New CFPB Tool Provides County-By-County Snapshot Of Home Mortgages

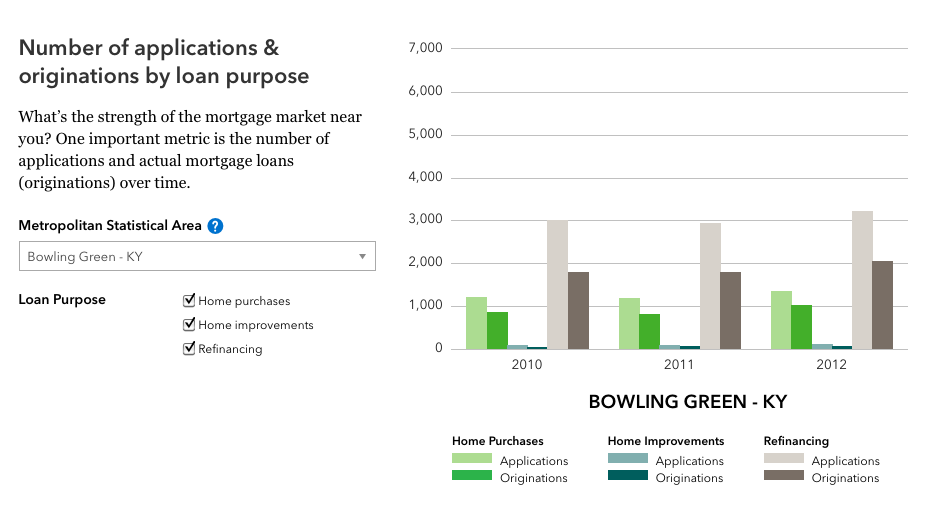

One tool already available to the public allows you to look at each county’s loan applications and originations over the last three years.

Earlier today, the CFPB unveiled the new tool that uses data from the Home Mortgage Disclosure Act, which requires thousands of financial institutions to maintain, report, and publicly disclose information about mortgages.

From this raw data, the CFPB has already created a handful of interactive maps and charts, and will be encouraging developers to use its API to make further use of the information made available by the HDMA.

For example, there is already a map that shows, county-by-county, the number of mortgage applications and originations between 2010 and 2012.

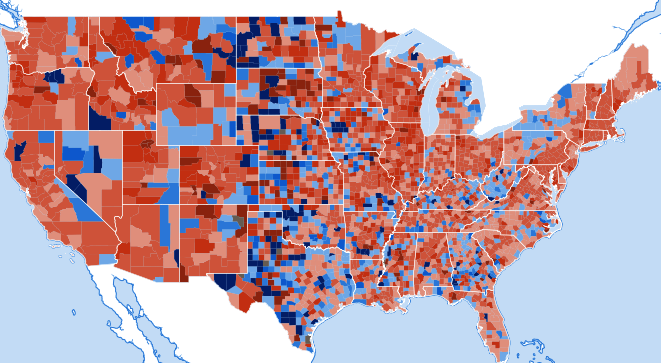

First, here’s the U.S. map of the change in mortgage originations between 2010 and 2011:

The reddish/brown areas indicate year-over-year declines in mortgage originations.

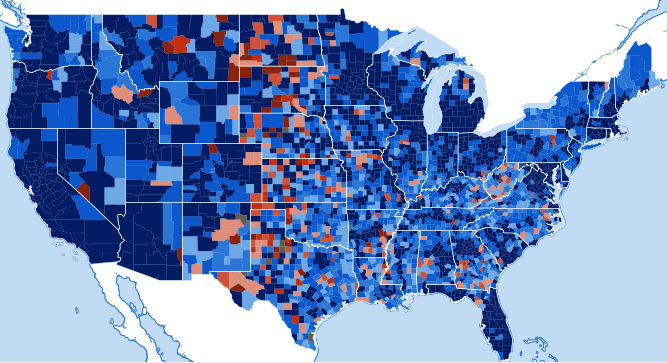

This next map shows the same changes, but between 2011 and 2012. As you can see, there is a general switch to bluer tones, indicating positive growth:

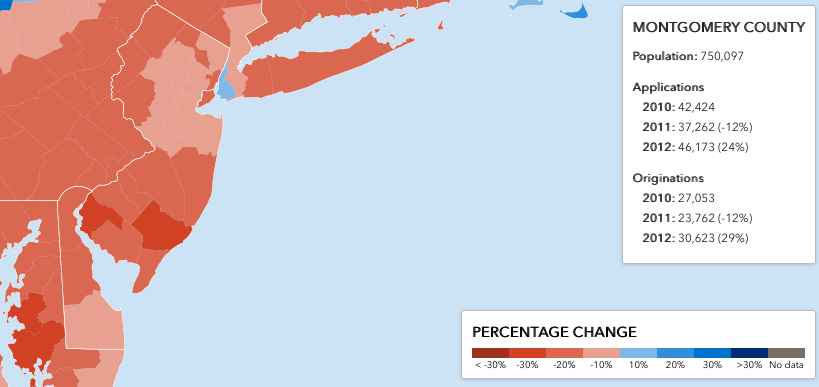

You can also zoom in and instantly see stats for any county in the nation, just by hovering over the location with your cursor:

Aside from just being a cool tool for people who love mapping data, CFPB believes this information can help show whether lenders are serving the housing needs of their communities.

“It gives public officials information that helps them make decisions and policies, and can shed light on lending patterns that could be discriminatory,” explains the agency.

CFPB will soon be releasing an API for developers to tinker around with, but the HDMA data is currently available here.

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.