This morning, BillShrink delivered a karate chop to the cable cabal with a new service, currently in beta, that shows you how to get the best cable/tv/satellite/dish package for the best price. [More]

personal finance

Personal Finance Roundup

Five Simple Substitutions, One Big Change [The Simple Dollar] “It’s amazing how much money can be saved by making one simple change in your life.”

Personal-Finance Basics for the Class of 2010 [The Wall Street Journal] “Here are some of the new developments most likely to affect the class of 2010.”

Things you think will make money but don’t [Smart Spending] “When asked, readers listed going to college, buying gold, and cooking at home, among other things. Not everyone agreed.”

The wacky world of college scholarships [MSN Money] “Need some help affording college? A special skill or interest — or even a particular last name — can put a big dent in a student’s tuition.”

7 Questions You Must Ask Your Financial Adviser [Kiplinger] “Understanding your financial adviser’s motives, expertise and methods is crucial to managing your wealth.”

Fighting About Money Frequently Increases Risk Of Divorce

You already know that it’s not healthy to fight about money all the time, but it might be a bigger risk factor for divorce than you think. A 2009 University of Virginia study found that couples who argue about finances every a week are 30% more likely to divorce than those who argue less frequently. In addition, a couple that marries with no assets are 70% more likely to divorce in three years than a couple bringing $10k in assets into the union. [More]

Reach HSBC Finance Executive Customer Service

Here is some contact information for HSBC Finance. It’s good for when you have a Sisyphean customer service issue that you’d rather have the sneakers of Mercury. [More]

Cut Debt Faster By Sending In Your Payments Sooner

One little trick you can do to get out of debt faster is to send in your credit card payments as soon as you can, says No Credit Needed. [More]

Does Your City Spend A Lot On Eating?

When it comes to spending on munching and swigging, how do you think your city stacks up? Bundle crunched the numbers and turned it into a plump and juicy infographic, served up piping hot inside… [More]

Credit Card Limits Going Lower, Rates Staying High

A FICO survey of risk officers at various financial companies found that they overwhelmingly agree that credit cards are going to get even crappier for consumers in the coming months. 83% said that card limits are going to go lower. 95% said that interest rates could go higher or stay at the currently high levels. Just two more reasons to cut the plastic. [More]

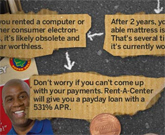

Rent-A-Center Responds To Predatory Lending Infographic

Sonia, Rent-a-Center’s Public & Community Affairs person, saw our popular post, “How Predatory Lending Works, From Payday Loans To Rent-To-Own” and has a rebuttal that shows how they do math. I showed it to Jess, the creator of the infographic, and he has a rebuttal to the rebuttal. Let the chips fall where they may: [More]

Personal Finance Roundup

The Ten Worst Money Mistakes Anyone Can Make [Free Money Finance] “You must avoid the financial pitfalls that can significantly derail your finances. Here they are along with some suggestions for avoiding them.”

5 Questions Couples Should Ask in the Money Talk [Wise Bread] “If you are thinking about living with someone or getting married, sit down as a couple early on and ask yourselves the following questions.”

71 Ways to Save on Taxes Now [Kiplinger] “Don’t wait until you file your return to find ways to lower your tax bill. These moves will help you save throughout the year.”

Solve your health care challenges [CNN Money] “Try these strategies to cure what ails you when it comes to getting and paying for medical care.”

A Toolkit for Women Seeking a Raise [NY Times] “A new study concludes that women need to take a different approach than men.”

Late Payments Are Dropping Thanks In Part To The CARD Act

Banks and card issuers warned against the credit card reforms that went into effect a few months back, but so far it’s been a good thing for consumers, according to new delinquency numbers. [More]

Some Homeowners Worse After Getting Rushed Into Gov't Loan Mod Program

Despite fulfilling every obligation under trial government-sponsored loan modification programs, some homeowners can end up far worse off than if they had never joined up at all, Propublica reports. That’s because if they’re denied a permanent modification, they have to pay the entire amount that was being discounted, often within a very short period of time. This pushes already strapped families past the breaking point. [More]

Senate Bill To Curb Credit Card Swipe Fees Passes

The bill to curb credit card fees that was being floated last night ended up passing. Credit card industry stocks fell Friday on the news. [More]

Personal Finance Roundup

How to find a car’s ‘real’ price [MSN Money] “Actual dealer cost is elusive, and the ‘invoice price’ is just one clue. But you can get an idea of dealer cost, and that will help in negotiating the price you pay.”

Seven Easy Steps to Your Dream Job [The Simple Dollar] “Pretty good advice for any “dream job” a person might have.”

We’re flunking personal finance [Washington Post] “The financial teaching grade is in for teachers — and it’s not good.”

Social Security: Get to know your options [Vanguard] “Your personal circumstances—such as whether you have other savings or sources of income—can affect the path you’ll take.”

How to Appraise Home Appraisers [Wall Street Journal] “A low appraisal is one of the more common reasons that transactions fall apart these days.”

How Predatory Lending Works, From Payday Loans To Rent-To-Own

You’re a savvy, savvy consumer. You pay your credit card bills in full every month, auto-deduct a generous portion of your paycheck into savings, invest in index funds, and always make sure you’re getting the best deal from your cable and wireless providers. Unfortunately, some of your brethren do not read Consumerist and can get caught up in the jaws of predatory lenders, wasting limited cash on things like payday loans, bad credit cards, and using rent-to-own stores. So let’s take a walk down the wild side and see how each of these bad choices work, in a giant infographic, courtesy of Mint and WallStats, after the jump. [More]

How Consumerists Are Saving Money With Consumerist

Consumerist readers are saving money left and right using tips and techniques they learned about here from posts and from other commenters. Here’s just a few a few of the ways they’re able to hold onto more of their hard-earned cash: [More]