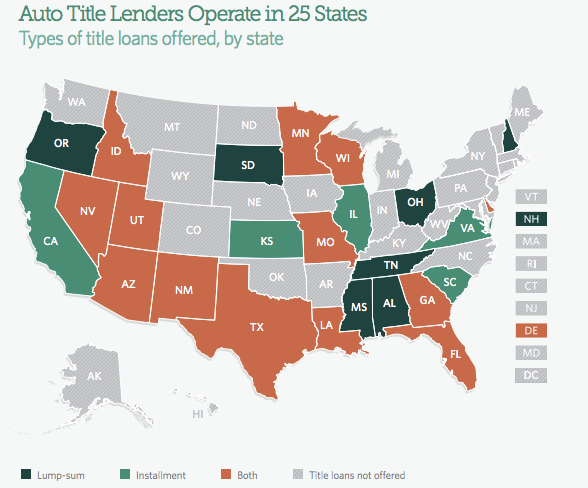

Each year millions of consumers turn to high-interest, short-term loans to make ends meet. While you may be more familiar with payday lenders who charge triple-digit interest rates with the goal of trapping borrowers into taking out new loans to pay off the old ones, a new report finds that payday’s lesser-known relative, auto title loans, have equally destructive repercussions. [More]

payday loans

Report: Auto Title Loans Just As Bad, If Not Worse Than Payday Loans; Should Face Same Rules

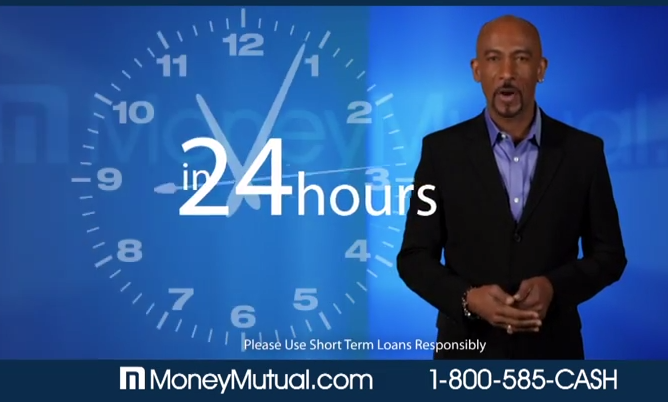

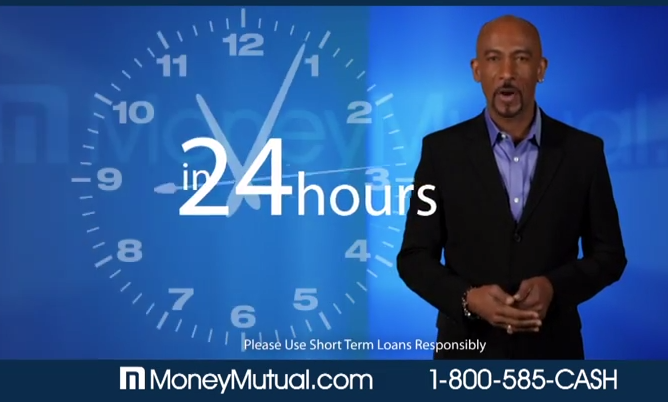

Montel Williams-Endorsed MoneyMutual To Pay $2.1M Penalty

For years, TV personality Montel Williams has been the daytime TV face of payday loan lead generation service MoneyMutual, even as it faced investigations from federal and state agencies. Just a few days ago, Montel got into a Twitter spat with a woman who questioned why he was acting as a spokesperson the company, and showed that maybe he needed a refresher course on annual percentage rates. But as part of a deal with regulators in New York state, Montel will no longer market payday loans in the state and MoneyMutual will pay a $2.1 million penalty to settle allegations that it illegally marketed payday loans to New York residents. [More]

Faith V. Greed: The Battle Between Faith-Based Organizations And The Payday Loan Industry

“The Bible condemns gaining wealth through usury; and the writers of Scripture warn about gaining wealth through exploiting the poor… [but] The State of Alabama allows Payday lenders to charge an annual interest rate of 456%.” [More]

Missouri AG Shuts Down Eight Online Payday Lenders Operating From South Dakota Reservation

More than 6,300 Missouri residents will receive refunds or have their debts voided after the state’s attorney general reached an agreement with an online payday lender based on a Sioux reservation in South Dakota. [More]

Montel Williams Defends Hawking Payday Loan Generator Money Mutual

By now we know that celebrities (and pseudo-celebrities) often lend their names to products that may or may not have devastating effects on consumers. Of course, hawking a product for a paycheck doesn’t automatically make the spokesperson in question an expert on the product or the consequences of using it. [More]

FTC Files Lawsuit To Shut Down Deceptive Payday Loan Debt Relief Operation

It’s probably safe to assume that consumers stuck in the payday loan debt-trap have enough financial issues without being deceived by a company promising to make their debts disappear. There may be one less unsavory debt relief company around after the Federal Trade Commission sued to stop an operation that targeted millions of consumers. [More]

