Bank of America announced they will stop charging overdraft fees on debit card purchases. If you don’t have enough money to buy the item, the transaction will be declined. [More]

personal finance

BoA So Messed They're Incapable Of Taking Your Money

It’s a real junkyard over there at Bank of America. We have yet another complaint about their online system being so jacked up that it won’t even take your money. That’s the last thing you want to happen when you’re trying to pay your mortgage in these foreclosure-happy times. Jason has already escalated to the executive office, and they still suck. [More]

Go Ahead And Cancel Your Credit Card, The Score Ding Is Minimal

New answers pried from the secretive FICO corporation that overlords our credit scores kill a longstanding myth. It turns out that cancelling your credit cards won’t destroy your credit score. [More]

Personal Finance Roundup

7 Sneaky Savings Strategies for Generation Y [Kiplinger] “Try these tricks to build a better financial future.”

10 Things Your Mechanic Won’t Tell You [Smart Money] “1. You might be in the wrong garage.”

10 tips for spending less and saving more [Washington Post] “Here are 10 surefire ways to trick yourself into spending less and saving more.”

4 reality checks for your finances [MSN Money] “A few simple calculations can tell you whether you’re doing fine or staring at debt disaster.”

The price you pay for frothy assets [CNN Money] “Nothing affects your future returns more than the price you pay for your investments.”

What Do You Do When Your Credit Card Has Been Armed With An Interest Rate Trap?

Harry’s got a problem: the Bank of America card he’s had for years is paid off, but now it’s been set to explode in Harry’s wallet if he ever uses it again because the variable APR will jump to 29.99 percent. What’s worse, his other card has been canceled. Now Harry doesn’t know if he should start using the BofA card or back away quietly from it. [More]

VIDEO: Should I Go Credit Union Or Bank?

Sick of interest rate hikes, new hidden fees, and their credit lines cut, more consumers are trying their local credit union a shot. This CBS video takes a look at a credit union in Michigan who bought back their credit card program that they had sold to large bank after members started complaining. [More]

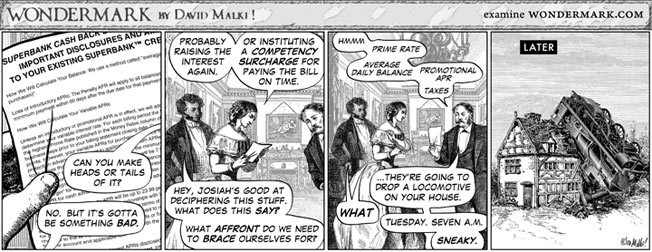

If I Read The Fine Print I Would Still Have A House

Credit card companies stuffed all the crazy they could into their contracts in advance of the CARD act taking effect. This time they might have taken it too far, even for banks. Shoulda read that boilerplate!

#599; The Boilerplate Clause [WonderMark] (Thanks to MercuryPDX!)

Buy A Georgetown Law Degree On Craigslist

Mom and Dad always wanted you to be a lawyer but who wants to dump all that money down the tubes and read those boring books? Well, no longer! Some burnout is selling his law degree from a fancy university on Craigslist! [More]

Would You Rather Have A Savings Cushion Or Get Rid Of Your Debt?

Personal finance blogger Debt Ninja writes that he has $22,000 in savings, and isn’t sure whether to use the majority of that to blast away his $15,000 debt. On top of that, he’s got a wedding and honeymoon to save up for. [More]

Reach Countrywide Executive Customer Service

Here is some Countrywide executive customer service info. Even though Bank of America acquired Countrywide, some of this contact info is still valid. Former Countrywide customers who experiencing post-integration account difficulties have reported success using it. [More]

Tax Tips For Gay Couples

There’s a reason why same-sex couples end up spending an average of $12,300 more over the course of a lifetime in tax prep fees: it’s more complicated! To help guide gay couples through the murk and mire, NYT Bucks Blog has a comprehensive guide to pitfalls and considerations to keep in mind when filling out those forms. Gay rights may divide our country, but nobody likes doing taxes.

Tax Tips for Same-Sex Couples [NYT Bucks Blog]

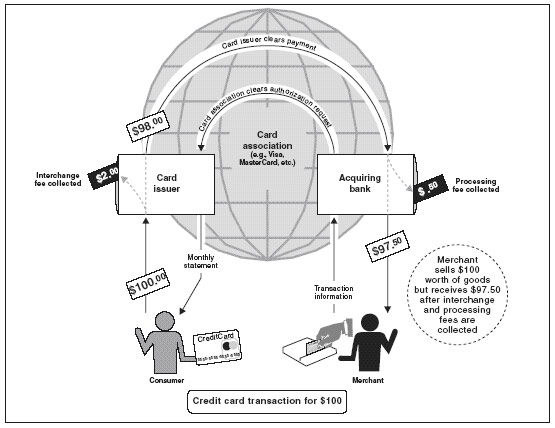

The Hidden Fee That Happens Every Time You Swipe Your Credit Card

It’s invisible to you but each time you swipe your credit card, a fee fairy gets its wings. An interchange fee fairy, to be exact. How does it work? This chart from the Government Accountability Office attempts to shed some light on the murky world of merchant processing fees. Did you know that over the past 10 years, while the technological costs of processing transactions has gone down, interchange fees have more than doubled? A cost that then gets passed on to you in the form of higher prices. [More]

Is Rich Dad Robert Kiyosaki Getting Rich Off Suckers?

If you’re looking to get rich, a CBC Marketplace hidden camera investigation reveals that Robert Kiyosaki’s “Rich Dad” seminars should probably be avoided. They attended a $500 3-day workshop and found it was little more than some very poor real-estate investing advice – tricks like “lease options,” “pre-foreclosure” and “buy 10 condos, get 1 free” – sprinkled on top of heavy upsells into the $12,000-$45,000 “advanced” training courses. In a new twist, the instructor tells everyone to go raise their credit card limit by $100,000 so they will have the money they need to start investing in real-estate, and even gives them the scripts to do it. [More]

Personal Finance Roundup

Two Simple Equations that Lead to Financial Success [Free Money Finance] “If you master these two equations alone, you will become wealthy.”

The 20 best money Web sites [CNN Money] “These sites have tools you can trust to help you make better money decisions.”

A Lavish Wedding Costs More Than You Think [Wall Street Journal] “The true cost of these things is more than most people realize. If they did the math, they’d probably get married in flip-flops.”

Seven Rational Things to Do When Financial Panic Hits [The Simple Dollar] “Here are seven things that you should attempt to do [when faced with a financial crisis.]”

Lifetime cost of bad credit: $201,712 [MSN Money] “If you’re not doing all you can to keep your credit scores high, you’re borrowing trouble — and you could pay a very heavy price.”

10 Ways To Save Money In Spite Of Yourself

If you’d like to save more money but find yourself unable to set anything aside after you pay your bills and buy such necessities such as MAD Magazine and lottery tickets, Kiplinger’s Personal Finance editor Janet Bodnar is out to help you. She put together 10 ways to trick yourself into saving. [More]

Just Calling Bank Of America Invokes The Cancel Monster

Be careful if you call Bank of America. You might wake the beast. April called BofA about a credit card that she hand’t used in a while to see about getting her interest rate reduced. At first they told her she qualified for a new card with an APR 10 points lower, but then the bloodshot eye of the guardian cast its fell gaze upon her for the first time in years and something nasty happened… [More]

Credit Card Companies Target Goody Two-Shoes

Like the nerdy girl in the movies who loses her glasses and gets a new haircut and all of a sudden she’s popular, consumers who pay off their credit card bills in full every month may soon find themselves the center of some unexpected courting. [More]