When Microsoft announced last month that its Xbox One would have the ability to provide users with live over-the-air content from local broadcast networks, the company said the new feature would allow viewers to pause the action for up to 30 minutes. But a half-hour just isn’t a lot of time for today’s busy TV watcher, which is probably why the company is reportedly looking to add a DVR feature to the console [More]

reports

NHTSA Won’t Open Investigation Into Unintended Acceleration In Toyota Corollas

Toyota will not face another probe regarding unintended acceleration in its vehicles, the National Highway Traffic Safety Administration announced over the weekend. [More]

GAO Report Finds Airplanes With WiFi Connections May Be Vulnerable To Cyber Attacks

Just as a report found in early February that the newest models of connected cars aren’t adequately guarded from security and privacy hacks, a new report from the U.S. Government Accountability Office found the same issue currently plagues another transportation segment: flying. [More]

Amazon Prime Members Less Likely To Visit Target.com, Walmart.com When Shopping Online

In recent months big box retailers like Walmart and Target have attempted to thwart Amazon’s growing influence over consumers with a variety of new policies such as reducing the minimum purchase required for free shipping and allowing price-matching with the online retailer (although, that effort didn’t’ last long). But, according to a new report, those measure might amount to “too little, too late” when it comes to Amazon Prime shoppers. [More]

Nearly 7% Of Americans Say Their Smartphone Is Their Only Way To Get Online

We may often joke that losing our smartphone would mean being cut off from the outside world. While that’s likely an exaggeration for many consumers, a new report from The Pew Research Center finds Americans’ reliance on smartphones to stay connected with the rest of the world is very real, especially when it comes to accessing the internet. [More]

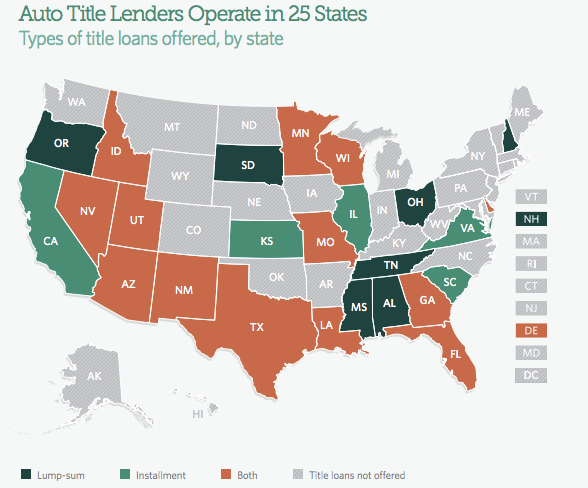

Report: Auto Title Loans Just As Bad, If Not Worse Than Payday Loans; Should Face Same Rules

Each year millions of consumers turn to high-interest, short-term loans to make ends meet. While you may be more familiar with payday lenders who charge triple-digit interest rates with the goal of trapping borrowers into taking out new loans to pay off the old ones, a new report finds that payday’s lesser-known relative, auto title loans, have equally destructive repercussions. [More]

FTC Report Alleges Google Used Anti-Competitive Practices Prior To 2013

When conducting a search on Google, consumers have a reasonable expectation that results will show a variety of options related to their inquiry. But a recently disclosed report shows that wasn’t always the case. [More]

Gasoline Credit Cards Might Not Be Worth The Hassle, High Interest Rates

Saving a few bucks at the gas pump is always nice, but signing on for a gas station-branded credit card might not be the way go about it, according to a new report. [More]

CFPB Returned $19.4M To 92,000 Consumers In The Last Half Of 2014

Each year the Consumer Financial Protection Bureau supervisory examiners hold hundreds of companies accountable for violations of fair lending and debt collection rules. During the last half of 2014, those actions resulted in the return of $19.4 million to more than 92,000 consumers, according to a new report from the agency. [More]

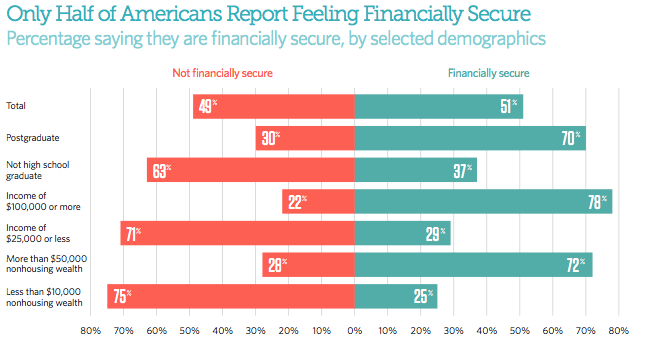

Report: Americans Are Optimistic About Their Finances But Few Actually Feel Secure

Americans’ positive feelings about the economy have officially returned to the level they were at on the eve of the Great Recession, according to a new study from Pew Charitable Trusts. While that might sound comforting, it doesn’t mean consumers are actually feeling secure in their own financial stability. [More]

