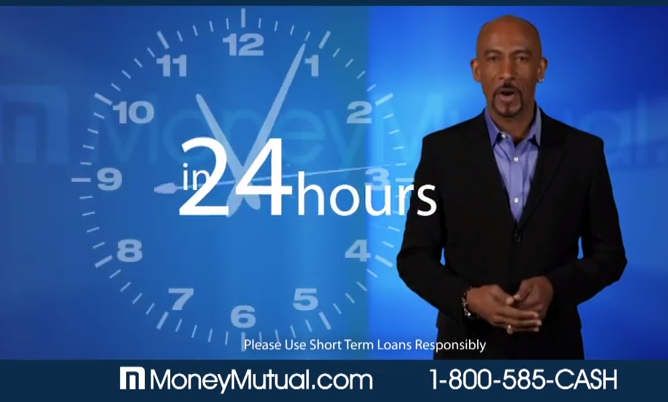

Montel Williams Defends Hawking Payday Loan Generator Money Mutual

By now we know that celebrities (and pseudo-celebrities) often lend their names to products that may or may not have devastating effects on consumers. Of course, hawking a product for a paycheck doesn’t automatically make the spokesperson in question an expert on the product or the consequences of using it.

By now we know that celebrities (and pseudo-celebrities) often lend their names to products that may or may not have devastating effects on consumers. Of course, hawking a product for a paycheck doesn’t automatically make the spokesperson in question an expert on the product or the consequences of using it.

Time reports that the former talk show host and Money Mutual pitchman Montel Williams got into a bit of a spat on social media when questioned about his backing of the payday loan lead generator.

The ordeal began Thursday evening when an education activist called out Williams on Twitter for supporting the “most predatory of loans in existence, PayDay loans.”

Williams quickly denied the implications, saying the activist’s message was “fundamentally incorrect.”

The back-and-forth continued as the man pointed out that Money Mutual – which has been under scrutiny by federal regulators in the past – provides leads to payday loan issuers with stated annual percentage rates in the triple-digits.

While the predatory nature of payday loans can be debated from both sides – with advocates saying the short-term loans perpetuate a costly and devastating debt trap, and supporters saying the loans are necessary for consumer with few other credit options – the most troubling aspect of the exchange came when Williams debated the high interest rates tied to payday loans.

Williams responded to the statements regarding Money Mutual APRs by saying that “a 14 day loan has an ANNUAL percentage rate? Maybe get a grip on reality.”

But according to federal regulators’ stance and research on payday loans, a 14-day loan carries significant fees and interest rates that often drive consumers deeper into debt.

Although borrowers are expected to repay their loans after 14-days, the Consumer Financial Protection Bureau found that often isn’t the case. In fact, many payday loans are rolled over or renewed every 14 days – incurring additional fees.

This practice has led to four out of five payday loans being made to consumers already caught in the debt trap.

Additionally, the CFPB found that by renewing or rolling over loans the average monthly borrower is likely to stay in debt for 11 months or longer.

With more than 80% of payday loans are rolled over or renewed within two weeks regardless of state restrictions, borrowers can end up paying more in interest than they borrowed to begin with.

A rep for Williams tells Time that Williams was specifically referring to loans that are paid off in two weeks, not payday loans in general.

“As someone who used short-term lending while in College, Mr. Williams understands that a large number of consumers, like he once did, have no access to traditional credit products,” the rep tells Time. “His endorsement of Money Mutual – which is not itself a lender – is reflective of the code of conduct it requires the lenders in its network adhere to and its historically low complaint rate. Certainly we believe consumers should make sure they fully understand the terms of any financial product they may be considering and would note Money Mutual encourages consumers to fully review and understand the terms of any loan, including the cost of any renewals, offered to them via its network of lenders.”

Montel Williams Got Called Out On Twitter For Endorsing Payday Loans—And He Didn’t Handle It Well [TIME]

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.