Consumers who took out federal student loans through private lenders are more likely to default on their debts than their counterparts who received federal loans through the Department of Education, in part because these borrowers have difficulty obtaining adequate information on repayment options. [More]

reports

Borrowers With Federal Student Loans Made By Private Lenders At Greater Risk For Default

Report: VW May Have Underreported Deaths, Injuries Related To Vehicle Accidents

Car manufacturers are required under law to report death and injury claims to the National Highway Traffic Safety Administration. Those figures allow the regulatory agency to identify potentially fatal and dangerous defects. In the last year, the federal agency has investigated reporting inaccuracies related to Honda and Fiat Chrysler. Now, a new report shows that Volkswagen – in the midst of an emissions scandal – may have underreported deaths and injuries relate to its vehicles. [More]

Regulators Accuse Fiat Chrysler Of “Widely Under-Reported” Deaths Related To Vehicle Accidents

After being fined $105 million by federal regulators for their leisurely pace in fixing more than 11 million vehicles connected to 23 safety recalls, Fiat Chrysler’s recall woes haven’t magically disappeared. Instead, it appears they may be intensifying, as the National Highway Traffic Safety Administration today accused the carmaker of widely under-reporting the number of deaths in accidents involving its vehicles. [More]

Health Group Challenges E-Cig Makers After Tests Find High Levels Of Toxic Chemicals In Most Products

A health watchdog group took legal action against some of the country’s largest e-cigarette manufacturers for failing to properly warn consumers about the risk of such products after tests show that most produce high levels of toxic chemicals. [More]

CarMax Plays “Used Car Recall Roulette” By Selling Potentially Dangerous Vehicles

During the height of recallopalooza 2014, a coalition of consumer advocacy groups raised concerns about CarMax, alleging that the nation’s largest used vehicle seller was misleading customers with claims of “Quality Certified” cars and “125+ point” inspections while not revealing that some cars had been recalled for safety issues that had not yet been repaired. More than a year later, a new report shows that CarMax is continuing this practice, which one legislator has dubbed “used car recall roulette.” [More]

Auto Loan Debt Tops $1 Trillion For First Time; All Consumer Debt Nearing $12 Trillion

Now that the Great Recession has gone from “is it really over?” to “remember when?” more Americans are buying cars, pushing auto loan debt beyond the $1 trillion mark for the first time in U.S. history. [More]

Why Didn’t Dept. Of Education Find Problems With Loan Servicer Fined $100M?

Last May, investigations by the Department of Justice and the Federal Deposit Insurance Corporation into student loans servicing resulted in a $100 million fine against government-contracted servicer Navient for allegedly violating federal laws limiting the amount of interest that can be charged on servicemember student loans. Following those investigations, the Department of Education undertook a review that found its four servicers – including Navient – weren’t cheating military personnel. With such conflicting reports, members of Congress are now getting involved, calling for an investigation into the Dept. of Education’s review process. [More]

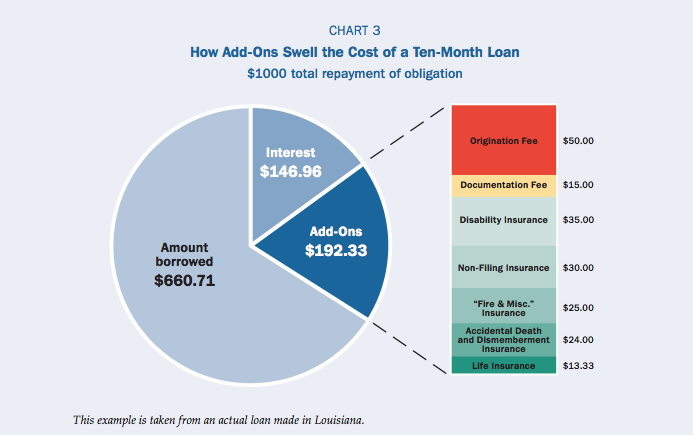

Most State Laws Can’t Protect Borrowers From Predatory Installment Loans, Open-End Lines Of Credit