Hungry Shoppers Also Buy More Non-Food Stuff

It’s a long-held belief that shopping while hungry leads to a larger than normal grocery bill. A new study claims that you might want also want to avoid hitting the department store on an empty stomach. [More]

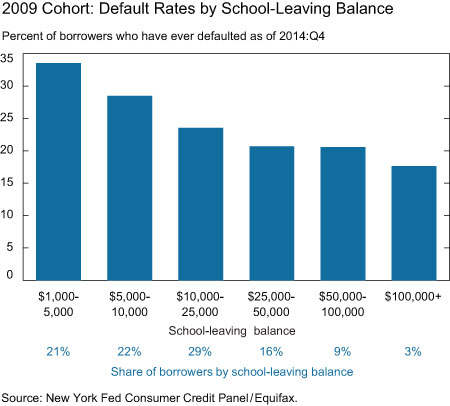

Why Are Borrowers With Less Student Loan Debt More Likely To Default?

Just days after the Federal Reserve Bank of New York showed that student loan delinquency rates were once again on the rise, a new Fed report finds it’s student loan borrowers with the lowest levels of debt who typically are the most delinquent.

[More]

Student Loan Debt Increased $77B In 2014, One In Nine Loans Now Past Due

Student loan debt reached an all-time high and delinquency rates continued to rise last year, according to a new report from the Federal Reserve Bank of New York found. [More]

Researcher Says It Only Takes Minutes To Hack Most Smart Home Security Devices

With a security hack taking place just about everyday, consumers are more on-guard than ever when it comes to making sure their personal information are secure from ne’er-do-wells. But a new report points out that we might be inviting those hackers into our homes with open arms thanks to the less-than-optimal security of many smart home products. [More]

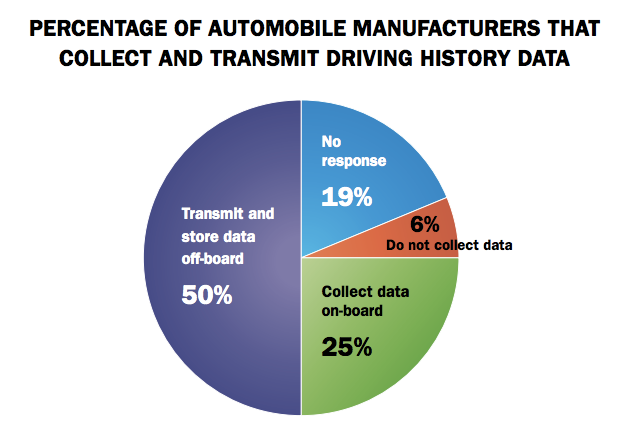

Report: Automakers Fail To Protect Connected Cars From Security, Privacy Hacks

The newest models of connected cars come with everything from built-in navigation and entertainment systems to roadside assistance. While these features might make life behind the wheel a little easier, a new report found that not enough has been done to adequately protect those components from hackers. [More]

Report Spotlights Impact Of Payday Lenders On Most Vulnerable Communities

It’s no secret that payday loan storefronts often pop up in lower-income communities where consumers are more likely to need a quick infusion of cash to get to the next paycheck. A new report from the Howard University Center on Race and Wealth shines a light on the frequency with which the small-dollar, high-cost loans are opened in susceptible communities in the southern United States. [More]

FTC: Credit Report Errors Continuing To Linger Years After Being Found

Two years ago, a Federal Trade Commission study found a surprisingly large percentage of consumers had discovered, and had corrected, errors on their credit reports. There were also several people who believed there were errors with their reports but had not yet reached a resolution. A new follow-up study from the FTC finds that nearly 70% of these disputes from 2012 are still unresolved. [More]

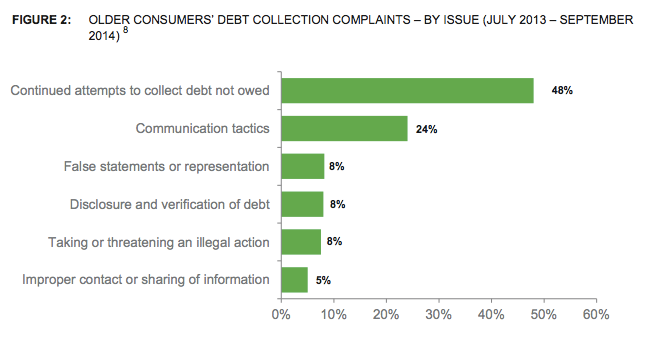

CFPB Finds Older Consumers Face Illegal, Harassing Tactics From Debt Collectors

As if we hadn’t said it enough, but debt collectors are the worst, especially when they use illegal tactics to pry money from older American’s living on fixed incomes. A new report from the Consumer Financial Protection Bureau shines light on the issues older consumers face when it comes to their financial well-being. [More]