Believe It Or Not, Outlawing Payday Loans Will Not Lead To Looting & Pillaging

(aloucha)

Critics of payday lending say the practice traps many borrowers in a debt spiral, forcing them to take out additional loans to pay back the first. Yet these short-term loans do have proponents (many of them profiting from the industry) who claim that without this pricey option for quick cash, desperate consumers will turn to more unsavory means, leading to increased crime rates and other doom and gloom predictions. But does that really happen?

According to consumer advocates in states where payday lending is prohibited (but where the masses have not resorted to rampant looting) the answer is no.

Today, 13 states prohibit or ban the short-term, high-interest loans intended to get the borrower through to the next paycheck. The laws generally enact a rate cap which puts the annual percentage rates at or below 36%.

“Payday loans are predatory, abusive products that take advantage of disadvantaged borrowers and trap them in vicious cycles of debt, interest payments, and repeat borrowing,” Sen. Richard Blumenthal of Connecticut, where payday lending is prohibited tells Consumerist in an e-mail.

While it appears to be a growing trend by states and the federal government to rein in predatory payday lending – no state has allowed payday lending to begin service since 2005 – that doesn’t stop the payday industry from using scare tactics and misleading information to keep the practice up and running.

BUT CONSUMERS NEED QUICK CASH

Last week during a Consumer Financial Protection Bureau panel discussion on payday lending, Jamie Fulmer, Sr. VP of Public Affairs with payday lending operation Advance America, said his company found that 98% of customers were satisfied with their payday lending experience.

“Every customer who walks in our door can expect to meet their individual needs,” he said.

That might be true for the short-term, but a recent report from the CFPB found that 4 out of 5 payday loans are made to consumers who are stuck in a debt trap. By renewing or rolling over loans the average monthly borrower is likely to stay in debt for 11 months or longer.

Many payday lending supporters put an emphasis on the convenience and availability of payday loans.

One report [PDF], titled “Effects of State Payday Loan Price Caps & Regulations,” from the University of Washington insists that payday loans are the best option for consumers.

“Payday loans—short-term unsecured loans intended to be repaid upon the receipt of expected income within a pay period—may legitimately be the most attractive option, due to their convenience, reliability, and availability on short notice.”

But what Zywicki and Sarvis fail to demonstrate in their article, and Fulmer failed to mention at the panel discussion, are the future consequences of taking out a short-term, high interest loan.

“What happens if a car breaks down and you need $300 to get the car fixed?” Ellen Harnick, senior policy counsel with the Center for Responsible Lending says. “If you don’t fix the car then you lose your job. What payday lending leads people to think is it’s a good solution so they don’t pursue other solutions. They take the loan because there’s a shortfall, but in two weeks they have a $345 shortfall because they now have the loan and the fee.”

And so the cycle of debt, and creation of a rollover loan situation begins.

“The standard argument is consumers really need this thing and that’s not true,” Harnick says.

IF YOU BAN PAYDAY LOANS, CONSUMERS WILL HAVE NOWHERE TO TURN

Payday industry leaders and supporters often try to illustrate the importance of payday lending by claiming that without the option consumers would have no viable alternatives available at their disposal.

One report [PDF] from the University of Washington “Effects of State Payday Loan Price Caps & Regulations” insists that few financially attractive alternatives to payday lending currently exist in the marketplace.

“Without access to payday loans, consumers likely use overdrafts, pawnshops, and late bill payment to cover short run credit needs.”

But advocates say that simply isn’t the case and a number of states have proven it’s not.

For instance, New York offers two products. The Credit Builder Loan for low-income borrowers with little or no credit, and a Score Builder Loan for those with low credit scores. Both options have a 14.25% interest rate and no fees for a six-month loan.

In North Carolina, the State Employee Credit Union offers a Salary Advance of up to $500 at 12% APR with no fees. The loan must be paid back in full by automatic payments on the next payday.

Borrowers in Connecticut can find help in the form of personal loans from the First New England Federal Credit Union. The loans feature APRs between 10.25% and 17.99% depending on a borrower’s credit score.

“In the absence of payday lending, people do a lot of things; they negotiate payment plans with creditors, they juggle bills, they sometimes borrow from family and friends,” Harnick with CRL says. “If it’s not available they will find other methods.”

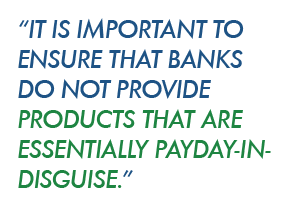

Of course there have been products masquerading as viable alternatives, such as legitimate banking institution’s Direct Deposit Advance programs. The services differ little from the typical storefront payday loan operation – both offer high-interest, short-term loans meant to get consumers out of emergency financial situations, but in reality have been found to trap them in an ongoing cycle of debt.

Facing tighter regulations, banks such as Wells Fargo and U.S. Bank have announced the discontinuation of the programs, something Blumenthal, the senator from Connecticut applauds.

Facing tighter regulations, banks such as Wells Fargo and U.S. Bank have announced the discontinuation of the programs, something Blumenthal, the senator from Connecticut applauds.

“It is also important to ensure that traditional banks do not provide products that are essentially payday-in-disguise, such as ‘deposit advance loans.'” he says. “These products cause real harm to Connecticut families, and we must ensure that such bad actors find no refuge in our state.”

PAYDAY LENDING BOOSTS THE ECONOMY

Payday lenders often argue that the small-dollar loans help boost the economy in a positive way. The argument is that when a consumer has more money they’ll spend it on goods and services, in turn pumping funds into the economy.

