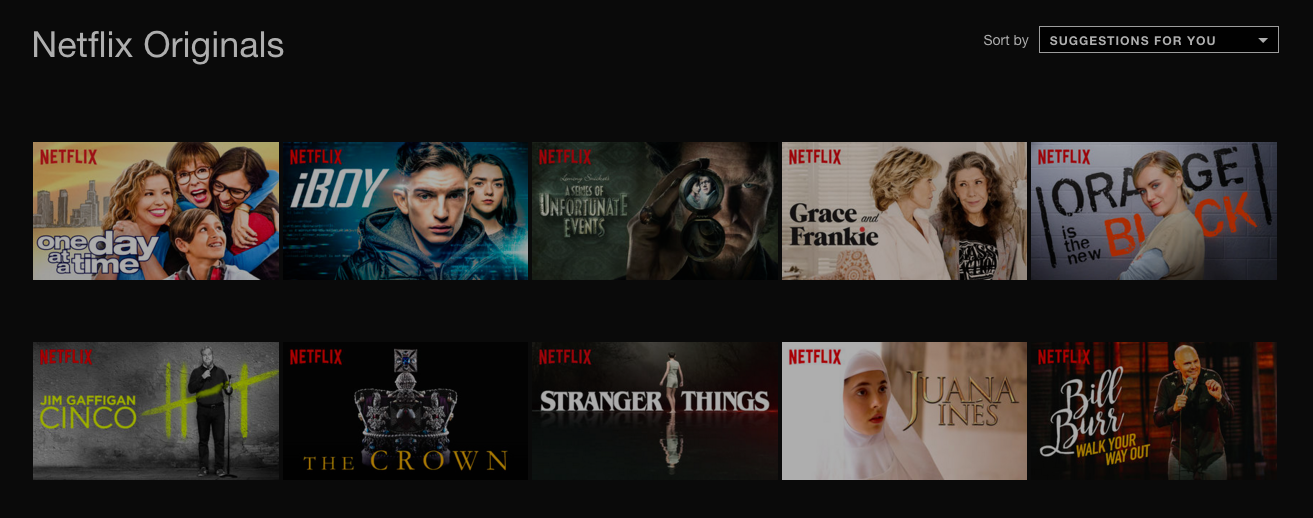

You’ve got to spend money to make money. That appears to be the mantra over at Netflix, where the DVD-by-mail service turned mega-streaming outlet has racked up nearly $20 billion in debt expanding its platform to new areas, producing original content, and buying the rights to show other company’s movies and TV shows. [More]

spending

45% Of Americans Carry At Least $25,000 In Debt

If you owe creditors less than $5,000 (not including a mortgage) you’re in a rather small group of Americans with minimal debt. According to a new survey, nearly half the country owes at least $25,000 — and spends as much as half of their monthly income paying down their debt. [More]

Retail Continues To Suffer As Sales Decline For Second Month In A Row

For the first time in nearly two years, retail sales declined two months in a row, highlighting once again the current challenges facing a retail industry that has suffered a number of bankruptcies and store closures so far in 2017. [More]

Average Wedding Now Costs $31,213, Even As Guest Lists Shrink

If you’re debating whether or not to cut the odd cousin or two from your wedding invite list, you now have a solid financial justification. A new study claims that the cost of weddings is at a five-year high even though the number of invited guests is shrinking. [More]

Quit Wasting Money On Internet Impulse Purchases

The Internet has brought an amazing array of merchandise into our lives and onto our doorsteps. However, being able to order a crate of hamburger-shaped cookies from Japan or a complete DVD box set of “Friends” episodes at 3 A.M. during a spell of insomnia isn’t always a good thing. Especially when you’re trying to eliminate debt and/or cut down on spending. [More]

Just Got A Job? Here's How To Handle Your Newfound Income

If you’ve lived on a tight budget for a while because you’ve been out of work or gone back to school, it’s a little bewildering to start drawing paychecks from a new job. You may feel rich, but your wealth will be determined by your budget rather than your income. [More]

