Banks & Credit Card Companies Saving Millions By Taking Away Your Right To Sue Image courtesy of Adam Fagen

Tens of millions of American consumers have clauses in their credit card, checking account, student loan, and wireless phone contracts that take away their rights to sue those companies in a court of law, and more than 93% of these people have no idea they’ve had this right taken away from them. The companies involved are presumably quite happy about this lack of awareness, as it results in millions of dollars in savings that aren’t being passed on to you.

This is all according to a new report on arbitration from the Consumer Financial Protection Bureau, which found, among other things:

• 53% of credit cards currently have arbitration clauses.

• Only 8% of banks and credit unions use the clauses, but those few institutions are so large that they represent 44% of all insured deposits.

• 92% of prepaid debit cards are subject to arbitration.

• 86% of the largest private student loan lenders include arbitration clauses in their contracts.

• 99% of payday loans in California and Texas include the restrictive clauses.

• 88% of wireless phone providers in the U.S., representing 99% of phones on the market, use arbitration.

• 75% of consumers don’t know whether their financial and credit accounts have arbitration clauses.

• Fewer than 7% of those with arbitration clauses understood that these few paragraphs of text take away their right to sue.

DIVIDE AND CONQUER

For those unfamiliar with arbitration it’s a process for resolving disputes outside of the legal system. Rather than have your case heard before a judge, a private arbitrator is responsible for the ultimate decision.

Even arbitration advocates have acknowledged that the process is often unbalanced in favor of the business that’s familiar with it.

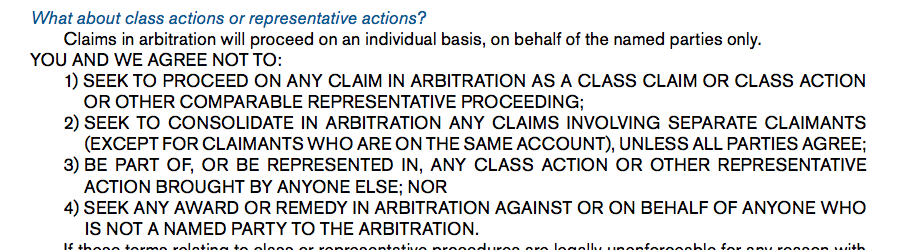

Of greater concern for consumer advocates is the fact that most forced arbitration clauses include a ban on class actions, meaning that even if a substantial number of customers were harmed in exactly the same way, each of those customers would have to enter into arbitration on his/her own rather than joining together into a single complaint.

The JPMorgan Chase contract for checking account customers is one of many financial agreements that not only force customers to resolve their disputes through arbitration but ban customers combining their complaints with other similarly affected customers.

Because the rewards of an individual arbitration case are, at best, only a fraction of what they could be in a class action, it can be impossible to mount cases that require extensive research and resources.

In that way, some companies have been accused of using forced arbitration to get around federal laws; if the consumer can’t afford to prove her case, companies can keep on violating laws.

And according to the CFPB report, financial services companies rarely try to compel individual consumer complaints into arbitration, but when there is a potential for a class action involving multiple plaintiffs, it’s quite common to force the case into an arbitration process. The report found that when credit card companies faced class action claims, they turned to arbitration 65% of the time in order to prevent the joined complaints from being heard together.

SMALLER CASES, SMALLER REWARDS

In 2013, the Supreme Court gave credit card companies more of a reason to use arbitration clauses, with a divided SCOTUS ruling that these clauses could be used to preempt class-action lawsuits, even in cases where class actions are the only economically feasible way for the plaintiff to make its case.

The CFPB attempted to compare the awards for arbitration cases versus those able to pursue a claim in court. That’s not as easy as it sounds, given that many civil complaints end up being settled before trial and those settlements may not be part of the public record.

In 1,060 arbitration cases filed in 2010 and 2011, the total amount of damages awarded was less than $175,000 with another $190,000 in debt forbearance. During the same period of time, the few individual (i.e., non class-action) cases that were actually decided by a judge totaled around $1 million in awards.

Meanwhile, class actions are resulting in significantly larger awards than either arbitration or individual lawsuits. Over the five-year period studied by the CFPB, settlements in the Bureau’s relevant markets added up to $2.7 billion, covering a total of 160 million class members.

“Further, these figures do not include the potential value to consumers of class-action settlements requiring companies to change their behavior,” explains the Bureau.

SAVING MONEY FOR SOMEONE; BUT NOT YOU

One of the arguments used by proponents of arbitration is that it saves companies money by preempting expensive and lengthy class action litigation. But the CFPB’s analysis found no evidence that the existence of an arbitration clause had any impact on prices.

“Tens of millions of consumers are covered by arbitration clauses, but few know about them or understand their impact,” said CFPB Director Richard Cordray in a statement. “Our study found that these arbitration clauses restrict consumer relief in disputes with financial companies by limiting class actions that provide millions of dollars in redress each year. Now that our study has been completed, we will consider what next steps are appropriate.”

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.