The sad news is that 1 in 3 lottery winners are in serious financial trouble or even bankrupt within 5 years. Why? The suddenly wealthy often never learn to manage their money.

money

Credit Card Machine Fails, Forcing Editor To Forgo Seltzer And Toilet Paper

So I was in the grocery store this morning buying three rolls of toilet paper and a bottle of seltzer with a credit card, as I am wont to do. (It was on my way back from the gym and I had brought a credit card just for this purpose. I didn’t have any cash, I don’t like to bring my wallet to the gym, and I don’t like to have to futz with lockers).

../../../..//2007/10/26/how-one-blogger-bought-a/

How one blogger bought a used minivan without borrowing a dime, just straight-up cash on the barrelhead. [No Credit Needed]

Track Accounts Online With Geezeo

Geezeo is a personal-finance management site that helps you keep track of all your accounts in one place. Like Mint.com, you give it all your account user names and passwords to use it. Also like Mint, Geezeo is a front-end system, but based on CashEdge instead of Yodlee. Unlike Mint, it has support for tracking your car loan, mortgage, and brokerage accounts (although they don’t interface yet my my fave, Vanguard), with plans to add support for student loans….

BoA Jacks Up Your Rates To 32.24% If You're Late With Two Payments

Bank of America gave Timothy a fun new “change in terms” yesterday that says if he pays late on his Visa at least twice in 12 months, they’re reserving the right to jack his rates up to a higher APR. It could go high as up as an effective APR of 32.24%. Hey, gotta make up for that 32% earnings drop somehow.

Use Halloween Candy To Educate And Annoy Your Kids

Sometimes parents like to drive their kids crazy by showing up on Facebook, or listening to rap music, or professing that Zac Efron is a cutie-patooty, but Grad Money Matters suggests a whole new level of annoyance: use their Halloween candy to teach them about money. Here’s how: on Halloween night, you buy all their candy off of them, then give them a pre-set limit of how much they can spend each day to buy choice pieces back, and as the days go along, you drop the “prices” on the candy so that they can purchase more if they want or forego the sweets in order to increase their savings.

Mint.com Responds To Security Concerns

Some people think that using Mint.com is crazy because of the security risk of handing over all your banking user names and passwords. FiLife asks them some tough questions about their security procedures and gets straight answers, like:

Let’s say you get hacked. Banks normally would protect me if they get hacked, but do I lose my protection if I’m using Mint to access the bank but the breach happens through your systems? You’re legally protected for $0 liability on credit cards and $50 on bank accounts if fraud is reported within two days. These rights are not voided by using Mint, Yodlee, Quicken, Microsoft Money or similar programs.

They also say all user names and passwords are kept on Yodlee’s servers, not anyone else’s. Every lock can be picked, but we’re more concerned about identity theft resulting from our local big box retailer’s lax security procedures than from Mint.com.

The Mom With $135,000 In Credit Card Debt Who Spends $400 A Month On Starbucks

“I love new clothes. However, I like getting rid of the clothes just as quickly to go buy new ones.”

The Best Credit Cards Ever

The annual Kiplinger’s “Best Of” guide is out and here’s their picks for best credit cards. Best…

7 Things You Need To Know About Health Savings Accounts

As health care costs continue to soar (medical insurance premiums alone are expected to rise an average of 8.7 percent this year), Americans continue to look for ways to afford medical insurance and to pay the increasing costs of medical treatment.

Is Your Credit Card Rate Higher Than Average? Switch!

Here are the national averages for credit card interest rates, according to Bankrate. How does yours compare?

Verify Extra Payments Are Applied To Your Principal

The Chief Family Officer blog outlined her strategy for paying off student loans faster.

A Family Of 4 Needs To Make $77,069 A Year To Get By In San Francisco?

According to a new study cited by the San Francisco Chronicle, a family of 4 needs to make $77,069 in order to “get by” in San Francisco.

Top 10 Most Fuel Efficient Cars

Here’s the top 10 most fuel efficient cars, according to the 2008 Environmental Protection Agency and Department of Energy’s fuel economy guidebook, published this Saturday. Prius tops the charts.

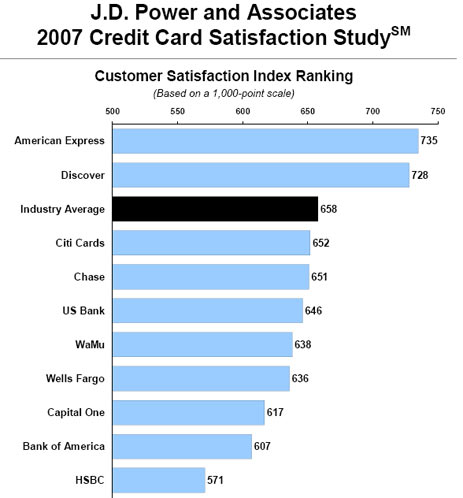

American Express Customers Are Most Satisfied, HSBC, Least

American Express ranks highest in customer satisfaction in the J.D. Power and Associates 2007 Credit Card Satisfaction Study. They said there’s two types of customers. One is transactors, who pay their bill off in full each month and for whom membership benefits are the most important drivers of customer satisfaction. The other is revolvers, who don’t pay their bill off in full each month, and for whom APR and fees are the most important drivers of customer satisfaction. So if we flip this survey over….