Spending Traps We Succumbed To In 2011 & How To Avoid Them Next Year

When we were feeling good about spending this year, man, we were feeling good. But those spend-happy habits when the economy was on the uptick or when a sweet deal landed in your inbox should be shed when the ball drops on 2012. [More]

Consumer Spending Went Up .6% In September

Even though they haven’t been making any additional money for the past three months, consumer spending ticked up 0.6% in September. Are people spending more because they feel that the low interest rates they get from the bank make it less valuable to save? [More]

What Broke Sports Stars Can Teach You About Personal Finances

Athletic skill and financial acumen don’t always come in the same package, which is why many successful pro athletes run out of money once their fat paychecks stop rolling in. [More]

Don't Mistake Luxuries For Necessities

Those of us who consider ourselves poor are probably overlooking key budget items that sap money away on a monthly basis, keeping us away from important goals that seem unreachable. [More]

How To Track Your Personal Inflation Rate

National average inflation rates can rise or fall, but the only number that makes a difference in your life is one that’s hidden from you unless you do some legwork to uncover it. Tracking and categorizing your purchases over time allows you to get a handle on how your budget and priorities evolve over time in relation to the fluctuating market. [More]

Which Personal Finance Tracking Software Is The Best?

Although the prevalence of online account access makes financial software tracking less crucial now than it was, say, a decade ago, a detailed record of your spending is still key to maintaining a budget. [More]

Do You Have What It Takes To Be A Cheapskate?

Jeff Yeager, Wise Bread blogger and author, has just published a new book titled The Cheapskate Next Door, where he interviews over 300 self-described cheapskates to find out what makes them tick. In an interview over at Daily Finance, he says that for most of his subjects, the choice to live frugal lifestyles wasn’t primarily about money. [More]

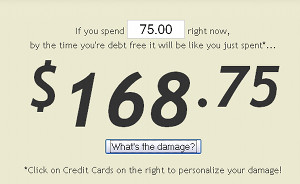

Force A Reality Check With This "Real Cost" Credit Card Tool

The next time you want to splurge on some big ticket item, you might want to head over to The Real Damage first to see what it’s going to actually cost you in the long run. The free online tool looks at your current balances and interest rates, as well as your monthly payments, and then approximates how much extra you’ll pay in interest on your new purchase before you’re totally debt free. [More]

Debt-Riddled Illinois Is A Subprime Borrower

Illinois credit rating sucks, which is unfortunate for the Sucker State, because it needs to borrow millions of dollars to pay its bills. This means that the state is paying a premium for the loans, which are going to be used to improve roads, bridges and schools. As a product of Illinois’ public schools, I can honestly say that the $900 million in new bonds it is issuing will not be enough. Whether this is because we are too poorly educated to figure out how much money is actually needed, or because it really isn’t, no one can say. [More]

Savings Rate Goes Up, But Spending Doesn't

As a nation, we saved more of our paychecks last month than any time since last September–nearly 4% of income went unspent. That worries economists, because it means we’re not spending at a high enough rate to support an economic recovery. But as the Washington Post notes, since unemployment remains high and most of the recent wage growth came from the government, consumers aren’t exactly comfortable with buying something shiny and new just because it’s on sale. [More]

Target Says You Are Buying Crap You Don't Need Again

Target’s first quarter profits were up and things are looking better for the retailer’s troubled credit card division. The secret to their success? Consumers are buying more “discretionary merchandise,” which is retailer speak for ” various bullsh*t like video games and cheap designer clothes that you don’t technically need to survive.” [More]

We're Finally Saving The Economy By Spending Too Much

Back in the early days of the recession, circa 2008, people were nervous about the future, and decided to start saving more of their money instead of just spending it. That brought personal savings rates up to over 5% by last year. But after hearing for months that the recession is over, consumers are apparently starting to believe it — especially when numbers show the economy growing by 3.2%. Savings rates are down to about 2.7%, and consumer spending is up by 0.6% as of March. Unfortunately, incomes are only up 0.3%, so plenty of people may be helping the economy grow by spending more than they earn. Thanks, guys! [More]