Tired of living paycheck to paycheck? Here’s some advice on getting your money situation together.

personal finance

Quicken And MS Money Are ExtortionWare

Both Quicken and MS Money sneak these “sunset” clauses in their end user license agreements, giving them carte blanche to completely disable major parts of their functionality if they feel like it. These features include online bill pay, downloading any financial information, portfolio tracking, and more. Basically, all the cool stuff.

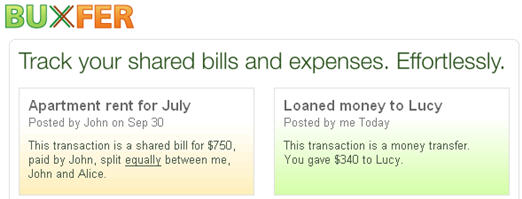

8 Free Personal Finance Management Programs

When we posted our scrappy guide to making your first budget, many readers chimed in with what personal finance software they enjoyed, many of them free. Here’s a roundup of the results:

Consumerist's 9-Step Beginner's Budget

Are you a budget novice? Constantly overdrafting? Never have enough money to buy what you really want? Wish you could get your shit together? We’ve got a sexy free Excel document to share with you.

UPDATE: Landlord Auto-Deducting My Life Away

Despite being a broke fool who let his landlord auto-deduct from his bank account, Mike was able to get all his money back from his landlord, using two of consumers most important tools: persistence, and sheer force of will.

Get Your FICO Score Without Breaking The Bank

Money, Matter, and More Musings has a roundup of stratagems for seeing your FICO score without subscribing to costly services. In case you don’t know, a FICO score is a 3-digit number lenders used to determine your credit worthiness. It’s based on your credit report info.

Thrifty Reader Tip Roundup

Readers submitted their tips for saving and making a small amount of money in the comments on “30 Ways To Save A Dollar Day (Or More).” We enjoyed them so much brought them out for all to see and benefit.

Debit Card Stolen, How Much Are You Liable For?

Federal law limits your liability to $50 if your credit card is stolen, but what about your debit card? It all depends on how fast you report it; the sooner the better, and if you wait too long, you’re totally screwed.

How To Save Your Home from Foreclosure

WikiHow has a primer on saving your home from foreclosure. If you find yourself unable to make payments…

30 Ways To Save A Dollar Day (Or More)

Frugal For Life has a new list of over 30 ways to improve your money situation by small measures, either by cutting down, saving, or finding new ways to make money.

HOW TO: Play 0% Balance Transfer Credit Cards For Fun And Profit

0% balance transfers can be a great tool to cut down credit card debt as you’re, obviously, paying nothing for interest. However, you need to know the rules of the game and how to play by them, or you could wind back up with a nasty APR. FiveCentNickel breaks it all down for you. He warns,

Leaving Your Job? Don't Forget To Take Your 401k

401k’s are critical long-term investments too often forgotten by job-switchers. They are vastly more important than the staplers and pens most people remember to box up.

Consider: Some 7.5 million Americans took about $440 billion in distributions from their 401k plans in 2004, according to Brightworks Partners research. Of the 7.5 million, 6.25 million were job changers and 1.25 million retired. Of the 7.5 million, 55% had 401k balances greater than $5,000.

Thanks to a law enacted in 2005, people leaving their jobs with less than $5,000 in their 401k automatically have their plan rolled into an IRA.

Math Problem: Best Paying Off Credit Card Method, Snowball or Orzman?

The “Snowball” method for paying off debt is very popular, but what about one offered by Suze Orman? Which one results in paying the least money and getting out of debt the fastest? First, take a peek at JLP’s description of both.

House Burglar's Advice For Hiding Money

A former burglar chatted with the Personal Finance Advice blog and gave some good tips on how to hide your money at home.