As we told you in September, a woman is suing a debt collector for her husband’s final heart attack and death. [More]

personal finance

Merchants Demand Credit Card Fee Relief

Merchants are pushing for more credit card fee reform, for the fees they have to pay. Every time you swipe at checkout, whether it’s a credit or debit card, the merchant has to pay two fees. One is a flat per transaction fee, the other is a percentage of the total sale, called the interchange fee. Those rewards cards you’re so fond of? They have the higest interchange fees. Those rewards and cashbacks don’t come from a magical reward tree, they’re paid for by the interchange fees. In other words, the Quickie Mart is paying for your “free” airline miles. [More]

Personal Finance Roundup

The holiday shuffle [The Washington Post] “In the gift card game, the rules keep changing. So do the winners and losers.”

It Pays to Be True to Your School: 5 Ways Your Alma Mater Can Save You Money [Wise Bread] “Alumni associations are doing everything they can to make things better for graduates of their college during this difficult time. Amazingly enough, some of the savings are pretty substantial.”

Personal Finance 101: What Does FDIC Insurance Really Mean? [The Simple Dollar] “What exactly is FDIC insurance? How does it work?”

Give Wisely at Work [The Wall Street Journal] “Be careful when playing Santa at the office. Giving certain gifts could get you in trouble.”

10 creative ways to wrap gift cards [MSN Money] “Does giving a gift card seem cold or impersonal? The trick is all in the presentation. For a few extra bucks, add a personal touch to an otherwise generic package.”

— FREE MONEY FINANCE (Photo: RichSeattle)

Gift Idea: A Book About Money

Books on managing your money better are an especially apt holiday gift this year. If you need some ideas, Vanguard recommends these 16 books. Mastering your personal finances, the gift that keeps on giving. [More]

Ooh Shiny: Sears Card Gives Free Credit Scores

How would you like a free credit score with not very much baloney? The Sears Card from Citibank gives you just that, with no annual fees. [More]

Reach HSBC Executive Customer Service

HSBC Card & Retail Services

James R. Lane

Vice President, Executive Resolutions

831-772-6248

james.r.lane@us.hsbc.com

Quantifying Credit Score Killers

Whenever “credit score experts” give advice, you rarely hear hard numbers. They are eager to advise keeping your credit utilization low or how you shouldn’t apply for too much credit, but can never tell you how much it helps or hurts.

Personal Finance Roundup

Six personal finance books with lasting lessons — even for tots [The Washington Post] “A sampler of books for all ages to whet your personal-finance appetite.”

How Divorce Affects Your Social Security (Or Not) [Wall Street Journal] “Here are the general requirements for collecting retirement benefits based on an ex-spouse’s earnings.”

20 Money-Saving Ways to Reuse Old Pantyhose [Wise Bread] “Here are 20 creative ways to repurpose today’s worn out nylon pantyhose, even if you’re not planning to rob a bank.”

How to give when the giving gets tough [CNN Money] “13 creative ways to maximize your charitable impact without writing a huge check.”

10 Tips for Selling Your Home in the Sluggish Winter Months [US News] “What you need to know to sell your home in the off-season.”

— FREE MONEY FINANCE (Photo: Mike Rollerson)

Pay Off $50k In Debt On A $20k Salary In 10 Steps And 5 Years

This 30-year old receptionist and single mother of 3 climbed out of a $50,000 debt hole in 5 years using these 10 steps. [More]

Sears Solution MasterCard Gives Free Credit Scores, But Has Annual Fee

The Wallet blog has a cool tip about a credit card that give free TransUnion FICO credit scores. Sweet! Closer inspection reveals it’s not such a good deal, unless you have stellar credit history. [More]

Slothful Home Loan Modifiers Earn More Money When You're Delinquent

With a rising wave of foreclosures looming, the Treasury is stepping up pressure on lenders to finish modifying home loans and to pick up the pace. Potentially exacerbating the problem is that many loans are held by servicers whose fees increase the longer borrowers remain in default. [More]

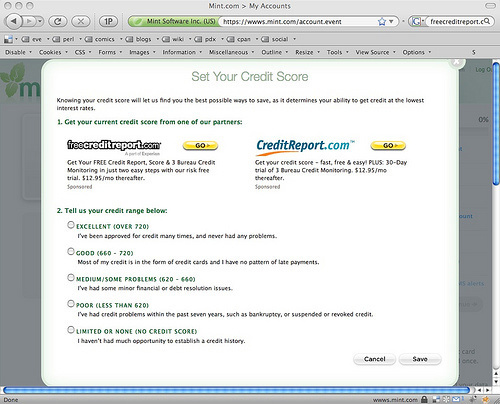

Mint Upselling To "Free"CreditReport.com

It didn’t take long for Intuit to start ruining a great product. They’ve begun upselling Mint.com customers to two “free” credit report sites that are anything but. UPDATE: Turns out Mint was already doing this pre-Intuit. Bully for them.

JP Morgan Chase Yanks Mandatory Binding Arbitration Clause From Credit Card Contracts

In response to legal and political pressure, JP Morgan Chase is removing the mandatory binding arbitration clause from its credit card contracts. Customers will receive a new member agreement reflecting the change first quarter 2010.

Newly Frugal Behavior Is Permanent, Say Some Consumers

A new study says that 26% of US consumers “have no plans to return to their free-spending ways,” which probably doesn’t sound like good news to retailers. Even worse (for retailers), about a third say they’ve become less loyal.

Checklist Your Way To Thanksgiving Success

It’s time to get ready for Thanksgiving. Stay in budget and manage your time effectively with ShelterPop’s pre-Turkey Day checklist. What do you do around your house to prepare?