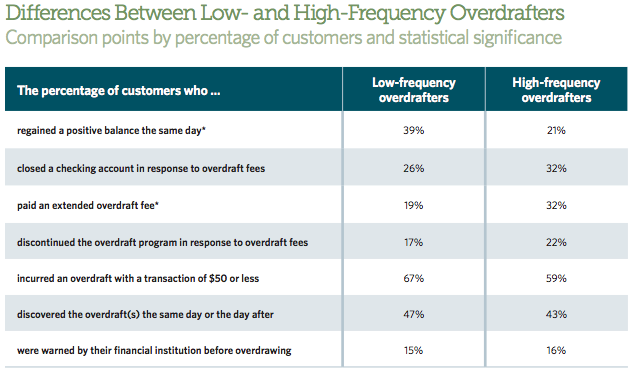

Report: Overdrafting Just A Little Or A Lot Has The Same Negative Consequences For Consumers’ Accounts

For most consumers, overdrawing their checking account results in a hefty fee. While it’s safe to argue that consumer who have more overdrafts will pay more in fees, a new report from The Pew Charitable Trusts finds that both high-frequency and low-frequency overdrafters often face the same devastating financial ramifications from banks’ overdraft penalties. [More]

Report: CFPB To Release Rules Governing Payday Loan Industry Soon

Last March, the Consumer Financial Protection Bureau said it was in the “late stages” of crafting rules to rein in the often predatory payday lending industry. Nearly a year, later the agency is reportedly on the cusp of announcing said rules. [More]

Report Spotlights Impact Of Payday Lenders On Most Vulnerable Communities

It’s no secret that payday loan storefronts often pop up in lower-income communities where consumers are more likely to need a quick infusion of cash to get to the next paycheck. A new report from the Howard University Center on Race and Wealth shines a light on the frequency with which the small-dollar, high-cost loans are opened in susceptible communities in the southern United States. [More]

Fifth Third Bank Has 100 Million Reasons To Want To Keep Offering Payday-Like Loans

When the four banks still offering customers payday loan-like services announced they would discontinue their often under-fire products, they likely knew their bottom-line would take a hit. One of those institutions, First Third Bank announced this week that changes to its program resulted in the loss of millions of dollars in revenue, providing an example of why it can be difficult to persuade lenders to ditch the profit-making, but financially devastating programs. [More]

Banks Are Cutting Off The Payday Lending Industry’s Access To Customer Data To Avoid Illegal Activity

Banks across the United States are distancing themselves from the unscrupulous payday lending industry by cutting off lenders’ access to a database of customer account information used to assess potential borrowers. [More]

Founder Of Consolidated Credit Counseling Services Reportedly Tied To Payday Lenders

If you’re in dire financial straits because you thought you could take out a 275% APR payday loan only to find yourself unable to repay, do you want credit counseling advice from someone with a financial interest in the success of payday lenders? Probably not, but the founder of Consolidated Credit Counseling Services, Inc. says that his investments in the payday loan business had no bearing on his work. [More]

Can Churches Provide A Meaningful Alternative To Payday Lending?

With one-in-four Americans turning to questionable financial products like payday and auto-title loans, an unlikely group is stepping in to provide consumers with a less-costly alternative. Churches across the country are helping members escape the trap of revolving debt by aiding them in obtaining safer loans. [More]

Ohio Senator Proposes Payday Loan Alternative That Allows Consumers To Access Early Tax Credits

For years, lawmakers have tossed around the idea of meaningful payday loan reform, from banning loans with annual percentage rates higher than 36% or looking to close loopholes that allow predatory lenders to claim tribal affiliation. This week, as Congress began its latest session, one lawmaker suggested a payday alternative that doesn’t involve another type of loan at all. [More]

Protecting Military Servicemembers From Predatory Loans Is A National Security Issue

In recent years, we’ve written a number of stories about laws aimed at protecting active-duty servicemembers and their families from predatory loans and the businesses that try to take advantage of loopholes in these rules. Some readers have asked why members of our armed forces merit protections not available to civilians. But this isn’t about just doing something nice for our soldiers; it’s about removing a threat to national security. [More]

Payday Lenders Now Outnumber McDonald’s (But Still Not As Many As Subway)

There are more than 14,000 McDonald’s locations in the U.S., meaning you’re rarely more than a few miles away from a Big Mac. But even though payday loans are illegal in more than a dozen states, these short-term predatory lending operations outnumber Golden Arches eateries by nearly 1.5 to 1, though they still have some catching up to do with the vast number of Subway stores. [More]

Pennsylvania Sues Think Finance, Alleging Illegal Payday Loan Scheme

Pennsylvania is one of several states with laws prohibiting payday lending, but the often predatory products still find their way to consumers via online marketplaces and companies’ claiming affiliation with American Indian tribes. In an effort to crack down on such nefarious lenders, the state’s attorney general filed a consumer protection lawsuit against a Texas-based company for allegedly engineering a payday loan scheme over the internet. [More]

Why You Shouldn’t Get A Reverse Mortgage Just Because Fred Thompson Tells You To

Turn on the TV and you’re just about guaranteed to come face-to-face with a celebrity or public figure selling a product or service. While those spokespeople may carry an air of respect and trust with consumers, what happens when the product they so happily lent their voice to turns out to have devastating affects on the consumer? Not much really, but it might be time for that to change. [More]