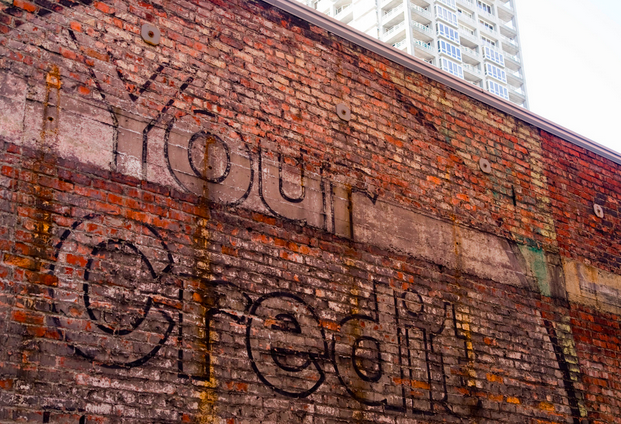

FTC: Credit Report Errors Continuing To Linger Years After Being Found

The updated report [PDF] focuses on those consumers who participated in the 2012 study and who believed at the time they had at least one unresolved error on their reports.

Of the 121 people in the study, 84 (69.4%) say they are still disputing that same error they challenged two years earlier. And the credit bureaus may end up winning this battle by attrition, with half of these consumers planning to abandon their fight, compared to 45% who say they intend to keep fighting.

Elsewhere in the updated report, the FTC says that around 1% of those consumers who had their credit report modified after after resolving a dispute ended up coming across that same error again when it subsequently popped up on a different report.

Back in 2012, the FTC study found that 26% of study respondents had at least one inaccurate piece of information on one of their three credit reports.

That study also found that about 20% of consumers who identified errors on one of their three credit reports experienced an increase in their credit score when their reports were reissued without the error. This resulted in a decrease in their credit risk tier, making it easier for them to obtain a lower interest loan.

FTC Issues Follow-Up Study on Credit Report Accuracy [FTC]

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.