China will spend $586 billion in its own economic stimulus plan. [NYT]

money meltdown

AIG Gets Additional $40 Billion From You

Congrats, taxpayers, you’re about to own $40 billion more of A.I.G. [NYT]

GM Almost Out Of Cash, Looks To Washington For Bailout

GM is running out of money and may not have enough cash to continue running its business. They’ve burned through $6.8 billion in the last quarter and will exhaust their reserves by the end of 2008 without government intervention or a significant increase in auto sales. Which sounds more likely to you?

Pro-Consumer Regulation Needs Real Teeth So You Can Sue The Jerks

If the recent economic meltdown has a bright spot, it is the possibility that smart regulation may return. There will always be those who will cheat if they can, putting both consumers and the market at risk. It cannot function properly without regulation to prevent cheating and ensure consumers are getting a fair deal. But without a private right of action and attorney fees, consumer protection regulations are nearly worthless. A “private right of action” means…

Chase To Fix 400,000 Option-ARM Mortgages

Chase will turn 400,000 high-interest option-ARM mortgages into lower-cost fixed ones, the bank announced this Friday. Foreclosure processes on the loans will be stopped for 90 days while the procedure gets set up. Banks mainly have latitude to adjust the mortgages they themselves own. The complexities of modifying a loan that may have been sold and repackaged into a security are intricate. For one, hedge funds have threatened to sue banks if they modify the loans underlying their bonds. So hooray for the lucky 400,000. Only a few more million to go. If you’re a homeowner facing foreclosure and you’re unable to get your lender to work with you, try contacting the HOPE NOW hotline at 1-888-995-HOPE for free advice from a home preservation counselor.

Girl Dresses As Credit Card For Halloween

This man says he saw a 10-year-old girl (not pictured) on Halloween dressed as a credit card. Cute. What financial-crisis-related costumes did you see this year? [Adverts Ruin Everything]

What's Worse Than Inflation? Deflation.

The New York Times has an interesting article today about the rising specter of deflation — in which a lack of demand causes prices to fall. Falling prices sounds like a good thing for consumers who have been battered with rising costs over the past year — but experts agree — deflation is nothing but bad news.

Economy: "Consumers Have Thrown In The Towel"

Consumer spending is down and credit card defaults are up!

Treasury, FDIC Considering Plan To Guarantee Millions Of Mortgages

The Washington Post says that the Treasury Department and the FDIC are considering a plan to guarantee millions of mortgages. According to the WaPo, the plan under consideration would encourage lenders to reduce borrowers monthly payments based on the homeowner’s ability to pay. To attract lenders into the program, the government would guarantee to repay the lender for a portion of its loss if the borrower defaulted on the reconfigured loan.

Attention: Credit Card Companies Have Realized That You Are Broke

The New York Times has an article detailing what promises to be the next fun financial crisis — credit card debt! Apparently, credit card companies have only just now realized that you people are broke! Whoops.

The Great Depression Diaries, Part 2

Aug. 5, 1931. I went to the fruit market house this evening. It was almost deserted. The farmers cannot sell their produce because men are not working and it has become fashionable for each family to have its own vegetable garden.

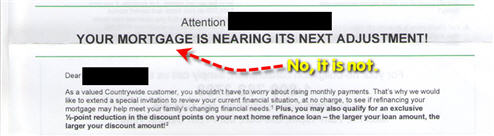

Countrywide To Fixed Rate Customer: Your Mortgage Is About To Adjust!

Countrywide either doesn’t know, or doesn’t care that reader Graham has a fixed rate mortgage, because they keep sending him “notices” that his mortgage is about to “adjust.”

../../../..//2008/10/28/the-case-shiller-home-prices-index/

The Case-Shiller home prices index, which tracks US home prices, fell a record-breaking 16.6% from last year in 20 metropolitan areas. [Forbes]

World Goverments Act To Try To Stem Financial Crisis

Governments around the world intervened early this week in their economies to try to hold back the financial slide. Here’s the latest of who’s doing what:

Banks Using $700 Billion Bailout To Buy Other Banks, Not Make More Loans

Washington told taxpayers a major rationale for us to fork over $700 billion to banks was to save the American economy by making loans more accessible, but it looks like at least at Chase they rather use it to buy other banks, NYT reports.

How An Ex-Lehman Brothers ibanker Fills His Days

What does an ex-Lehman Brothers i-banker do now that he has no reason to live? This brilliant, amusing, well-put-together, and NSFW video explores the answer. “I’ve been waking up 5:40 every morning, not waking up for Lehman Brothers necessarily, but when I wake up, I put on a suit.” I know there’s a lot of so-called “funny videos” on the internet, but seriously, this is a good one. Watch it inside.

Understand The Financial Crisis In 3 Minutes

If you or someone you know still scratches their head when trying to understand how the financial crisis began and played out, the Washington Post has a 3-minute slideshow with voiceover by business reporter Frank Ahrens that clearly and succinctly explains how it all happened. The pictures are pretty, too.