Two months after Bridgepoint Education, the operator of for-profit colleges Ashford University and the University of the Rockies, revealed it was being investigated by the Department of Justice over its federal student aid funding, another federal agency has ordered the company to forgive $23 million in student loans and pay an $8 million penalty over allegedly illegal student lending practices. [More]

private loans

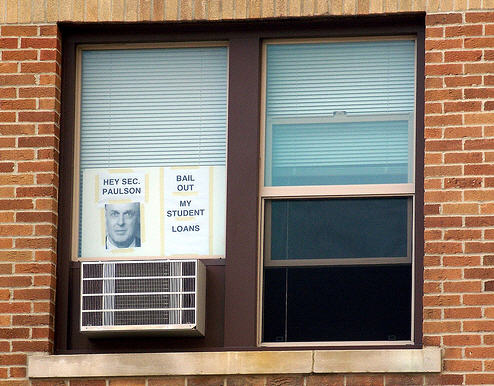

Student Loan Bubble Eerily Similar To Subprime Mortgage Debacle

Billions in high-interest loans being handed out to people who probably shouldn’t qualify for them, who may not understand the full terms of the loans, and who will likely have trouble paying the money back. Sounds a lot like the stories we were writing five years ago as mountains of subprime, adjustable rate mortgages were coming due, but now it’s about the massive number of student loans written in recent years. [More]

Father Stuck With Dead Son’s Student Loans But No One Will Tell Him How Much He Owes

While federal student loans are forgiven if the student dies before the money is repaid, lenders of private student loans can choose to forgive the debt or go after a co-signer for the money. And just like mortgages, private student loans are bundled and re-sold again and again, leaving some parents struggling to figure out how much they owe on their deceased child’s student loan — all while being hounded by debt collectors. [More]

Help! Is Anyone Still Giving Out Private Student Loans!?

Reader Michael has some questions about how the credit crunch is affecting private student loans. Is anyone still lending?

Don't Be Ashamed To Ask Friends Or Family For A Loan

Taking a private loan from friends or family can be a win-win proposition, not necessarily a shame-filled dish with a side order of failure. Private loans are an ideal way to reduce the amount you need to borrow from a bank—instead of paying loan application fees, processing fees and higher rates, you can save money while offering attractive yields to your friends and family.