As regulators continue to craft rules meant to crackdown on costly and harmful short-term payday lending, companies are offering alternative products like installment loans and open lines of credit to consumers. But, as it turns out, these cash infusions can be just as devastating to those in need, and few states offer sufficient protections for borrowers. [More]

Report: GM Threatened With Regulatory Investigation Before Issuing Recall For Fire-Prone Hummers

Last week, General Motors announced that it would recall nearly 196,000 Hummer vehicles because simply turning on the heating or cooling system could set the car ablaze. While we reported that federal regulators had received nearly two dozen consumer complaints about the issue over the past seven years, a new report finds that the real number of reported incidents is much higher, and that GM may have continued to put off issuing the recall had it not been for threats of an investigation. [More]

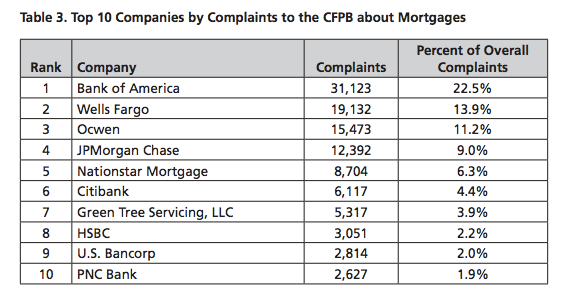

Bank Of America, Wells Fargo Top List Of Most Complained About Mortgage Issuers

For the past four years, the Consumer Financial Protection Bureau’s Consumer Complaint Database has seen its fair share of consumer issues related to mortgages. In fact, complaints regarding loan modification, collection, foreclosure, loan servicing, payments and escrow accounts continue to be one of the biggest financial thorns in consumers’ sides. And the worst offender? Bank of America. [More]

10 Things We Learned About The University Of Phoenix’s Alleged Military Marketing Strategy

It’s no secret that for-profit colleges receive a large chunk of their revenue from military education benefits. To deter unscrupulous for-profit colleges from unfairly targeting these prospective students, the government has imposed several limitations on just how these companies can recruit servicemembers. But a new report shows that one of the nation’s largest proprietary education institutions – The University of Phoenix – spends millions of dollars to allegedly skirt those rules. [More]

Pew: With Nearly 23 Million Consumers Using Prepaid Cards, More Protections Are Needed

To the naked eye, general purpose reloadable prepaid cards function much like long-established credit and debit cards and have quickly gained traction with consumers, especially those who have been shut out from traditional banking options. In fact, about 23 million consumers use prepaid cards regularly. [More]

Reports Show NHTSA Failed At First To Properly Investigate GM’s Ignition Switch Defect

Recently released internal reports from the National Highway Traffic Safety Administration show that for nearly a decade the agency did little to adequately address concerns regarding the deadly General Motors ignition switch defect. [More]

No Surprise Here: CFPB Finds Reverse Mortgage Ads Create False Impressions

Last year, Consumerist reported on why you shouldn’t run out to sign up for a reverse mortgage just because Fred Thompson or other paid spokespeople opine about the benefits in national advertising campaigns. Today, the Consumer Financial Protection Bureau echoed our fears that these ads can be misleading by releasing the results of a focus group and issuing an advisory warning consumers that promotions for the costly product often don’t tell the whole story. [More]

Looking To Finance A New Or Used Vehicle? You’re Likely In For The Long-Haul

Purchasing a new or used vehicle can represent quite a commitment for consumers, especially as the length of an average vehicle loan continue to get longer, now reaching all-time highs. [More]

Warrant: Researcher Claims He Commandeered Flight Through In-Flight Entertainment System

Nearly a month after a government report identified security weaknesses within the airline industry, including the possibility that newer airplanes with interconnected WiFi systems could be hacked, a recently obtained Federal Bureau of Investigation search warrant shows a security researcher claims he briefly took control of an aircraft after hacking into the plane’s in-flight entertainment system. [More]

Chase Raising Fees On Some Checking & Savings Accounts In 16 States

Chase customers in more than a dozen states will be seeing a slight change to some of their account statements next month, as the bank announced it would increase service charges for both checking and savings accounts. [More]