../../../..//2009/03/04/looking-for-a-mortgage-you/

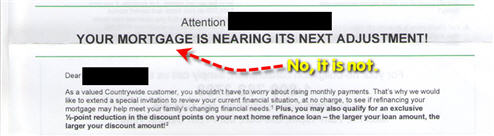

Looking for a mortgage? You might want to consider an FHA loan. The New York Times says, “The Federal Housing Administration used to be known as a place for low-income borrowers with tarnished credit histories. But now, it has become a destination for borrowers whose credentials are respectable, but not stellar.” [NYT]