You currently can’t get Republican and Democratic lawmakers to agree on a lunch order, let alone jointly support legislation. But one controversial piece of legislation is not only garnering support from both sides of the aisle, it’s also got the Chair of the Democratic National Committee pushing for legislation that would undermine the Consumer Financial Protection Bureau’s ability to regulate predatory lending. [More]

payday loans

Feds Arrest Heads Of Two Massive Online Payday Loan Operations

Back in June 2014, Consumerist showed readers what might have been the scammiest payday loan we’d ever seen. Today, federal authorities arrested the man behind the company, AMG Services — along with his lawyer and another, unrelated, payday lender — for allegedly running online payday lending operations that exploited more than 5 million consumers. [More]

Regulators Sue Pension Advance Companies Over Deceptive Marketing Of Loans

Five months after the Consumer Financial Protection Bureau warned that pension advance loans could be the new payday loan – leaving consumers who are already struggling to make ends meet in dire financial situations – the agency announced it had teamed up with the state of New York to shut down two companies that allegedly deceived retirees about the risks and costs associated with the loan products. [More]

Regulators File Suit Against Data Broker That Helped Payday Loan Scammer Bilk $7M From Consumers

From time to time, federal regulators shut down shady payday lending companies that debit consumers’ accounts or charge their credit cards without permission. But those nefarious operations have to get their information from somewhere, right? Well, today the Federal Trade Commission sent a message to all of those companies providing such personal information to scammy-mcscammersons by taking action against a data broker operation that illegal sold payday loan applicants’ financial information. [More]

Regulators Sue To Shut Down Illegal Offshore Payday Loan Network

While most of us think of payday lenders as small-time storefront operations, there is also a complicated web of interconnected payday businesses operating outside the U.S. borders, but illegally issuing costly short-term loans to American borrowers. A newly filed lawsuit hopes to put an end to one such network. [More]

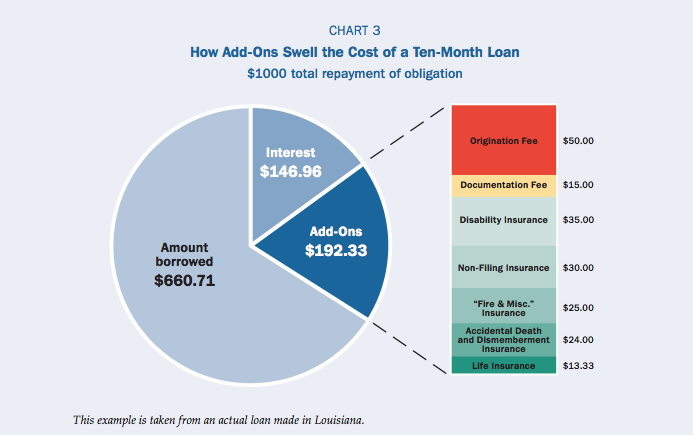

Most State Laws Can’t Protect Borrowers From Predatory Installment Loans, Open-End Lines Of Credit

As regulators continue to craft rules meant to crackdown on costly and harmful short-term payday lending, companies are offering alternative products like installment loans and open lines of credit to consumers. But, as it turns out, these cash infusions can be just as devastating to those in need, and few states offer sufficient protections for borrowers. [More]

Payment Processor Pleads Guilty After Allowing Fake Payday Lenders To Raid Bank Accounts

If a payment processor — the intermediary between a merchant and the banks — facilitates transactions that it knows aren’t on the up-and-up, it’s not just a no-no; it’s a federal offense. Just ask the California man who pleaded guilty to wire fraud for enabling the operators of fake payday loan sites to steal money from consumers’ bank accounts. [More]

Operators Of Massive Payday Loan Scheme Banned From Industry

The masterminds behind a massive payday loan scheme have agreed to be banned from the consumer lending industry to settle federal regulators’ charges they bilked millions of dollars from customers by trapping them into loans that were never authorized. [More]

Pennsylvania Man Charged With Racketeering Related To Massive Payday Loan Scheme

A life of stealing started with the snatching of a candy bar and transformed into an illegal multi-million dollar online payday lending scheme that allegedly defrauded thousands of people. At least that’s what federal prosecutors say led to charges against a Pennsylvania man recently. [More]

