A growing number of America’s unbanked and under-banked consumers have been turning to prepaid debit cards as an alternative to checking accounts. Between 2003 and 2012, the total amount of money deposited annually onto these cards increased from $1 billion to $65 billion, and that amount is expected to near $100 million for 2014. But those cards often come with hefty fees and lack protections of other financial products. The Consumer Financial Protection Bureau is looking to make prepaid cards safer and lest costly with a new slate of proposed rules. [More]

payday loans

Fifth Third Bank Backtracks On Its Pledge To End Payday Loans

In early 2014, the four major banks still offering customers payday loan-like services announced they would discontinue their often under-fire programs by the end of the year. Apparently Fifth Third Bank has changed its mind, announcing plans to continue with a revised, supposedly less harmful version of the service for existing customers. But consumer groups say the revamped service doesn’t actually address the problems that led banks to discontinue programs in the first place. [More]

Tribes Suing New York For Restricting Payday Lending Businesses Drop Federal Suit

Despite having some of the toughest regulations prohibiting high-interest, short-term loans, New York has continued to face issues in the form of illegal online payday lenders who claim to have affiliation with Native American tribes. But those issues came a step closer to being resolved late last week when two American Indian tribes with online lending operations abandoned an effort to block the sate from restricting their businesses. [More]

UK Artist Creates Payday Loan Store For Kids

At first glance, the bright blue London storefront with a hand-painted technicolor scene of a cartoon cityscape in the window — complete with a smiling yellow mascot — looks like some sort of kid’s toy store or maybe a daycare center. That is, until you see the sign that reads, “Payday Loans 4 Kids.” [More]

1-In-4 Americans Turn To Payday Loans & Other High-Cost Financial Products

When discussing the topic of payday loans — or other high-cost, short-term financial products like auto-title loans and check-cashing — there can be a tendency to treat them like something that only a small percentage of Americans use. But a new report from the FDIC confirms that 25% of us have turned to one of these potentially predatory services in the past year, and that this rate has not been going down. [More]

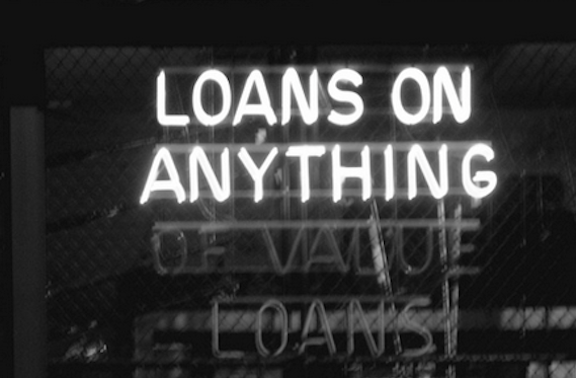

Online Payday Loans Cost More, Result In More Complaints Than Loans From Sketchy Storefronts

We understand why someone might opt for getting a payday loan online instead of doing it in person. It’s easier, faster, doesn’t require going to a shady-looking storefront operation where some trained fast-talking huckster might try to upsell you unnecessary add-ons or tack on illegal insurance policies. But the truth is that people who get their payday loans online often end up in a worse situation than they would have if they’d applied in person. [More]

Transferring Funds To Prisoners Is Big Business For Some Financial Companies

Life isn’t supposed to be easy for prisoners, but should the punishment extend to their families? A new report highlights the ways in which some financial institutions appear to be benefiting from the bad fortunes of others while prisoners’ families fall into debt trying to provide necessities like underwear and toothpaste to their loved ones behind bars. [More]

Defense Dept. Aims To Close Predatory Lending Loopholes For Military Personnel

While the Military Lending Act aims to protect military personnel and their families from predatory lenders’ often unsavory lending practices that include high interest rates and excessive fees, it still allows for clever lenders to get their hooks into borrowers. That’s why the Obama Administration and the Department of Defense announced a proposed overhaul of the rules – much to consumer advocates’ delight. [More]

Court Shuts Down Payday Lenders Who Made Millions Off “Loans” Borrowers Didn’t Ask For

Whether you think that payday loans are a necessary financial offering for people with bad credit to get low-value, short-term loans or a predatory product that only results in more debt for the nation’s poorest consumers, you’d agree that no loans should be doled out without the borrower’s approval. But one network is accused of putting unauthorized payday loans in consumers’ bank accounts so it can eventually siphon off even more money. [More]

Is ActiveHours A True Payday Alternative Or Just Another Too-Good-To-Be-True Letdown?

We’re largely a society built on convenience: fast food, one-stop shops and other we-need-it-now services. Unfortunately, that need for timeliness seeped in to the financial system in the way of quick-fix payday loans, which can provide the convenience of a quick, low-value loan but which often result in a revolving cycle of high-interest debt. Now a new lending product aims to take the predatory stigma out of short-term loans, but, like many payday alternatives of the past, a closer look reveals reason for concern. [More]

“Payday Syndicate” Accused Of Charging Illegal Triple-Digit Interest Rates In NY

States have usury laws to limit illegal lending from loan sharks and organized crime. Some states’ laws limit interest rates on loans so much that payday lending and other predatory financial products are effectively banned. New York is one such state, and prosecutors there have filed charges against the operators of a “payday syndicate” that allegedly issued loans with illegally high, triple-digit interest rates. [More]

The Best Lines From John Oliver’s Takedown Of The Payday Loan Industry

As regular readers of Consumerist know, we’re not exactly fans of the payday loan industry. If we were snotty teens and lived in the same neighborhood as Mr. Payday, we’d leave a flaming bag of dog poo on his doorstep. That’s why it was so nice to see our disgust for payday loans shared by John Oliver on HBO’s Last Week Tonight. [More]

Study: One Third Of Americans Have Debt In Collections

Sometimes debt isn’t so bad, and sometimes it is, but one thing is clear: 80% of Americans owe someone, somewhere, some money. It might be a mortgage or student loan, or a five-year-old fee that got forgotten about, but the vast majority of us have some outstanding debt. And worse: a third of the country may have debt collectors chasing after them for that cash. [More]

Loophole Allows Auto-Title Lender To Charge Triple-Digit Interest Rates Despite Law

Consumer advocates have long claimed that usury caps are the best way to protect borrowers from predatory lenders offering payday or auto title loans. But even those protections aren’t surefire. A title loan company in Florida has been skirting the state’s cap for the past three years. [More]

Is Cash America Getting Out Of The Payday Loan Business? Not Exactly

Sometimes there’s no better feeling than the one you get when you return to your so-called roots. Maybe that’s what Cash America International is looking for now that the company is making plans to separate itself from payday lending and returning to its first moneymaker: pawnshops. [More]

The CFPB Has Only Just Begun Tackling Financial Services In Its First Four Years

Four years ago, the Consumer Financial Protection Bureau was created – and three years ago it opened its doors – as a safeguard to ensure the financial industry followed the rules when selling products and services to consumers – and a lot has happened since that time. [More]

Phony Payday Loan Brokers Must Turn Over Rolls Royce, Maserati, Ferrari To Feds

When someone goes hunting for a payday loan — just looking to get their hands on a small amount of cash to tide them over until the next paycheck — it’s bad enough that they can end up trapped in a hellish debt cycle that sees them taking out loan after loan. But the FTC says a Tampa-based operation preyed upon these already-desperate victims by tricking them into applying for payday loans, only to steal their info and what little money they had. [More]

CFPB: ACE Cash Express Must Pay $10M For Pushing Borrowers Into Payday Loan Cycle Of Debt

Another payday lender faces a hefty fine — to the tune of $10 million — for allegedly pushing borrowers into a cycle of debt. [More]