It’s been argued that traditional storefront payday lending creates jobs, an estimated 77,000 jobs nationally according to the Community Financial Services Association of America (CFSAA), a payday lending advocate.

CFSAA estimates that the industry contributed over $10 billion to the U.S. gross domestic product in 2007.

However, the Consumer Financial Protection Bureau found that in 2011 the U.S. economy took a net loss of $774 million due to the payday loan industry.

“The economic activity generated by payday lending firms receiving interest payments is less than the lost economic activity from reduced household spending. Specifically, each dollar in interest paid subtracts $1.94 from the economy through reduced household spending while only adding $1.70 to the economy through spending by payday lending establishments.”

Additionally, a number of studies have concluded that borrowers who use payday lending are left in worse circumstances than when they first took out the loan.

A 2008 report from researchers at Vanderbilt and the University of Pennsylvania, “Do Payday Loans Cause Bankruptcy” [PDF], found that a borrowers chance of filing for chapter 13 bankruptcy doubles within two years after receiving their first payday loan.

A 2008 report from researchers at Vanderbilt and the University of Pennsylvania, “Do Payday Loans Cause Bankruptcy” [PDF], found that a borrowers chance of filing for chapter 13 bankruptcy doubles within two years after receiving their first payday loan.

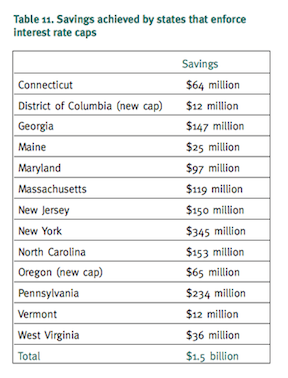

Consumer advocates have found that, in reality, regulating or eliminating payday lending actually proves to be better for the economy. Connecticut, North Carolina and New York each reported saving consumers millions of dollars through the use of interest rate caps.

CRL’s “Springing the Debt Trap” report [PDF] found that Connecticut saved $64 million, North Carolina saved $153 million and New York saved $345 million.

Savings and alternative forms of small dollar credit have led to consumer’s often changing their tune about needing payday loans.

CONSUMERS: ‘WE DON’T NEED YOUR LOANS’

“Generally, we can say that when states have adopted rate caps there has not been a clamor from consumers to have triple digit lending come back,” Lauren Saunders, attorney with the National Consumer Law Center says. “There’s a transition period in those states where consumers get cut off from predatory loans, but once they are gone, people find other options that are better for them.”

That certainly seems to be the case in North Carolina. The state offers a unique perspective on payday lending; it was banned for nearly 200 years before the state legislature allowed payday lenders an exemption from the state’s 36% rate cap.

That certainly seems to be the case in North Carolina. The state offers a unique perspective on payday lending; it was banned for nearly 200 years before the state legislature allowed payday lenders an exemption from the state’s 36% rate cap.

When the sunset period ended in 2001, the legislature determined the loans weren’t good for consumers and did not extend the exemption.

Harnick, who works in North Carolina, says the legislature’s finding concluded that payday lending not only does not help consumers, but in most cases it makes people’s situation substantially worse.

Shortly after the exemption ended, the North Carolina Commissioner of Banks requested the University of North Carolina conduct a study on the consequences of the rate cap.

The report [PDF] found that 9 out of 10 households said payday lending was a bad option. Additionally, three out of four former payday loan users said the loans were harmful.

“Three-quarters of low- and middle-income people were unaffected by the ban on payday lending…of those that were affected by the end of storefront payday lending, more than twice as many reported that the absence of payday lenders had a positive impact on their lives.”

“Even consumers who were presently facing a shortfall of funds said it was better that payday lending was not available,” Harnick said.

FOR STATES WITH RATE CAPS, THE FIGHT IS NOT OVER

Even with strict rate caps, predatory lending has found its way to consumers in states like Connecticut through the Internet.

Sen. Blumenthal has been working to prevent online payday lenders from skirting state regulations and taking advantage of consumers.

“Like many states, Connecticut has strong usury laws that have all but eliminated storefront payday lending in the state. But out-of-state, online lenders continue to try to skirt Connecticut’s restrictions,” he says in an e-mail to Consumerist. “In fact, many of the constituent complaints I hear in Connecticut are about these sorts of online lenders, which is why I have co-sponsored the SAFE Lending Act – a bill that would close loopholes in federal law that enable these abuses.”

The payday lending industry and their supporters continually push to be let back into states where they are banned.

“North Carolina has been fortunate that our legislature has banned payday lending, but there have been efforts to bring it back,” Harnick says. “Lenders are eager to bring it back. The North Carolina legislature has thankfully not taken the bait, but lobbyists have invested a lot of money to try to take back the state.”

States such as Connecticut, North Carolina and New York have proven that enacting rate caps can have a positive impact on consumers and the economy. And that should be used to help further extend protections to other states and the federal government.

“I think that people have spoken in these states and legislatures have listened and that what we are seeing now is continued pressure to put in strong federal standards,” Tom Feltner, Director of Financial Services with Consumer Federation of America, tells Consumerist. “So that those states that have taken steps can keep protections and states where they are unprotected this will be a baseline that states and federal regulations can build on.”

And federal protections could be in place soon.

Last week, CFPB director Richard Cordray announced the agency was in the “late states” of working on rules to stop predatory lending.

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.