Abusive Lending Practices Can Lead To Negative Long-Term Consequences For Borrowers, Communities

Every year, more than 12 million Americans spend $17 billion on payday loans, despite the fact research has shown these costly lines of credit often leave borrowers worse off. Yet abusive lending practices are not relegated to borrowers in need of a couple hundred dollars to stay afloat until their next paycheck; there are mortgages, car loans, and other traditional lines of credit that can leave the borrower in a bind. Even if you never find yourself on the wrong end of a predatory loan, these products can still be a drain on your entire community. [More]

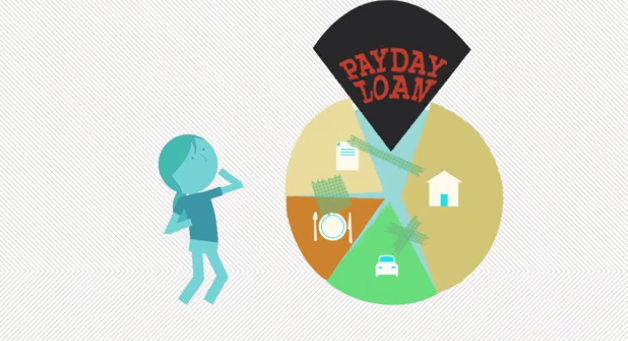

Pew Charitable Trusts Illustrates The Devastating Effects Of Payday Lending, How It Can Be Fixed

Back in March, the Consumer Financial Protection Bureau took its first long-awaited step in reining in the payday loan industry by releasing an outline for potential regulations over the small-dollar lines of credit known to thrust consumers into a devastating cycle of debt. While consumer groups were quick to applaud the steps, they also expressed concern that more could be done to protect people from the devastating consequences of such loans. This week, Pew Charitable Trusts released a video detailing the predicament nearly 12 million Americans face every year when taking out payday loans and how regulators might be able to find an answer. [More]

Legislators Once Again Trying To Delay New Lending Protections For Military Personnel

The Department of Defense is trying to do something good for servicemembers by closing loopholes in the Military Lending Act that can leave military personnel vulnerable to predatory lenders. But these safeguards are now the target of a Congressman who has received substantial campaign contributions from payday lenders. [More]

House Panel Strikes Provision That Would Delay Added Military Lending Act Protections

Yesterday we reported that Congress would make a decision whether or not it would intervene to slow the Department of Defense’s work to create new rules aimed at closing loopholes in the Military Lending Act that often leave military personnel vulnerable to predatory financial operations. Thankfully, legislators saw the need for more protections regarding military lending and determined the rules could go into effect as planned. [More]

Congress May Delay Predatory Lending Protection For Military Personnel

The Military Lending Act prevents military personnel from being caught in revolving debt traps of triple-digit interest loans from predatory financing operations like payday and auto-title lenders, but there are loopholes that allow some lenders to get around the MLA’s 36% APR interest rate cap, resulting in the loss of millions of dollars to servicemembers each year and raising issues of national security. The Dept. of Defense is currently working toward new rules that would add protections for military personnel, but Congress may intervene to slow the DoD from making progress. [More]

The Other Danger Of Online Payday Loans: Identity Theft

Many people who seek online payday loans are already in a very vulnerable position when they take on the added risk of the excessive interest rates and often exorbitant fees associated with these short-term loans. But there’s another danger possibly lurking in the payday shadows: Having all their personal and financial data end up in the hands of cyber criminals. [More]

Google, Bing To Block Search Result Ads For Unlicensed Payday Lenders In California

Government officials in California found a few unlikely allies when it comes to ensuring online payday lenders aren’t illegally advertising their services to residents online: The nation’s top search engine providers. [More]

Can New Payday Loan Rules Keep Borrowers From Falling Into Debt Traps?

Nearly one in four consumers continue to turn to high-cost, short-term financial products like payday loans, auto-title loans and other pricey alternatives when struggling to make ends meet, even though research shows these expensive lines of credit often leave consumers worse off than when they began. After nearly three years studying the issue, the Consumer Financial Protection Bureau is now announcing its first attempt to protect consumers from predatory lenders. [More]