Credit default swaps are a confusing concept, since some forms resemble gambling on the failure of a company without even owning any stock in it. As a consumer, especially if you’re someone who likes to shop at Sears, you should know that now that Radio Shack has declared bankruptcy, the hot retailer that credit swap traders are betting will fail is Sears. [More]

credit default swaps

RadioShack Creditors Question Bankruptcy Timing

Experts and ordinary shoppers alike have been predicting the demise of RadioShack for some time now. The only question was when it would happen. A rescue financing package kept the company going for a while longer, but the company’s creditors allege that there was a very important reason for that: to line the pockets of lenders and distressed debt traders. [More]

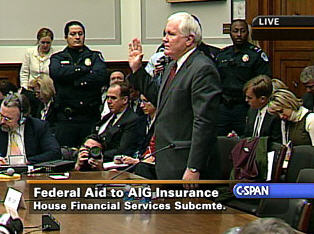

Why Is The AIG Bailout Money Being Given To Banks?

The Wall Street Journal recently unleashed a wave of anger by reporting that much of the $173 billion given to nationalized insurer AIG went to banks — including billions to European institutions like Societe Generale and Barclays.

Two Economists From The University Of Chicago Explain What The Hell Just Happened

It’s one thing to understand what just happened to the financial markets, and yet another to actually be able to explain what just happened. Thankfully, Steven Levitt from Freakonomics walked down the hall and found two economists from the University of Chicago (Doug Diamond and Anil Kashyap,) who gave him the best explanation I’ve been able to find about what the hell just happened.