If you’ve heard us rave about USAA’s stellar financial services but grown sad when you learned that it’s only available for military-members and their family, have heart: you can get still get access to some of their services like banking and checking.

savings

Citizens Bank Now Charging An Overdraft Protection Fee

Lynne writes, “Citizens Bank is now charging customers an annual overdraft protection fee. This is a charge for linking your savings account to your checking account. Customers can be removed from the program and can get the fee back.” We don’t know when this started—they just say there might be fees involved and call for details on their website—but if you’re a customer of the bank you might want to make sure you haven’t been enrolled without knowing it.

Link Your Online Savings Accounts Together

Back in the days of 5% and 6% APY interest rate savings accounts, rating chasing was a great way to get a little extra out of your savings. Be ready when those days return by linking your online savings accounts.

Who Uses Coupons The Most? Affluent Suburbanites

The Nielsen Company—the people responsible for getting good TV shows canceled—just released a survey of coupon users. It turns out affluent consumers (those who make $70k or more annually) use coupons more frequently than the average U.S. household. Those who use coupons the least are from either low-income, one-member, male-only, African-American, or Hispanic households.

How to Minimize CD Early Withdrawal Penalties

Ten years ago, opening a certificate of deposit required $5,000 and an hour at the bank. Today, you only need $1 and five minutes. Take advantage of that to help minimize early withdrawal penalties on CDs.

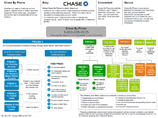

Chase Bank By Phone Telephone Tree Map

Should you ever get lost in the Chase bank-by-phone tree, this function map may help you. Or it may explode your brain all over the receiver. The choice is yours.

Do You Talk To Friends About Your Finances?

A recent Huffington Post article wondered if talking about personal finance was “the final taboo.” Talking about money can feel as revealing as a strip-tease with none of the fun, but for something as complex and individual as your financial future, a one-way conversation with the internet or personal finance columnists isn’t enough.

Crafty Michigan Credit Unions Implement A Lottery Worth Playing

Save to Win gives Michigan residents the chance to win the lottery simply by purchasing a certificate of deposit. Here’s how it works: residents who contribute at least $25 into a Save to Win CD are automatically entered into monthly drawings for a $400 raffle, and an annual drawing for a $100,000 jackpot. Even if you don’t win, you still have an interest bearing CD.

The Five Universal Financial Truths

Saving can be boiled down to a few universal financial truths. The sooner you know and internalize them, the sooner you can start enjoying a responsible, sustainable lifestyle.

Pulling The Plug On Central Air May Be Worth The Gain For the Pain

As you lounge in your house during the summer days, it’s hard not to associate that ambient air conditioner hum in the background with a paper shredder destroying your money.

../../../..//2009/07/28/we-dont-recommend-keeping-your/

We don’t recommend keeping your savings in your pantry, but in case you were wondering, here’s how much money you can fit into an Apple Jacks box. [Slate]

Consumers Are Scared To Lose Their Jobs, Still Saving For Their Inevitable Unemployment

The deepest “employment slump of any recession in the last eight decades” has consumers convinced they’re about to lose their jobs — and that’s affecting consumer confidence, says Bloomberg.

AARP Tells You How To Love Your Money The Old-Fashioned Way

It’s not such a great time to be heading into retirement, which may be a reason prospective retirees may want to glance through the AARP’s 50 Ways To Love Your Money PDF.

Are Dollar Stores Really That Cheap?

Kim McGrigg at Blogging for Change took a look at the dollar stores in her neighborhood and found that it can take some work to make sure you’re actually saving money. In fact, on a couple of items she actually paid a fraction more than what she would have at a superstore like Walmart. This matches what Consumer Reports’ shopping mag, ShopSmart, discovered in their recent “Dollar Mania” report (free PDF download).

Eat Out And Save

Eating out is one of the fastest ways to burn a hole through your wallet, but with a few tips from Five Cent Nickel, you can still enjoy a good meal without breaking the bank.

Woman Hides Life Savings In Mattress, Mattress Taken To Dump By Helpful Daughter

A woman in Israel hid her life savings—she says nearly $1 million dollars—in her mattress. Her daughter bought her a new mattress as a surprise upgrade and threw it out. Dump employees are now searching on behalf of the family while security has been hired to keep out treasure hunters, but they don’t know which of the two city dumps it was taken to. We imagine it’s the one where the rats are all wearing tiny gold rings and toasting each other with little glasses of champagne.

How To Redeem Government Bonds

Earlier this week, Consumerist published a story about how you can check for unredeemed, matured government bonds by checking with TreasuryDirect. Here’s how to redeem a bond.

Give Yourself A Financial Stress Test

Why let banks have all the fun? Run the numbers on your own personal finances, suggests a certified financial planner in the Dallas Morning News, and see whether or not you’re prepared for disruptions like a layoff or sudden interest rate increase.