CFPB Finds Older Consumers Face Illegal, Harassing Tactics From Debt Collectors

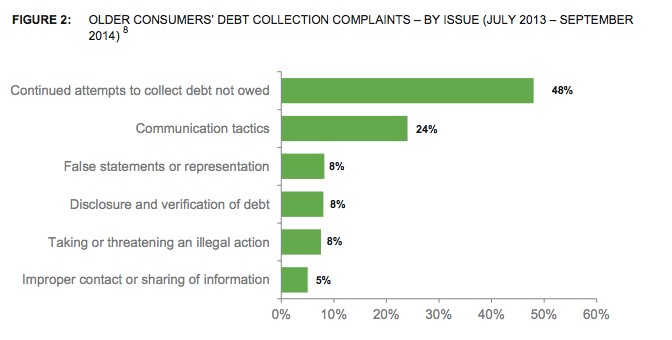

According to the report [PDF], which looked at older consumers’ complaints filed with the CFPB between July 2013 to September 2014, the number one issue Americans 62 years of age and older faced involved their experiences with debt collectors.

The most referenced problems with debt collection that older American’s faced included collectors hounding them about medical debt, attempting to collect debts of deceased family members and illegally threatening to garnish federal benefits.

“Since September 2013, older consumers, like their younger counterparts, have consistently submitted more complaints each month about debt collection than about any other financial product or service,” the report states.

The top debt collection complaint involved misidentification of the borrower. Many consumers reported that although they may have the same name as the actual consumer alleged to owe a debt, they don’t actually owe the debt.

Additionally, the older consumers report that when they try to tell a collector they have the wrong person they are often ignored.

“I am receiving a large volume of telephone calls from [debt collection company] regarding an apparent debt owed by my ex-wife from whom I have been divorced for 15 years,” one consumer wrote “The debt collection company acknowledged receipt of my email protest. I also wrote to their CEO. In response, the communications from [the debt collection company] have increased.”

Another repeated complaint the CFPB received from older consumers involved debt collectors attempting to collect the debts of deceased family members. Of those complaints, many included repeated attempts by collectors to receive payment for debts the older consumer was not responsible for.

One woman reported receiving letters and frequent phone calls from a collection agency seeking payment of her deceased husband’s debt.

“After my crying through the whole conversation, he offered for me to pay three-quarters of the balance due on the doctors’ bills of my husband,” she recalls. “No one told me I was not responsible for the debt. He was asking what assets my husband had and if I went to probate court on the estate. He told me that my husband’s insurance never paid anything on the bill. … I am now reliving watching my husband suffer years of sickness.”

Finally, older consumers say, that like younger consumers, they receive illegal threats of garnishment from debt collectors.

Many older Americans who survive on fixed incomes, reported repeated threats the collectors would garnish their Social Security, Supplemental Security Income or Veteran’s benefits even though those funds ordinarily are not subject to garnishment by collectors, the CFPB reports.

According to the complaints, these threats cause older consumers significant distress, especially when they rely on federal benefits to pay essential living costs.

In addition to releasing the new report, the CFPB issued a consumer advisory including tips for older Americans faced with debt collection.

To protect themselves when dealing with debt collectors, older Americans should:

•Protect their federal benefits: Consumers need to know that most federal benefits are protected in debt collection. Also, when a consumer receives federal benefits by direct deposit to a checking account, the bank or credit union is required automatically to protect up to two months of these benefits.

•Get more information to identify the debt: Older consumers report that collectors often reject or ignore their attempts to correct instances of mistaken identification.

•Dispute inaccurate debts: Older consumers report that it is difficult to obtain accurate or trustworthy information about alleged debt from collectors. Many consumers complain that they often inform collectors that they do not owe the debt, do not recognize it, or believe the amount that debt collectors demand is wrong.

• Stop the harassment: One of the most common debt collection complaints that the Bureau receives from older consumers is that debt collectors use abusive communication tactics to intimidate, aggravate, or coerce them into making payments. Older consumers complain that debt collectors make successive calls using profanity, condescension, indignation, or rage.

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.