Nearly four years ago, as America was still crawling out of the crater left by the collapse of the economy, a former CEO of AIG — a company whose name had become synonymous with the crash — sued the federal government over the bailout, alleging that the government had violated shareholders’ Fifth Amendment rights. Today, a court sided with wealthy investor Maurice “Hank” Greenberg, but he won’t be getting any damages because the company would have gone bankrupt without the bailout. [More]

aig bailout

AIG Asks Federal Permission To Pay $2.4 Million In Executive Bonuses

A hush fell over the AIG conference room on the day that their Worst Company in America 2009 trophy was unveiled. The eyes of every executive in the room sparkled with just a bit of pride. “Well done, everyone,” said the man at the head of the table. “But we mustn’t rest on our gilded-feces laurels. It’s time to begin our work for next year’s competition.”

Remember How Mad You Were About Those AIG Bonuses? They're Bigger Than You Thought

So, remember those bonuses everyone was so mad about? Well, it turns out that they were bigger than originally disclosed. A lot bigger.

AIG Financial Products Employee's Public Resignation Letter

Here is a resignation letter sent on Tuesday by Jake DeSantis, an executive vice president of the American International Group’s financial products unit, to Edward M. Liddy, the chief executive of A.I.G. It was published in the New York Times.

Treasury Secretary Wants The Ability To Seize Insurance Companies, Hedge Funds

The Washington Post is reporting that Treasury Secretary Timothy Geithner will testify before the House Financial Services Committee today and argue that his agency needs broad powers to seize companies and “wind them down” without allowing them to enter bankruptcy.

AIG Who? Company Name Removed From Facade Of New York Building

Gothamist has some photos of 175 Water Street in NYC — which until recently proudly displayed the name and logo of the American International Group. What happened?

AIG Turns Over The Names Of Bonus Recipients

AIG has complied with Andrew Cuomo’s subpoena and turned over the names of the bonus recipients. The NY AG has released a statement about the issue, which you can read inside.

Congress Considering Sending The IRS After AIG

The Washington Post says that the House will vote this afternoon on a bill that would seek to impose a 90% tax on the AIG bonuses. The Senate Finance Committee is also working on similar legislation, but have not yet scheduled a vote.

../..//2009/03/17/aig-misses-their-400-pm/

“We had given AGI up to 4 o’clock today to provide the information on the latest round of bonuses that they paid out,” Cuomo told reporters. “Four o’clock has come and gone.”

How Do You Solve A Problem Like AIG? Suicide.

Another day, another livid politician. Senator Charles Grassley of Iowa told a Cedar Rapids radio station that the AIG executives who are taking bonuses should, as an alternative, kill themselves.

NY Attorney General To AIG: You Have Until 4:00 PM To Give Us The Names

Andrew Cuomo has written a letter to AIG in which he explains that they will turn over the names of those employees from the Financial Products subsidiary (that’s the division that brought down the company) who are receiving bonuses by 4:00 pm today or they are coming at them with subpoenas. Yes, ladies and gentlemen, it’s another awesome Andrew Cuomo letter after the jump.

Lawmakers, Regulators, Taxpayers Unbelievably Pissed At AIG

There’s no shortage of outrage directed at AIG today as the fallout from the bailed-out insurer’s announcement that they intend to use $165 million in taxpayer money to pay bonuses to the very executives that ruined the company continues.

Why Is The AIG Bailout Money Being Given To Banks?

The Wall Street Journal recently unleashed a wave of anger by reporting that much of the $173 billion given to nationalized insurer AIG went to banks — including billions to European institutions like Societe Generale and Barclays.

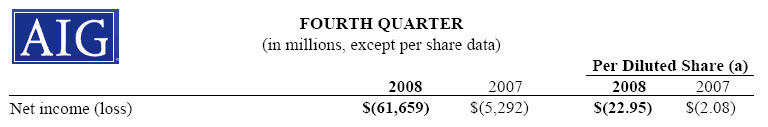

AIG Loses $62 Billion In A Single Quarter

The government is taking steps to revamp the AIG bailout, after the company lost a mindbogglingly huge amount of money, $62 billion, in a single quarter.

AIG To Give Executives "Retention Payments" Instead Of "Bonuses"

CBSNews says that AIG will be suspending “bonuses” for executives and will instead replace them with “retention payments.” We’re not entire sure what the difference is and the government doesn’t know either.