The Washington Post profiles a couple with over 20 different credit cards. The Chengs keep four in their wallet and a sticky note to tell them which card to use for which purchases. This year, they made $1,093 from spending $47,800. The Chengs are part of a growing breed of people who try to play the rewards programs offered by credit card companies for fun and profit. But the game has gotten harder. Credit card companies give more like 1% back instead of the 5% of yesteryear, points can be voided if payments are late, and there’s those will-o-the wisp airline miles…

money

Call For Advice: Reader Wants Discount Brokerage Recommendations

Onoodles writes, “I’ve managed to put away 20k into a Roth IRA. I started it directly through one mutual fund and now I’m looking to move it to a discount brokerage firm to diversify. So my question is, which one is the best?!” For a general overview and comparison of leading brokerages, we suggest looking into SmartMoney’s 2007 Broker Survey from a few months ago. And note that by going with a discount brokerage firm, you’ll likely be trading better customer service, research tools, and trading tools for cheaper fees.

Don't Wait Too Long To Get Help With Money Problems

Too many people wait until they hit rock bottom before seeking help from credit counseling agencies, says a New York credit counseling service. The consequence is that consumers end up limiting “the options available to them without having to make major, and often very difficult lifestyle changes. If they wait too long, debt repayment plans become unaffordable—leaving them more vulnerable to losing assets or having to file bankruptcy.”

So how do you know when it’s time to ask for help? If your monthly payments are exceeding your monthly income, it’s probably a good time. To find an agency, check out wikiHow’s How To entry, and use this list provided by Bankrate to ensure the agency will be able to provide the services you need.

3 Ways To Take Advantage Of The Fed Rate Cut

Bankrate shares three ways consumers can take advantage of the recent federal interest rate cut.

../../../..//2007/11/05/could-credit-cards-be-the/

Could credit cards be the next subprime meltdown? [Fortune]

Get Fit Or Pay Up

As health care costs continue to rise and talk of some sort of reform remains a large part of the upcoming presidential elections, some companies and businesses are taking matters into their own hands. The latest idea is to charge higher health insurance fees to people with less-than-stellar health. Here’s how it works: all plan participants start with the lower costs and are then screened medically. If their scores are found to be lacking, they are assigned to a health coach to help them improve. If the participant decides he doesn’t want to bother, he’s charged more. The details:

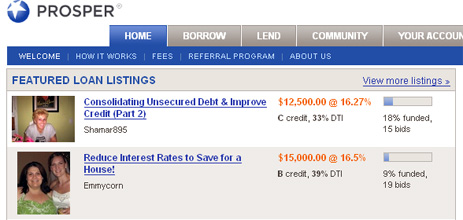

Make And Take Person To Person Loans With Prosper

Person-to-person lending site Prosper.com lets you take and make loans to other average citizens. Prospective borrowers register and let Propser review their credit history. They can request from $1,000 to $25,000 in an unsecured loan and specify an upper limit of interest they’re willing to pay. Then, other users check out the borrower’s profile and decide whether to fund them. You can bid as little as $50 on other people and fund multiple borrowers, spreading out the risk. Depending on the type of loan, you can earn upwards of 9% interest on your investment. The loans are for three years and there’s no prepayment penalty.

Irrational Humans Trying To Be Rational Buyers

I was listening to one of personal productivity maven’ David Allen’s teleseminars and he said something incisive about the impulse to buy fancy stuff. People think they want to buy a sports car, Allen said, but maybe what they really want is the sense of freedom they think a sports car will give them. Advertisers understand this and use it to get you to buy stuff. It’s the principle of “selling the sizzle, not the steak.”

Sands Casinos Lose Money, Wish You Weren't So Good At Blackjack

At the Las Vegas Venetian, earnings dropped 19 percent to $58.3 million. The casino’s winning percentage in baccarat, blackjack and other games was 14.7 percent, below its forecast range of 20 to 22 percent and last year’s winning percentage of 23.4 percent. Gamblers also won more than forecast at the Sands Macao.

New Credit Cards Incorporate Security Key Fob Features

This new kind of credit card being shown off at trade shows is designed to prevent against loss due to identity theft by incorporating a security key fob with a credit card. The idea is that when you buy online, swipe at the store, or take money out of the ATM, you hit a button to randomly generate a unique, disposable key code. Enter that code to verify the transaction. This way, someone would actually have to steal your physical credit card to conduct fraud. Best of all, it’s the same size and thickness as a regular credit card.

6 Financial Demons And How To Exorcise Them

If you keep trying to save money and failing, there’s a good chance you’re possessed… by “financial demons,” says Kiplinger. Here’s a list of six common ones and how to exorcise them, before your credit rating goes all Linda Blair on you.

The Little Lies We Tell To Let Ourselves Spend

Frugal For Life lists some of the things we tell ourself that rationalize irrational buying decisions, things like “I’ve been working really hard” or “this one little thing won’t be a big deal.” One that I’ve been guilty of is, “I have plenty of allocated disposable income and I never got the nice things as a kid that other kids got so now it’s my turn to have the toys.” We all do it, the trick is to catch yourself doing it and counteract the impulse by asking if the purchase is really important, necessary or of good value. What do you find yourself telling yourself makes you spend or spend extra for the upgrade?

With Free Rickshaw Rides. Chase Lures College Students To 23% APR Credit Card

Chase is giving college students free rides in special marketing rickshaws. Reader Ben reports seeing some, which look like the one pictured, on the campus of his North Carolina State University. Apparently the whole ride around the driver tries to sell you on the “Plus 1” credit card with its super-dope 23% APR. There’s also pitches for Bee Movie. The card gives you “karma points” which you can cash in for crap, share with friends or donate to “causes.” College kids go love to feel socially aware and responsible, and if it can be accomplished without leaving the dorm, all the better. Chase is also marketing the card on Facebook, the social networking site for people who go to college. The Plus 1 card earned a lemon award from creditcards.org.

5 Ways To Prepare For A Surprise Layoff Or Firing

If it’s truly going to be a surprise, there’s not much you can do on the day it happens, other than roll with the punches and maybe meet up with some friends after work for a beer. However, you can take some important steps to insure that you’re well-protected if you ever find yourself in this situation, so that you can improve your odds of landing another job quickly, before that creepy desperation sets in and you start to make recruiters and HR specialists uncomfortable. Consumerism Commentary describes 5 ways to prepare yourself for unexpected “career mobility.”

../../../..//2007/10/29/keeping-up-with-the-jones/

Keeping up with the Jones may seem hard, but here’s an easy way to be better than 73 % of rich parents: talk to your kids about money. A survey by PNC Wealth Management found that only 27% wealthy parents had discussed family budget with their children.