelmed By Debt, But They See A Bright Future Ahead

In news that is in no way shocking, millennials say they are overwhelmed by debt. [More]

Bill To Allow Students To Refinance Private And Federal Loans Dies After Senate Debate

A bill to allow consumers to refinance their student loans to the rate currently being issued on new federal and private student loans succumbed to a painful death on the Senate floor Wednesday despite being championed by consumer advocates. [More]

Executive Order Would Expand Student Loan Debt Forgiveness Program To 5 Million Additional Consumers

College students and graduates weighed down by crushing student loan debt can expect a little help in repaying those loans with the forthcoming expansion of the Pay As You Earn initiative. [More]

For-Profit Schools Are More Flexible & Convenient Than Community Colleges, But Can Land You In Debt Hell

Whether it’s for financial, academic or personal reasons, a traditional four-year college isn’t in the cards for everyone. Community colleges have long offered the opportunity for people to get started (or restart) their education without having to go into debt, so why have so many Americans recently opted for more expensive for-profit colleges that are regularly criticized for spending more on acquiring students than they do on teaching them? [More]

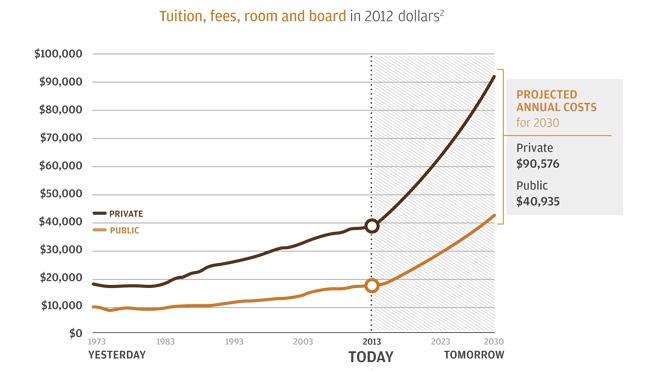

Here Are Two Graphs Any Parent Of A College-Bound Kid Didn’t Want To See Today

As we’ve mentioned numerous times over the last few years, college tuition costs have skyrocketed during the past two decades, far outpacing inflation and saddling an entire generation of college-educated Americans with student loan debt that can take many years to pay off. All the while, college graduates aren’t making as much as they did when college was more affordable. Surely the trend of soaring college costs has to level out, right? [More]

How To Not Suck At Making The Transition From School To The Real World

All around the country, people who’ve never had a full-time job or paid their own way are going to be pushed out of safe bosom of school. Maybe you’re one of them. Well, now that you’re done with your cap and gown and you have a diploma in your hand, it’s time to join the rest of us in the real world. [More]

College-Educated Consumers With Student Debt Have Median Net Worth Of Just $8,700

It’s no surprise that most college graduates leave with a degree and an excessive amount of student debt. But what was once promoted as a gateway to a better life has left graduates under 40 with lower accumulated wealth and a lower level of satisfaction in their financial situation. [More]

Sen. Elizabeth Warren Introduces Legislation To Allow Refinancing Of Many Student Loans

Students who took out their first federal student loan this past fall will someday be glad that they are only paying 3.86%. Just ask those of us whose loans were nearly double that percentage. But a new bill introduced in the Senate today by Massachusetts Senator Elizabeth Warren would allow student loan borrowers to refinance at the rates set for new borrowers by last year’s legislation. [More]

Proposed Bill Would Eliminate Automatic Default For Private Student Loans

Between finding a job, finding a place to live, paying bills, and generally being an adult for the first time in their lives, many recent college graduates face a slew of challenges. One thing they shouldn’t have to think about is automatically defaulting on a student loan when a co-signer dies or files for bankruptcy. Today, legislators proposed a bill to protect consumers from getting stuck in this trap. [More]

Student Loan Forgiveness Plans Could Be A Victim Of Their Own Success

Student loan debt in the U.S. currently totals more than $1 trillion, with some predicting it will only get worse as tuition increases continue to outpace inflation. Recently launched federal student loan forgiveness programs were intended to provide relief to some of these borrowers, but the plans’ unexpected popularity has created a new set of concerns. [More]