As the real estate market still continues to creep up out of the sinkhole that opened beneath our feet five years ago, home buyers have still been able to rely on loans backed by the Federal Housing Administration. But if lawmakers in Washington can’t figure out a way to keep spending money in the very near future, the federal government would effectively shut down, putting pending FHA mortgages at risk of falling through. [More]

mortgages

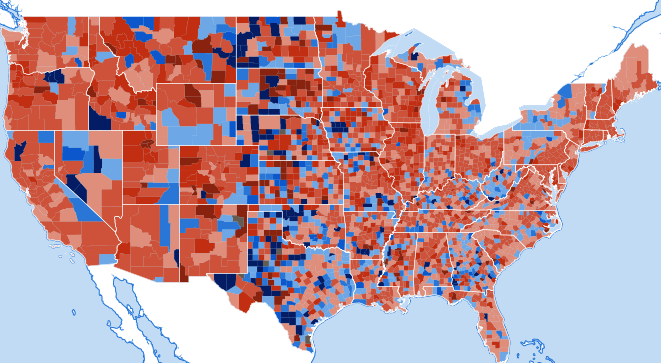

New CFPB Tool Provides County-By-County Snapshot Of Home Mortgages

We hear all the time about how national home sales are up, down, flat, bouncing like a rubber ball, or twirling like a ballerina, but we rarely get information that goes down to the local while also allowing you to instantly make comparisons to nationwide and regional trends. A new interactive tool from the Consumer Financial Protection Bureau aims to put that ability at your fingertips. [More]

DOJ Sues Bank of America For Lying About Sketchy Mortgage-Backed Securities

Even though Bank of America execs appear to have avoided criminal prosecution for their part in the recent economic collapse, BofA continues to be slapped upside its head with civil suits for its bad behavior. The latest comes from the U.S. Dept. of Justice, which sued BofA and a number of its affiliates, alleging the defendants misled investors by telling them that mortgage-backed securities were A-OK, when in fact they were more toxic than a house full of lead paint and asbestos. [More]

Clearer Mortgage Rules, No-Fee Refinances Key To President’s Plan For Middle-Class Housing Market

On Tuesday, President Obama will visit Arizona, one of the states that took the biggest butt-whooping from the housing boot, and one of five states (along with Nevada, Florida, Michigan, and Georgia) that still account for a full 1/3 of the negative equity in the U.S. In a speech in Phoenix, the President will outline what his administration believes are steps that will help give more middle-class Americans a chance at securing a foothold in the housing market. [More]

Drop In Number Of First-Time Home Buyers Is Cause For Concern

The notion of buying your first home, building equity, and eventually moving up the property ladder is still something many young Americans aspire to, but between more stringent underwriting procedures, lingering student loan debt, competition from real estate speculators and higher interest rates, first-time buyers are being squeezed out of the market. [More]

Bank Of America Attempts To Discredit Statements Of Former Employees

Last month, it was revealed that six former Bank of America employees and one ex-contractor for the bank, had given sworn statements in a lawsuit filed against BofA, and that these statements painted a picture of a system that deliberately lost mortgage modification paperwork and rewarded staffers for pushing employees into foreclosure. Now BofA has issued a detailed rebuttal of those allegations and why it believes that these statements misrepresent the truth. [More]

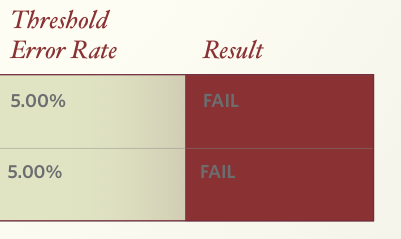

Big Banks Failing To Comply With All The Rules For National Mortgage Settlement

Remember that massive $25 billion settlement between the nation’s largest mortgage servicers — Bank of America, Wells Fargo, Chase, Citi, Ally — and attorneys general from around the nation? Well, it comes with a lot of rules for these institutions to follow. But the person in charge of monitoring the settlement says most of the banks are failing to comply fully. [More]

