Floyd Norris at the New York Times is live blogging the global financial panic today, and has compiled a list of how the world’s markets have performed in October. Compared to some countries, our situation doesn’t seem that bad. Which is scary.

money meltdown

AIG Has Already Used Up 3/4 Of $123 Billion Bailiout

It’s only been a month, but AIG has already gone through 75% of its $123 billion government bailout. Those golf trips and sea-side hotels sure add up, don’t they? [Washington Post] (Photo: ChristophrHiestr)

Stocks Are Still Sad

Monday’s brief hope of a better week for stocks was exactly that as the market continued its downward spiral through Friday and international indexes suffered body blows. [WSJ]

The Great Depression Diaries

July 30, 1931. Magazines and newspapers are full of articles telling people to buy stocks, real estate etc. at present bargain prices. They say that times are sure to get better and that many big fortunes have been built this way. The trouble is that nobody has any money.

Greenspan Says That His Free-Market Ideology Was Flawed

Here’s something that probably doesn’t happen too often. Former Federal Reserve chairman Alan Greenspan had a crappier day than you did. He had to admit before our federal government that his free-market, anti-regulation ideology was “flawed.” Ouch.

../../../..//2008/10/22/the-wall-street-journal-says-1/

The Wall Street Journal says that the troubled California real estate market may be healing, but not without considerable pain. [WSJ]

../../../..//2008/10/22/wachovia-announced-their-237-billion/

Wachovia announced their $23.7 billion third quarter loss with an all-too-easy-to-mock pre-taped conference call. “Let’s just close our eyes and imagine what the combination of Wells Fargo and Wachovia will create,” said CEO Bob Steel. We suppose that does make it easier not to rudely stare at the number “23,700,000,000.” [WSJ Deal Journal]

Artists To Stage Literal Meltdown Of American Economy

On October 29, the economy will melt down. Not the general economy per se, but a 5 foot tall, 15 feet wide, 1,500 pound ice sculpture of the word “ECONOMY” in Manhattan’s Foley Square, relatively near to Wall Street. Artists Ligorano/Reese say, “this sculpture metaphorically captures the results of unregulated markets on the U.S. economy.” October 29 also happens to be the 79th anniversary of Black Tuesday.

Bank of America CEO Explains How He Beat Wall Street

Is the new financial capital of our country located in Charlotte, NC? 60 Minutes traveled down south to talk to CEO Ken Lewis about his bank, its recent purchase of Merrill Lynch, whether or not the bank bailout is “socialism” and the economic crisis in general.

../../../..//2008/10/21/more-countries-on-the-global/

More countries on the global money trouble list: Hungary, Serbia, Baltic states, Kazakhstan, Indonesia, South Korea, Argentina Russia, Brazil, Ukraine, Poland. [Slate]

"Whatever You Like" Parody: Coupon Clipping Is The New Largesse

Have you seen T.I.’s redonkulous “Whatever You Like” music video, where a burger girl gets picked up and gets drenched by the rapper in expensive alcohol, jewels, fancy cars and an evening of disgusting extravagance? If you haven’t, it’s basically TI singing “I will give you any number of expensive things so you will have sex with me,” on top off a rejected melody from a My Little Pony episode cut with the tinny reggatonic hiccups that pass for beats. Now, perhaps marking the first time I’ve found “Weird Al” Yankovic worth more than a “heh,” the musical parodist has released his own version of “Whatever You Like.” In it, he croons his lovergirl with tales of how they’ll spend time together clipping coupons and rolling up at Costco. As a gesture of his munificence, she can even have a large fry when they go to McDonald’s. Both songs in convenient YouTube format for easy comparison and contrast, inside.

Fed Chairman Discusses Passing Another Stimulus Package

Fed Chairman Ben Bernanke suggested today, while testifying before the House Budget Committee, that Congress should consider passing some sort of economic stimulus package that would improve access to credit by homebuyers and other borrowers.

10 Things That Are Going Right For Consumers

Kiplinger’s is more optimistic than we are, so they had the cheerful idea to put together a list of 10 things that are going right for consumers — despite the financial apocalypse. Hooray!

AIG Says It Will Try Harder To Cut Costs, Begins By Canceling $10 Million Severance Package

AIG has been repeatedly called on the carpet over the past week or so for indefensible “business as usual” expenditures—a lavish corporate retreat, an executive hunting trip, and severance packages costing tens of millions of dollars. Now, after a meeting with NY Attorney General Andrew Cuomo, they’ve announced they’ll start trying harder to monitor and stomp out unnecessary expenses.

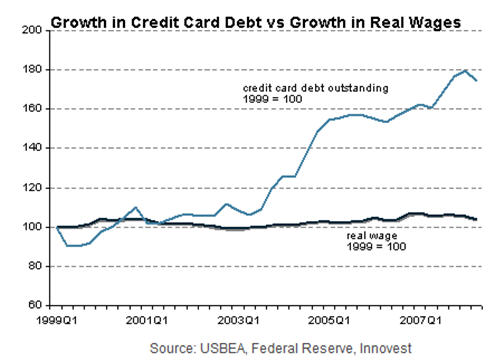

Hold On To Your Hats And Sunglasses, Here Comes The Credit Card Meltdown

We hope you’re enjoying our current economic roller coaster because it’s likely to continue — According to a new report from research firm Innovest Strategic Value Advisors, titled “Credit Cards at the Tipping Point,” the fun has only just begun. As the credit crunch begins to affect consumers, they’re going to have more difficulty paying their credit card bills. The report suggests that credit card companies’ misleading practices and cavalier extension of credit may come back to bite them. Who should be worried? Capital One.