You might think of yourself as a long-term investor with your cute little retirement fund, but that’s nothing compared to an investment that recently paid out to Yale University. Twelve years ago, the university’s rare books and manuscripts library purchased a bond issued by a Dutch water authority to fund the construction of a pier. The thing is, the bond pays out in perpetuity, and that water authority still exists, so Yale checked to find out whether it was still earning interest. It is. [More]

bonds

Portland Will No Longer Invest In Walmart

In its continuing quest to become a caricature of outsiders’ clichés , the city of Portland, Oregon has decided to stop investing in Walmart. Wait, Portland invests in Walmart? Yes, just under 3% of the city’s portfolio consists of Walmart bonds, the last of which will mature in 2016. The city’s total Walmart holdings were $36 million. [More]

SEC Warns S&P It May Sue Them

In an unprecedented move, the SEC warned S&P that it might be suing it over its rating of a mortgage-backed bond. It’s the first warning a credit rating firm has gotten over its behavior leading up to the financial crisis. [More]

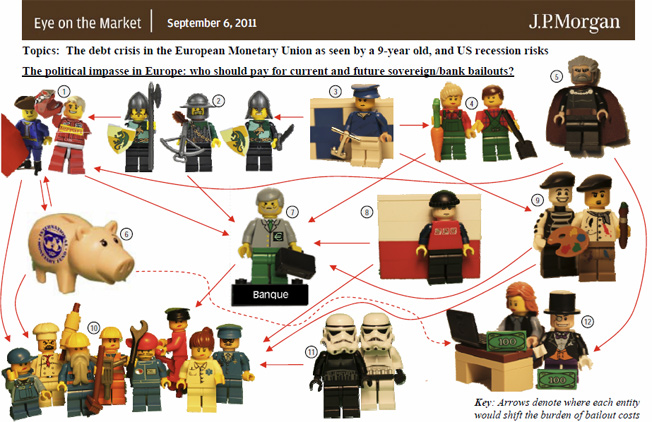

JP Morgan Explains Euro Debt Crisis With Legos. Really.

In order to explain the Euro debt crisis, Michael Cembalest, the Chief Investment Officer of JP Morgan’s private bank, sent around a research note that used Legos to depict the different players. The Legos were fashioned by his 9-year old son. This really happened. Here’s the legend to explain which parties each figure represents, or you can play a fun game and guess on your own first. [More]

"Secret" Way To Keep Buying Paper Savings Bonds After 2012 Deadline

The Treasury announced last week that, in order to save money, they’re going to stop selling paper saving bonds after Jan 2012. Gone will be the days when a grandparent could walk down to the bank and sock away $50 every year to make an ironclad investment for their grandchildren. But there is a bit of a “backdoor” way you can still buy them without having to go through their weird online “gift box.” It will also let you buy more bonds than the $5,000 limit. What you do is use your tax refund to buy them through the IRS using form 8888. [More]

Your Age -10 = % Of Your Portfolio That Should Be In Bonds

Just subtract 10 from your age and that’s how much percentage of your portfolio should be in bonds, commenter sevatt points out. [More]

Subtract Your Age From 110 To Figure Out How Much Of Your Portfolio Should Be In Stocks Vs Bonds

With the Feds buying up more Treasuries, bonds are looking attractive. But how much of my portfolio should I have invested in bonds? What’s the proper asset allocation between stocks and bonds? Well, an old-school rule of thumb is that you subtract your age from 110. [More]

How To Redeem Government Bonds

Earlier this week, Consumerist published a story about how you can check for unredeemed, matured government bonds by checking with TreasuryDirect. Here’s how to redeem a bond.

Check For Unredeemed, Matured Government Bonds

A PR person just contacted us on behalf of the U.S. Treasury Department to point out that there are $16 billion in unredeemed bonds that are no longer earning interest. “Specifically, there are 40 million Series E savings bonds purchased between 1941 and 1978 that are over 30 years old and therefore have fully matured. They can be cashed out today for at least four times their face value.”

General Motors Defaults, Idles Plants

General Motors is projected to default on its next bond payment—the last before the June 1st government-imposed restructuring deadline. Next freeway exit: bankruptcy.

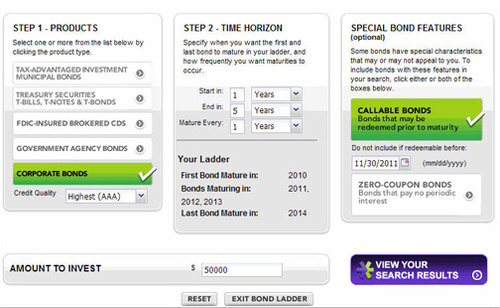

Want to Buy Some Bailout Debt?

Ever wonder how the government is going to afford the bailout? Public debt. If you don’t know the difference between a T-Bill and a T-Note, this article should clear that up.

Here's A Cartoon Explaining The Types Of Bonds

Slate’s “The Big Money” has decided it’s time to start educating readers on some core financial principles, and they’re starting with the very basics, presented in a “Schoolhouse Rocks!” style. Their first cartoon explains the four types of bonds. Visually, it’s a perfect match to the style of the original cartoons, but we hope they work on a catchier jingle for their next installment.

5 Myths Of Retirement Investing

Here’s 5 common myths people tell themselves that can end up bungling their retirement savings plan, cribbed from the Autumn issue of the Vanguard market report.

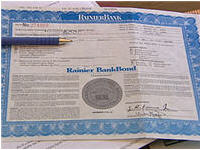

Family Says Bank Of America Refuses to Cash Bond Worth $30,000

Greg Miller, the son of Bette Miller, the woman who is in a dispute with Bank of America over a $5,000 bond bought in 1984 from Rainier National Bank, has written in to tell his side of the story. Here’s his letter.

Bank Of America Refuses To Pay 80-Year-Old's $5,000 Bond

Bette Miller has a bond she purchased in 1984 from Rainier National Bank. That bank was purchased by other bank, which was then purchased by Bank of America.

../..//2007/07/05/inflation-eats-up-most-of/

Inflation eats up most of the appeal of zero-coupon bonds.