Saving money and slashing spending aren’t typically the most entertaining or intrinsically rewarding activities, but those who make a game of the act can entertain themselves and others with bold attempts at lofty financial goals. [More]

personal finance

Personal Finance Roundup

Everyone Should Use the Overnight Test [Bucks Blog] “Ask yourself what you would do if someone came in and sold all of your investments overnight.”

10 Monthly Bills You Can Slash [Wise Bread] “You can work the system and save some money on these so-called necessary expenses.”

Calculate How Much You Really Make [The Simple Dollar] “On a per-hour basis, my part-time job in college was more lucrative than my first ‘good’ job after college.”

How to Marry a Millionaire [Smart Money] “It makes you more interesting if you have an obscure hobby like tornado-chasing and boomerang-throwing.”

The Best and Worst Sources of Financial Advice [US News] “Here are my choices for sources of good advice, based on solid data.”

Recipes For Chipping Away At Various Types Of Debt

Everyone with debt would like to eliminate it, but it’s not always clear where or how to get started. There are many types of debt, and each is suited to a different payoff strategy. [More]

Personal Finance Roundup

What If I Lost My Career? Envision, then Act [Free Money Finance] “The bottom line is that whatever your job situation, you can’t bury your head in the sand and think that your employer will always take care of you.”

10 Things You Do to Save Money That End Up Costing You More [Wise Bread] “Here are 10 things that you may be doing to save money that could actually cost you a lot more in the weeks, months, or years to come.”

Career resolutions: How to negotiate a raise [CNN Money] “Before you go into your boss’s office demanding more money, take the time to lay the groundwork for a successful conversation.”

4 Mobile Apps for Job Seekers [US News] “77 percent of job seekers use mobile apps during their job hunt.”

Financial Scams 2012: The Latest Twists in the Ever-Evolving Art of the Con [Daily Finance] “Here are some highlights from scams that made the rounds in 2011 — and will likely be back in some form or another this year.”

3 Ways To Keep The Heating Bill Down

When the temperature drops, the heating bills surge. But there are more ways to stay warm than figuratively setting your money on fire. [More]

What A Repo Men Reality Show Teaches You About Finances

Reality TV isn’t particularly known for its educational properties, but you can find some useful lessons if you look hard enough. For instance, a show about tow truck operators who repossess vehicles can teach a personal finance blogger how to handle her money. [More]

It's Not Too Late To Contribute To Last Year's Health Spending Account

A few weeks from now, you should have all the forms and information you’ll need to file your taxes. Most of the numbers you’ll crunch have already been decided by your actions last year, but there are still some maneuvers you can make to tweak the numbers more in your favor. [More]

Personal Finance Roundup

Retiring in 2012? Read This Today. [Wall Street Journal] “Here are five things to do now.”

12 Steps to Financial Freedom in 2012 [Get Rich Slowly] “If you’ve resolved to take control of your finances in 2012, this article is the place to start.”

12 retirement resolutions for ’12 [MSN Money] “The new year is a good time to review and adjust your retirement plan, and some changes this year can help you boost your savings.”

Guide to Buying a Used Car Without Going Crazy [Wise Bread] “Here’s some information I wish I had known up front that will hopefully make your car-buying process easier.”

6 Reasons to Reject a Counteroffer [US News] “Before you say yes, consider these reasons why you should decline.”

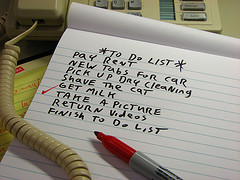

Punish And Reward Your Own Behavior To Save Money

If you want to start saving but know you lack the discipline to stash money away, you’ll need to come up with ways to trick yourself into getting into the mood. An ongoing game of mental solitaire could end up being quite profitable. [More]

Personal Finance Roundup

Hidden costs of dental neglect [MSN Money] “Few people know that good dental care can be the key to good overall health.”

How to Play Your Gift Cards Right [Wall Street Journal] “Here are some tips on how to get the most value from all of your gift cards–even the ones you don’t want.”

25 Small New Year’s Resolutions You Can Start Today [Wise Bread] “This year, make resolutions you can reasonably keep — short-term goals that give you the satisfaction you want right away.”

A Plan for 2012 That You’ll Actually Follow [NY Times] “During the next year, see what happens when you do these three things.”

Tips for Unloading Unwanted Gifts [Daily Finance] “‘Tis the season for unloading those albeit well meaning — but unwanted — holiday presents.”

Solid Financial Goals To Swipe For Yourself

It’s easy to set financial goals for the new year, but harder to make them matter. Make them too vague, such as “take control of my finances” or “reduce wasteful spending” and there’s nothing to gauge your success. [More]

Personal Finance Roundup

The stupidest fees of 2011 [MSN Money] “When it comes to outrageous fees imposed on consumers, these are some of the worst — whether it’s a charge for ending pay-TV service or a fee to deposit a lot of cash.”

11 Things That Are Worth the Money [Wise Bread] “When it comes to spending with discretion, it’s important to have priorities about things you think are worth the money, and those items or services that are not.”

16 Money Moves For Your Year End Financial Checklist [The Digerati Life] “Consider it an annual financial checkup.”

Flexibility or Salary: What Do You Value Most at Work? [Kiplinger] “Members of Generation Y are likely to choose flexibility over higher pay.”

5 Signs That You’re Borrowing Too Much [Moneyland] “Here are five guidelines to keep you from borrowing too much.”

How To Handle Lending Money To Loved Ones

Lending money to a significant other, close friend or family member is an excellent way to hang a black cloud over your relationship, but sometimes it’s the only financial maneuver that makes sense. Be smart by treating the transaction just as formally as you would one with a financial institution. [More]

Here Are Some Signs That Bankruptcy Is Your Best Option

Most people don’t set out to go bankrupt, but a fresh start offered by the maneuver could be a wise and necessary move to recover from such setbacks as poor financial choices made when you were young, medical disasters or a divorce. [More]

Personal Finance Roundup

Put your iPad to work [CNN Money] “Can’t justify buying a $500 tablet simply for entertainment? Then take it seriously: Make an investment in these add-ons and get down to business.”

The Hard Question [Wall Street Journal] “Who will take care of your child if you die?”

How to Give Thoughtful Gifts on a Scrooge-Like Budget [Wise Bread] “A few strategic conversations and a dash of creative thinking can help transform the holiday season from financially stretched and stressful to modest and merry.”

Questions to Ask When Drafting an Estate Plan [US News] “You can bring this four-part checklist to your initial meeting to discuss how to make your plan comprehensive and up-to-date.”

Getting a Grip on Taxes Before the Storm Hits [NY Times] “Taxpayers should run a checklist for everything from selling securities that have lost money to taking advantage of annual gift allowances.”

Places At Home To Stash Your Cash

Most financial experts don’t recommend keeping large amounts of cash stashed at home, but that doesn’t stop people from socking their savings in corners they believe to be safe. Those who do so leave themselves vulnerable to losing huge amounts of money due to burglaries or forgetfulness. [More]