The more credulous you are, either because you’re new to the whole line-of-credit experience or because you’re uneducated, the more likely you are to mistake a high line of credit for an indication of your future earnings potential. You can see how this can lead to bad things, as noted by the researchers who studied this unfortunate problem earlier this decade. Luckily, the savvier you get about credit cards, the less influence your credit limit has on you, which is yet another great reason to make financial literacy education mandatory.

spending

Three Tips To Keep The Recession From Depressing Your Relationship

Money can ruin relationships, but by talking honestly about finances with your significant other, you just might emerge from this depressing recession as a couple. Even if your finances are deteriorating, there are a few ways to keep your money problems from rotting your relationship.

Your Piggy Bank Is Happy: Savings Rate At 14-Year High

Americans took their cost of living raises and stuck them in their piggy banks, says the Commerce Department, pushing the savings rate to a 14-year high. Not long ago we had a savings rate of 0.1% — now it has skyrocketed to 5%.

Five Things Worth Paying For In A Recession

Just because the economy is imploding doesn’t mean you should entirely freeze your spending. The Wall Street Journal brings us a list of five things that are well worth their price, even in a recession.

Prepare For A Budget Meltdown By Conducting A Financial Fire Drill

You’re fired! Now what? It’s the nightmare scenario, and you can prepare for it by conducting a financial drill. Take a moment and pretend you have no income. Ask how you would pay pay for rent and food, and what lifestyle changes you could make on two week’s notice. To guide your planning, the New York Times has a few unorthodox and downright scary suggestions that are worth considering in a worst case scenario.

Deprogram Bad "Money Scripts"

How you relate to money money could have a lot to do with emotional connections you made to money at a young age, and these so-called “money scripts” can be a blindspot that’s causing you financial pain, reports WSJ.

Consumer Borrowing Dropped $7.9 Billion In November

“Consumers have clammed up,” said Ken Mayland, president of ClearView Economics LLC in Pepper Pike, Ohio, who forecast a decline. “The reduction in consumer credit doesn’t stop here, and will spill over into 2009. Households are bolstering their balance sheets.”

../../../..//2008/12/30/according-to-bloomberg-retailers-expect/

According to Bloomberg, retailers expect to close 73,000 stores in the first half of 2009, because no one bought enough Christmas presents. Thanks, Marc!

Last-Minute Shoppers Unable To Save Christmas For Retailers

The AP says that while last-minute shoppers are still out there looking for bargains — the holiday season was over long ago for retailers.

Auto CEOs Flew Private Jets To Washington To Ask For Your Tax Money

ABCNews says that the big three auto CEOs “flew to the nation’s capital yesterday in private luxurious jets to make their case to Washington that the auto industry is running out of cash and needs $25 billion in taxpayer money to avoid bankruptcy.”

Next Victim Of The Economic Meltdown? Santa.

Christmas Creep may be more out of control than ever this year (Were Veterans Day sales always Christmas-themed?), but that doesn’t mean that these are happy holidays for professional Santas. Yes, according to the Amalgamated Order of Real Bearded Santas, an organization that actually exists according to the Wall Street Journal, Santa bookings are down. Way down.

Save $1,000 In 30 Days?

Ramit over at I Will Teach You To Be Rich has thrown down a challenge. Can you save $1,000 in 30 days? He, like us, is annoyed with crappy frugality tips that will save you $1 a week, and promises to post decent money saving tips every day in November. If you follow them, he thinks you’ll be able to save $1,000 in 30 days.

Economy: "Consumers Have Thrown In The Towel"

Consumer spending is down and credit card defaults are up!

How Can We Save Our Debt-Swamped Government?

The United States is $10.2 trillion in debt. Like countless Americans, our government has spent beyond its means and needs help getting back on its feet. We recently received a panicked email from White House Budget Director Jim Nussle…

6 Ways Not To F— Up Your Finances Before You're 30

1. Stop with the credit cards already! MSNMoney says that the average credit card debt among 25- to 34-year-olds was $5,200 in 2004. You should be saving in your 20s, not spending.

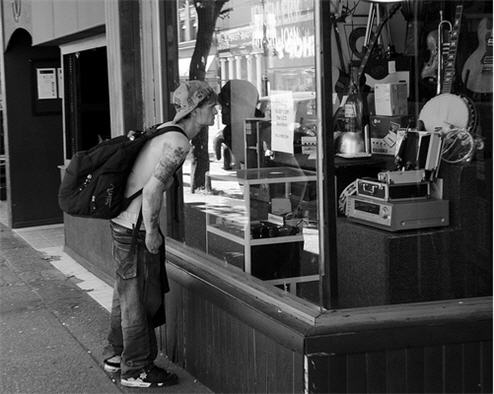

How I Talk Myself Out Of Buying Stuff

If you find yourself in one of those moods where you just “have to have it”, and end up in the store staring at it, talk to yourself about it. List all the reasons you want it (want, not need), and all the reasons you don’t want or need it…

Consumer Spending Will Shrink For The First Time In Nearly Twenty Years

Consumer spending, the engine that powers our economy, is probably going to shrink for the first time in nearly two decades, says the NYT — a move that will “all but guarantee” that the current economic crisis will deepen.

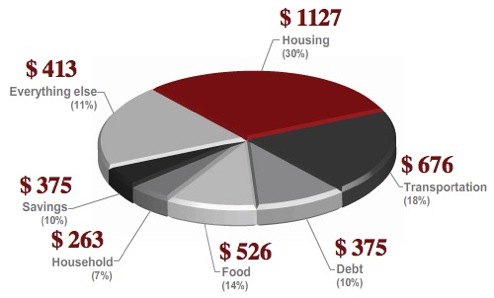

On The Money's Budget Calculator Helps Guide Your Monthly Spending

On The Money’s budget calculator makes it easy to determine how much you should be spending across the seven categories that make up any responsible budget. Regardless of income, tracking and limiting your overall spending is a foolproof strategy for keeping your accounts in the black. Though the percents will vary according to geography and personal situation, On The Money’s calculator gives you a quick glance at concrete spending targets that you can compare against your credit card bills and bank statements. Give it a try and tell us in the comments what other tools you use to control your spending.