../../../..//2007/10/16/it-begins-start-hiding/

IT BEGINS! Start hiding gold in your mattresses and boarding up your windows, because today the first official U.S. baby boomer filed for Social Security. [Reuters]

Thanks for visiting Consumerist.com. As of October 2017, Consumerist is no longer producing new content, but feel free to browse through our archives. Here you can find 12 years worth of articles on everything from how to avoid dodgy scams to writing an effective complaint letter. Check out some of our greatest hits below, explore the categories listed on the left-hand side of the page, or head to CR.org for ratings, reviews, and consumer news.

../../../..//2007/10/16/it-begins-start-hiding/

IT BEGINS! Start hiding gold in your mattresses and boarding up your windows, because today the first official U.S. baby boomer filed for Social Security. [Reuters]

According to Money, there are 13 big myths about retirement that you need to be aware of—and the sooner you know about them, the sooner you can make any necessary adjustments to improve your preparations for those twilight years.Myth 1: You need a big income to have a big nest eggMyth 2: You…

A.G. Edwards has a short online quiz that determines your “nest egg score” based on criteria like how long before you plan to retire, how aggressively you invest, and where you live. It’s not meant to provide an in-depth portfolio review, just a quick sketch of where you stand—you’ll get a score very similar to a credit score, along with a comparative national average and a list of tips on how to improve your score.

If you’re a freelancer, or work for a small company, or for some other reason don’t have a healthy start on a retirement plan, Smart Money has some suggestions for how to jump-start your investment before you hit your golden years.

The Digerati Life has a lengthy article that offers 12 tips on how to help beat the eroding power of inflation. Broadly speaking, you should first recognize that inflation erodes purchasing power in the long run and take steps to insure yourself from it, while also being “mindful of when inflation rates rise” and taking additional measures during those periods.

If you wanna make an omelet, you gotta break a few eggs—even if those eggs are old people who die from bedsores that have become infected. The Centers for Medicare and Medicaid Services say that on average, patients at nursing homes that are bought by private investment firms do worse than those at other nursing homes, with higher rates of depression, increased loss of mobility, and less ability to dress and bathe themselves. The New York Times has a horror story on 48 Florida nursing homes where staff was reduced to levels below mandatory requirements and didn’t repair equipment or keep facilities sanitary. Even senior activities were reduced. And there are thousands of (now profitable) nursing homes across the country that are owned by private investment companies.

“Americans collectively spent more than we earned after taxes for the past two years in a row,” says SmartMoney in their latest cover story, “Live Debt-Free”. Their point: we spend a lot of time thinking about how to save and how to invest, but not enough time working out a healthy debt strategy that doesn’t eat away at our happiness, not to mention our retirement savings. They offer four different strategies for reducing your debt to little or nothing, so that you can apply your income to more worthwhile activities than fighting off your liability monster.

SmartMoney is trying to spin it as a “take care of yourself” article, but we know that the real reason you’re in the market for a good retirement home is because Dad has gotten older and he’s nowhere near the madcap character Abe Simpson is on TV. Luckily for you (and your dad), they’ve put together a brief guide of 5 things you should look for when choosing a retirement home. You know, for “yourself.”

The series is full of good, basic information on the fundamentals of retirement planning — a great resource for those wondering how to plan for retirement as well as those who need a brief refresher course on the subject.

../../../..//2007/07/26/all-encompassing-directory-of-retirement-planning/

All-encompassing directory of retirement planning tools and calculators. [All Financial Matters]

The 401(k) is one of the best ways to maximize your retirement savings. After all, if the company matches your contribution, you start off with a 50% to 100% gain right off the bat. That said, many employees are not making the most of the potential locked in their 401(k)s. Here are some of the most common mistakes, according to Vanguard:

It’s easy to manage your finances when you close unnecessary bank accounts and credit lines and chisel down to the bare essentials. Blueprint For Financial Prosperity has compiled an excellent list of accounts that you need, and accounts you should avoid.

Mint has collated a collection of thirty free ebooks on personal finance and money management. The selection ranges from budgets to credit cards to mortgages to general consumer advice. Each one is in PDF format. Check ’em out and get your learn on.

Maybe I won’t live long enough to retire. Life is so uncertain. Why should I miss out on the high life now when I might not even need to have money put aside for my old age? (If married, change pronouns in this reason to the plural.)

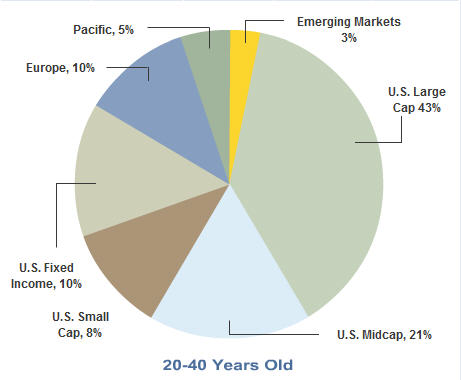

Bankrate has some nifty pie charts that show you how you should be allocating your retirement investments at different age groups. How you allocate your assets determines the risk in your portfolio. Of course, you don’t have to take these suggestions, your level of risk should reflect your tolerance for it. —MEGHANN MARCO

The personal finance rule-of-thumb regarding saving has historically been that each of us should sock away 10% of our salaries for retirement. But this old rule is coming under an increasing level of scrutiny from all sides — some saying we need to save more, some arguing that we’re already saving too much, and others replying there’s no one answer that fits everyone. Is it any wonder we’re all confused?

![]()

Part of ![]()

Founded in 2005, Consumerist® is an independent source of consumer news and information published by Consumer Reports.