Fannie Mae Staffer Accused Of Taking Kickbacks Says He’s Not The Only One

Since 2009, bailed-out mortgage-backer Fannie Mae has sold nearly three quarters of a million repossessed properties. And considering that there are plenty of investors and speculators looking to snap up bottom-dollar homes with the hopes of eventually reselling at a profit, someone with inside information could be tempted to put a premium on that data, even if doing so is against the law. [More]

Bank Of America Gives Existing Customers Yet Another Reason To Flee

Many banks offer benefits to account-holders who also have their home loan serviced by the institution. Bank of America has been doing that for years, cutting fees for people with both checking accounts and mortgages. But now BofA has gone and sold off millions of these mortgages to another servicer, starting a countdown clock for account-holders to go elsewhere or likely face new fees. [More]

Mortgages Slightly Easier To Get For Prime Borrowers, Still Tough For Subprime Applicants

Ten years ago, a potential home buyer could walk into a Countrywide office and get pre-approved for a half-million dollar home loan based on a bank statement written in crayon on a restaurant place mat and a pinky swear that the loan could be paid back. We all know too well the results of those lax standards, which is why regulators and banks ramped up restrictions on lending to the point where applying for a home loan is like auditioning for American Idol, without the washed-up celebrity appearances. But a new survey says that lenders are easing up… a bit. [More]

Should You Pay Off Your Mortgage Before You Retire?

Considering that the average retirement age is approaching 282 and a large number of people have taken out second mortgages or equity lines of credit in recent years, not everyone who is nearing retirement has the option or ability to get rid of that home loan early. But for those that do, there are some things to consider. [More]

Are Wall Street Investors Pumping Up The Next Housing Bubble?

Areas like Las Vegas, Phoenix, and Miami — all hit pretty hard by the collapse of the last housing bubble — are now seeing home prices rise at rates above the national average. But rather than this being an indicator that these areas are finally recovering, some worry that it’s just a lot of hot air being pumped into another bubble by Wall Street investors. [More]

How Bank Of America Lost All Of My Business Over A $2 Balance Check Fee

As a reader of Consumerist, Shawn knew that he should probably stay away from mega-bank and Worst Company in America 2013 Final Four contender Bank of America. Yet his non-BoA lender of choice sold his mortgage to…well, guess who? He moved his other banking there for the sake of convenience, and that’s when he walked up to an ATM and conducted the fateful transaction. [More]

Homeowner Tries To Get Mortgage Adjustment, Ends Up Owing $14,500 More On Her House

When a retired Michigan homeowner applied for a mortgage adjustment back in 2009, little did she know that it would result in years of ongoing legal wranglings, a sizable increase in the amount of her mortgage and possible eviction. [More]

Feds Now Letting Big Banks Review Their Own Foreclosures For Errors

Pre-recession banks turned a blind eye to problems with the mortgages they handed out, bundled, sold and securitized. When that bubble burst, these same banks put the foreclosure process on auto-pilot, allowing anyone with a pulse to sign legal documents. So who better to review all those foreclosures for errors than the institutions that didn’t care in the first place? [More]

Investors Accuse Bank Of America Of Continuing Countrywide’s Bad Practices

Most of the $40 billion Bank of America has set aside to pay out over the mortgage meltdown can be blamed on malfeasance at Countrywide Financial. But some investors say that BofA’s hands are not totally clean in this mess — and that the bank has gotten off too easy thus far. [More]

46 States Will Share $120 Million As Result Of Robo-Signing Settlement

Another day, another business hit over the head with a multi-million settlement over faulty foreclosure practices. We’ve already seen big retail banks and heavy-hitting investment banks pay the price for robo-signing foreclosures and engaging in other suspect loan servicing activities and now Florida-based business Lender Processing Services will be paying $120 million to 46 states to settle similar allegations. [More]